Category contribution rates can be based on a percentage of salary, or on a flat amount. There may be instances where the contribution rate for a particular category is a combination of both percentage and flat amount.

If the coding is not done correctly, the calculations will be wrong, because the flat amount may be interpreted by the system as being the percentage of salary. Similarly, if the administration and miscellaneous fees are also flat amounts (as opposed to the other categories), the amounts may be generated as percentages and not flat rates.

This section describes the steps to be followed to ensure that the calculations are done correctly.

Members contribute a minimum of R50.00, irrespective of salary. Due to incorrect coding, the system calculates the deduction as 50% of salary, instead of the flat rate as coded.

Log in to the system from the Logon page.

STEP 1:

Add global data for the new type (Infrastructure)

Refer to

Infrastructure

System Data

Parameters

Global Data Type

Click infrastructure.

The Welcome screen will be displayed.

From the main menu on top, select System Data.

- Select Parameters > Global Data Type.

- From the JU1AE Global Type List screen, select Add Income Types from the sub-menu on the left.

- On the JU1AE Income Type Details screen, create a new global type called ADF (Admin Flat Fee), and set the GLOBAL GROUP as FEE.

Add global data for the new type (Contribution Process)

Refer to

Auxiliary Activities

Adding a New Income Type

Add a new Income Type to a Scheme (Payroll)

Click processes, then click contributions.

The Welcome screen will be displayed.

From the main menu on the top, select Payroll. The Payroll screen will be displayed.

Select System Administration from the menu on the top. The Payroll screen will be displayed with the Payroll sub-menu on the left.

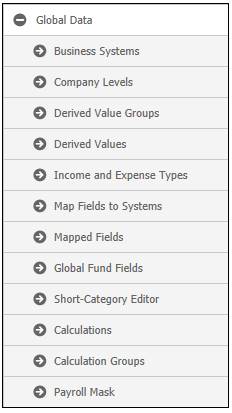

Click ![]() alongside Global Data on the sub-menu. The following additional options will be displayed.

alongside Global Data on the sub-menu. The following additional options will be displayed.

Select Income and Expense Types and add the following types:

|

|

Type |

Pension System code |

|

ADF (admin flat amount) |

Expense |

ADF |

|

AF1 (admin flat rate) |

Category contribution rate |

ADF |

- Select Calculations and add the following new calculation for ADM (Admin percentage + flat fee):

ADM = ([ACT]*[AD1]/100)+[AF1]

STEP 2:

Change the rules

Refer to

Product Launch Requirements

Product Update

Product Update Type: Income

Assume that the latest pay centre cycle date is 200501, and that two membership groups exist, viz. CAT A (1% of salary) and CAT B (R50 flat amount).

- Create a new fund update of INCOME, with an effective date of 01/05/2005 (ensure that this date corresponds with the cycle date).

- Add additional expense type of ADF

- Select the old expense of ADM and select the scheme global rules list.

- Select the latest rule for ADM and end date it using the Edit hyperlink or the Delete hyperlink option.

- Create two new rules for ADM, as follows:

Create a percentage of salary rule for 1%, and associate it to CAT A.

Create a percentage of salary rule for 0%, and associate it to CAT B (this rate will nullify the existing rate of AD1).

- Close and authorise the INCOME fund update type.

STEP 3:

Check that the fund update has come through on Payroll Admin

Refer to

Auxiliary Activities

Adding a New Income Type

Add a new Income Type to a Scheme (Payroll)

From the Fund Management menu, select Categories.

- Check that the latest rules captured have come through for:

AD1 (CAT A: AD1 = 1.0)

AD1 (CAT B: AD1 = 0.0)

- Once this is complete, capture the FLAT amount rate for CAT B.

STEP 4:

Capture the new flat rate for category B

(this must be completed after step 2)

Refer to

Product Launch Requirements

Product Update

Product Update Type: Income

- Create a new fund update of INCOME, with an effective date of 02/05/2005.

- Select ADF and select the scheme global rules list.

- Create a new rule for FLAT AMOUNT of R50 and associate it only to CAT B.

- Close and authorise the INCOME fund update type.

- Once this is complete, log on to the web.

STEP 5:

Check the rate, add the new calculation and calculate salaries and contributions

Refer to

Auxiliary Activities

Adding a New Income Type

Add a new Income Type to a Scheme (Payroll)

From the Fund Management menu, select Income and Expense Types.

- Check that the new global types of ADF and AF1 are displayed on the list.

- Select Categories.

- Check that the latest rule captured has come through for AF1 (CAT B: AF1 = 50.00)

- Select Calculations.

- Select the old ADM calculation and discontinue its use.

- Add the following new ADM calculation to the scheme:

ADM = ([ACT]*[AD1]/100)+[AF1]

- Select Data Capture.

- Select the pay centre.

- Select Salaries and Contributions.

- Select all calculations and select all members for the selected level, and calculate.

- Once the calculation is complete, check the fee calculations for CAT A and CAT B members. The amounts should differ.