You can change the allocation of future contributions between portfolios, and you can switch units between portfolios in which the member has already invested. You can also view the status of allocations and switches that have been initiated.

When allocating future contributions, you can select a set of default or life cycle allocations. Default and life cycle investment allocations represent the Trustees' recommended investments for all of the members, or for specific groups of members. If no individual choice has been selected, or is not applicable, then the scheme default allocation will be applied or, where applicable, the default for the membership group will be applied.

Note:

The choices available may be limited by the rules of the product.

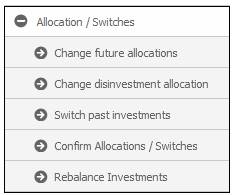

To change the allocation of future contributions, click ![]() alongside ALLOCATION / SWITCHES on the sub-menu on the left. Additional options will be displayed.

alongside ALLOCATION / SWITCHES on the sub-menu on the left. Additional options will be displayed.

Select Change future allocations from the sub-menu on the left.

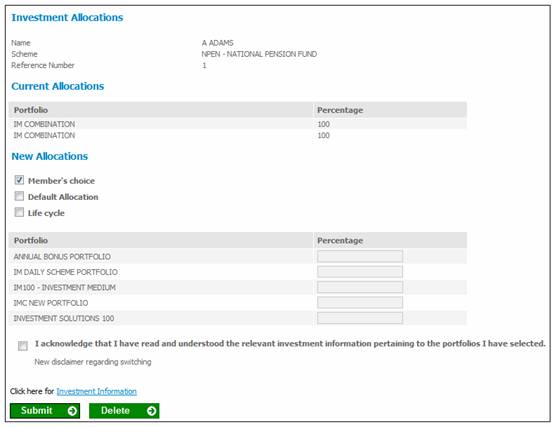

The Investment Allocations screen will be displayed.

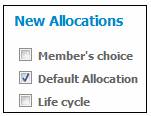

Tick the appropriate box below New Allocations.

Note:

If the member is a Living Annuitant, the Life Cycle option will be disabled for selection.

If Member's choice has been selected, enter a percentage for each portfolio in which the money should be invested, by entering a figure in the Percentage box alongside the applicable portfolio. You may choose to invest in more than one portfolio.

Note:

Where an investment portfolio has been closed for further investment, the portfolio will not be displayed for selection.

If you select a portfolio in which you do not yet have money invested and there is no switch currently in progress, then the following message will be displayed:

You may only select this Portfolio if you have money invested in it. If you want to invest future contributions in this Portfolio please transfer money into it by capturing a switch.

Before updating your allocations, you must acknowledge that you have read the relevant investment information pertaining to the portfolios you have selected, by ticking the check box.

I acknowledge that I have read and understand the relevant investment information pertaining to the portfolios I have selected.

![]()

Note:

To access the relevant investment information, click Investment Information. The General Information page will be displayed. Refer to Investment Information.

Click SUBMIT.

The System will not enable a Portfolio to be selected if the value for the Closed From Date field on the JU1BV Scheme Portfolio Details screen is less than or equal to the Effective Date of the Product Update.

Note:

The system will read the value for Fixed Term Investment on the Investment Linked to each Portfolio selected. If it is Y, the unit balance on the Member’s INVSTMEMUNIT account will be retrieved if the Earning Allocation Basis on the Investment Medium is UNITISED or on the Member’s INVESTMEMB account if the Earning Allocation Basis is BONUS. If the balance is zero the system will check if there is a Switch Buy in process for the Portfolio. If not, the following error message will be displayed:

You may only select this Portfolio if you have money invested in it. If you want to invest future contributions in this Portfolio please transfer money into it by capturing a switch.

Note:

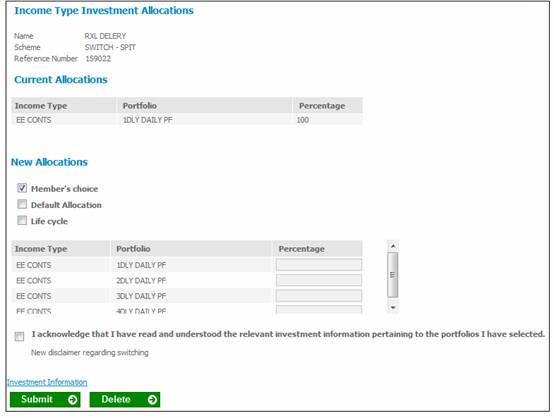

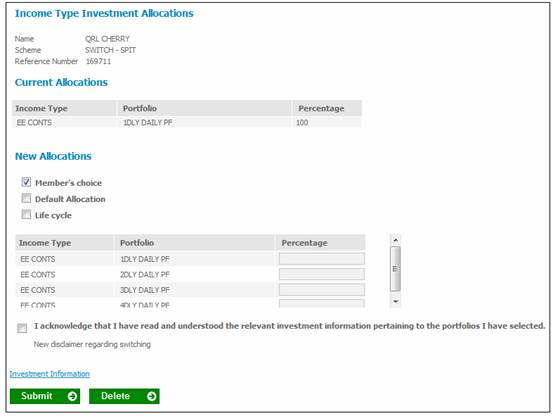

If the Product has Investment Choice at Income Type Level, the Income Type Investment Allocations screen will be displayed with the Income Types.

To change the allocation, click on the hyperlink in the Fund Income Type column.

Click on a hyperlinked value in the Fund Income Type column. The screen will display a New Allocations section on the screen.

Note:

An error message will be displayed if the income type on the fund is defined as FUND INCOME TYPE MEMBER CHOICE = YES, but it is not on payroll.

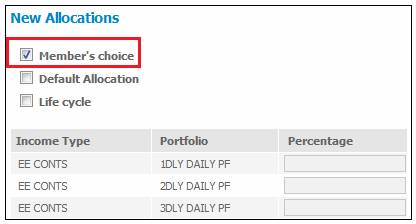

Member’s Choice

If the Member’s Choice check box under New Allocations is selected, a list of the Income Types for which there is an Income Rule linked to the Contribution Membership Group to which the Member is linked and for which the value for Member Investment Choice is Y will be displayed.

The relevant allocation percentage(s) may be captured in the Percentage column.

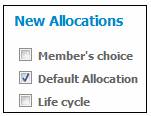

Default Allocation

If the Default Allocation check box is selected, the system will display the following:

- All of the Income Types for which there is an Income Rule linked to the Contribution Membership Group to which the Member is linked with the Portfolios and Percentages for each Income Type as per the default Scheme investment allocation.

- if the Member is linked to an Investment Membership Group, the default investment allocation for the Investment Membership Group to which the Member is linked, and for which the value for Member Investment Choice is Y.

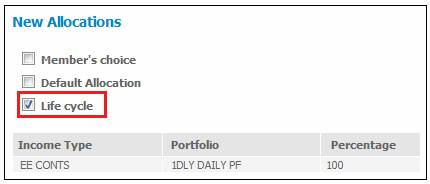

Life Cycle

If the Life Cycle check box is selected, the system will display all of the Income Types for which there is an Income Rule linked to the Contribution Membership Group to which the Member is linked with the Portfolios and Percentages for each Income Type as per the investment allocation for the Investment Membership Group matching the Member’s age or number of years to normal retirement date, and for which the value for Member Investment Choice is Y.

Note:

To access the relevant investment information, click Investment Information. The General Information screen will be displayed. Refer to Investment information above.

Click SUBMIT.

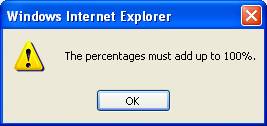

The sum of the allocations must add up to 100%. If not, an error message will be displayed.

The percentage must add up to 100%

Click OK and change the percentages so that they total 100%.

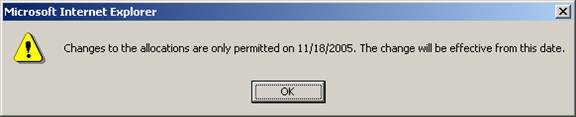

If the product rules provide for switching on a specific date only, the following message will be displayed.

Changes to the allocations are only permitted on (dd/mm/ccyy). The change will be effective from this date.

Click OK to continue.

Click SUBMIT.

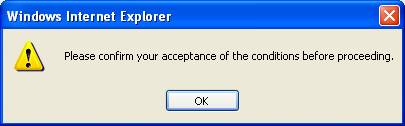

If you haven't ticked the check box, the following error message will be displayed:

Please confirm your acceptance of the conditions before proceeding.

Click OK, then tick the check box.

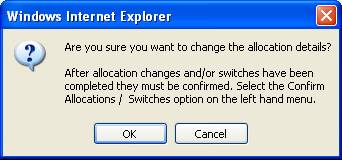

When you click SUBMIT on the Investment Allocations screen, the following confirmation message will be displayed:

Are you sure you want to change the allocation details?

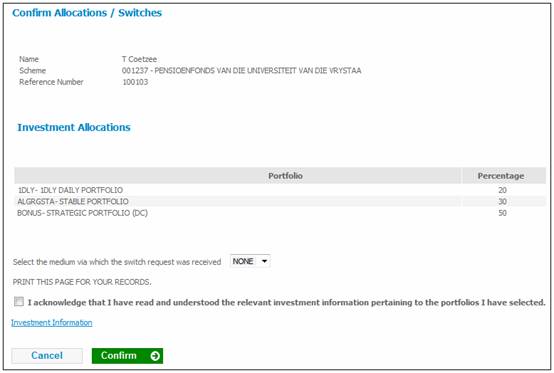

After allocation changes and / or switches have been completed they must be confirmed. Select the Confirm Allocations / Switches option on the left hand menu.

Click OK.

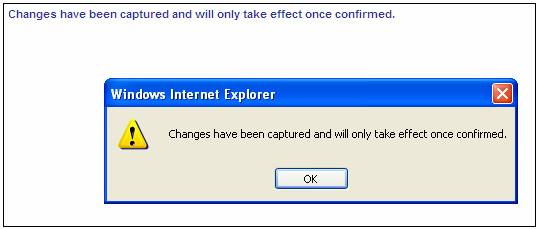

Once you have clicked OK for the message above, the following confirmation message will be displayed:

Changes have been captured and will only take effect once confirmed.

Click OK.

Once you have updated the screen, the Investment Allocations screen will be re-displayed, showing the new allocation and a confirmation message. Refer to Confirm allocation / switches below).

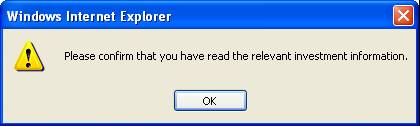

To delete the allocations made, click DELETE. The following confirmation message will be displayed if the check box has not been ticked.

Please confirm that you have read the relevant investment information.

Click OK to remove the message. The following confirmation message will be displayed.

Are you sure you want to delete the allocations?

Click CANCEL to cancel the deletion or OK to confirm that the allocations must be deleted. The allocations previously captured will be removed from the New Allocations screen.

To switch investments of past contributions, select Switch past investments from the sub-menu on the left.

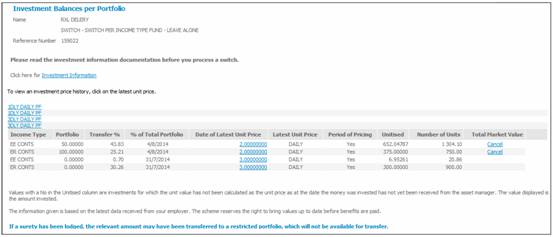

The Investment Balances per Portfolio screen will be displayed.

This screen displays both the unitised and non-unitised portfolios in which the member has invested, the percentages that have been allocated to each portfolio, and the market value of the investment in each portfolio.

Note:

If the product has Investment Choice at Income Type Level, the Investment Balances per Portfolio screen will be displayed with the Income Type.

Note:

To access the relevant investment information, click Investment Information. The General Information screen will be displayed. Refer to Investment information above.

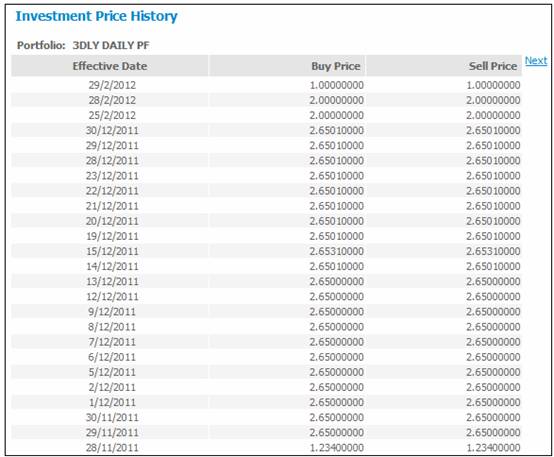

You can view the investment price history for each of the portfolios in which the member has invested. Click the hyperlinked figure in the Latest Unit Price column. The Investment Price History screen will be displayed for the selected investment medium.

Click the hyperlinked here to return to the Investment Balances per Portfolio screen.

To perform a switch, click on the hyperlinked investment medium name in the Portfolio column.

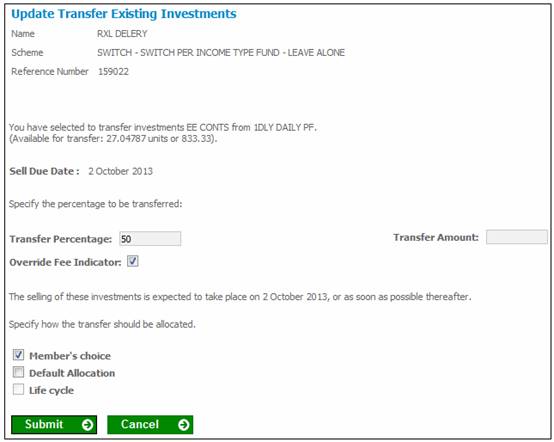

The Update Transfer Existing Investments screen will be displayed.

Notes:

If Life cycle was selected on the Investment Allocations screen, the Life cycle box will be ticked, and cannot be changed here. The Transfer Percentage will default to 100.

Note:

If the member is a Living Annuitant, the Life Cycle option will be disabled for selection.

To use the default investment allocation, tick the box alongside Default Allocation.

To specify a different percentage or amount, tick the box alongside Member's choice.

Either capture a percentage in the Transfer Percentage field or capture an amount in the Transfer Amount field.

Note:

Whichever one is used, the system will default the value of the other to 0 as only one or the other may be captured.

If there are any fees charged to the member defined on the product rules, tick the Override Fee Indicator box.

If no switching fees are defined on the product Rules, no text regarding switching fee will be displayed on the Transfer to Available Investments screen.

Click SUBMIT.

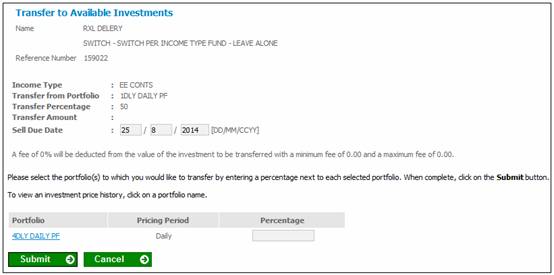

The Transfer to Available Investments screen will be displayed.

You can view the investment price history for each of the available portfolios. Click the hyperlinked name in the Portfolio column. The Investment Price History screen will be displayed for the selected investment medium.

Enter a percentage for the portfolio(s) in which you would like the money invested, by entering a figure in the Percentage box alongside the applicable portfolio. You may choose to invest in more than one portfolio.

The System will not enable a Portfolio to be selected if the value for the Closed From Date field on the JU1BV Scheme Portfolio Details screen is less than or equal to the Effective Date of the Product Update.

Note:

The system will read the value for Fixed Term Investment on the Investment Linked to each Portfolio selected. If it is Y, the unit balance on the Member’s INVSTMEMUNIT account will be retrieved if the Earning Allocation Basis on the Investment Medium is UNITISED or on the Member’s INVESTMEMB account if the Earning Allocation Basis is BONUS. If the balance is zero, the system will check if the Portfolio is included in the Member’s investment allocation. If it is, the following error message will be displayed:

If you want to cancel this switch then you must remove the Portfolio from the allocation of your future contributions that you have captured.

Click SUBMIT.

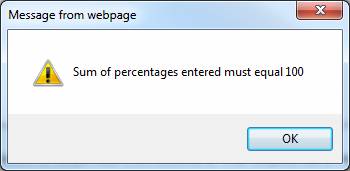

The sum of your switch percentage must add up to 100%. If not, an error message will be displayed.

Sum of percentages entered must equal 100

Click OK and change the percentages so that they total 100%.

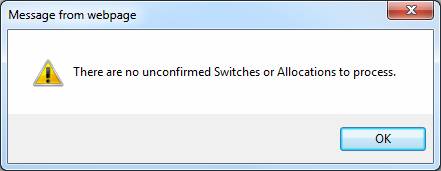

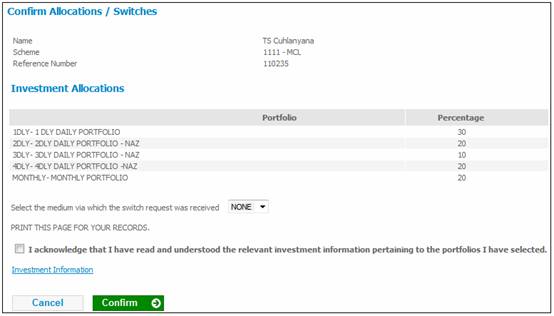

To confirm the allocation or switches, select Confirm Allocations / Switches from the sub-menu on the left.

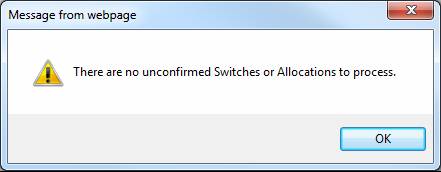

If there are no switches or allocations to be processed, a message will be displayed.

There are no unconfirmed Switches or Allocations to process.

Click OK to remove the message.

If there are Allocations and switches available for confirmation, they will be displayed on the Confirm Allocations / Switches screen.

Note:

If the product has INVESTMENT CHOICE AT INCOME TYPE LEVEL, the Confirm Allocations / Switches screen will be displayed with the Income Type.

Note:

If the product has Investment Choice at Income Type Level, the Confirm Allocations / Switches screen will be displayed with the Income Type.

Before confirming the allocations or switches, you must acknowledge that you have read the relevant investment information pertaining to the portfolios you have selected, by ticking the check box.

In addition, the request method should be updated by selecting a value from the drop-down box.

Select the medium via which the switch request was received

![]()

Note:

When a switch is created via the JU3CA Bulk Switch From screen, the request method on the switching detail will be updated to BULK.

When a switch is created via the BJU3BN_LCSWI Life Cycle Switches batch job, the request method on the switching detail will be updated to LIFE CYCLE.

When a switch is captured via the Member Website the request method on the switching detail will be update to MEMBER WEB.

Note:

To access the relevant investment information, click Investment Information. The General Information screen will be displayed. Refer to Investment information above.

In the BJU3BN Life Cycle Switches batch job, when the number of years to Normal Retirement Date (NRD) is determined for a Member, the system will check if the Member has a Member Values record with a Member Value Type of PLANNED RET DTE. If found, the system will determine the Number of years to NRD based on the value for Period End Date in place of Normal Retirement Age.

To confirm the allocations or switches, select CONFIRM ALLOCATIONS / SWITCHES from the sub-menu on the left.

Note:

The system will check that the result of the switches and changes in allocations will not result in a portfolio from which funds will be disinvested to cover the member’s monthly annuity having a zero balance.

Note:

The system will check that the result of the switches and changes in allocations will not result in a portfolio from which funds will be disinvested to cover the member’s monthly annuity having a zero balance.

The balance on the member’s investment accounts will be retrieved for all of the portfolios included in the member’s Investment Allocation. If any portfolio has a zero balance, the system will check if a switch has been captured for which the portfolio is included in the portfolios to be transferred into. If not, the following error message will be displayed with a zero balance:

There is no money invested in the (name of portfolio) and therefore there will not be funds available to cover your monthly annuity. Please switch funds into this portfolio or change your allocation.

If there is a switch for which the percentage captured for the portfolio selected for switching out of is 100%, the system will check if the portfolio is included in the Member’s Investment Allocation. If it is, the following error message will be displayed:

The portfolio you are switching out of is included in the portfolios you have elected to disinvest from to cover your monthly annuity. You must change your allocation or cancel this switch.

If you haven't ticked the check box, an error message will be displayed.

Click OK then tick the check box.

The Confirm Allocations / Switches screen will be re-displayed for final confirmation.

Click CONFIRM.

If the change is not permissible, an error message will be displayed on the screen.

You may only invest in 2 Portfolios at a time. You would have money invested in 5 calculated portfolios, therefore the change is not permissible.

If the product set up does not provide for this type of allocation or switch, an error message will be displayed on the screen.

The member’s access type is not “SWITCHING” or “SWITCH & ALLOC” for Portfolio

Once the allocation or switch has been successfully confirmed, the following confirmation message will be displayed on the Confirm Allocations / Switches screen.

There are no unconfirmed Switches or Allocations to process.

Click OK to remove the message.