The cash flow report produced using this facility contains the opening balance, total of the transactions for the period selected, and the closing balance. Three types of report are available:

- per accounting activity

- per account

- per account and sub-account

The finalisation of the bank reconciliation is governed by the closing of the financial period, and so when the financial period has been closed, no further transactions can be processed for that period. Therefore, the closing balance on the bank reconciliation cannot change.

If the cash flow report and the bank reconciliation are run after the financial period has been closed, then the opening balance of the cash flow report will equal the balance of the bank account as at the effective date of the bank reconciliation.

This report can be used to support the bank reconciliation, and as a cash flow report.

From the main menu on top, select Bank. A sub-menu will be displayed on the left.

Select Cash Flow from the menu.

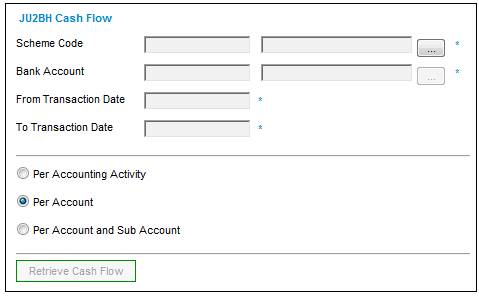

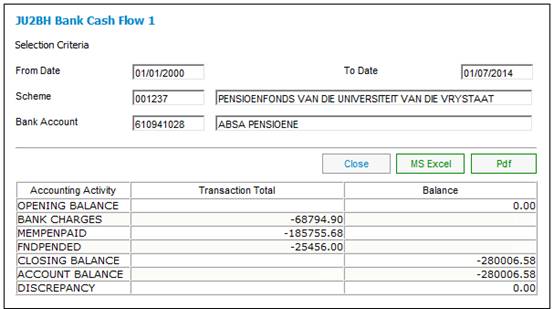

The JU2BH Cash Flow screen will be displayed.

This screen is used to specify the criteria for retrieving

- balances as at the specified dates

- transactions for the specified period

The following cash flow reports can be selected:

- Per Accounting Activity

- Per Account (this is the default option)

- Per Account and Sub Account

Capture details for the screen as follows:

|

Scheme Code |

Click LIST alongside the field. This links to the JU1BK List screen. This screen displays a list of schemes to select from. Once a selection has been made, click SELECT. |

|

Bank Account |

The product bank account. Click LIST alongside the field. This links to the JU1CC Product Bank Account List screen. This screen displays a list of bank accounts to select from. Once a selection has been made, click SELECT. |

|

From Date |

Enter the start of the period for which the report must be provided. |

|

To Date |

Enter the date up to which the report must be provided. |

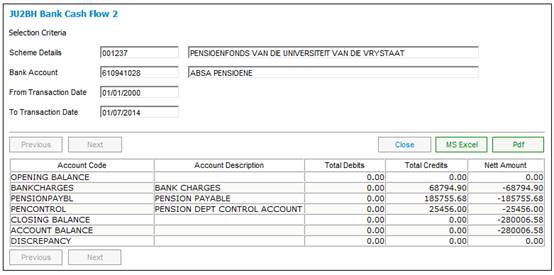

Once the data has been input, select RETRIEVE CASH FLOW. TheJU2BH Bank Cash Flow 2 screen will be displayed.

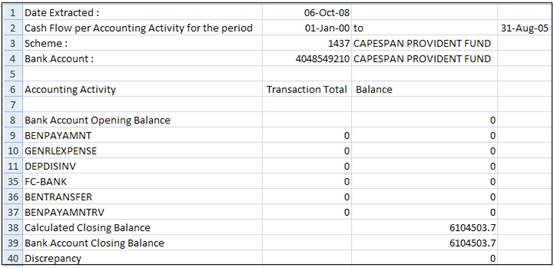

To display the data in an excel spreadsheet, click MS EXCEL.

To display the data in a Pdf document, click PDF.

Note:

The discrepancy on the last line of the report will reflect the total balance in the deposit and payment allocation accounts.

To display the data in an excel spreadsheet, click MS EXCEL.

To display the data in a Pdf document, click PDF.

To display the data in an excel spreadsheet, click MS EXCEL.

To display the data in a PDF document, click PDF.

Processing for umbrella funds

When retrieving the other leg of the Business Transactions (BT’s) in the BANK account for the Cash Flow reports, if the account for the other leg of the BT is BANK ALLOC then the system will retrieve the BT’s for which the Debit or Credit account is BANK ALLOC and the account for the other leg of the BT is not BANK, to determine the Accounting Activity or Account to include in the Cash Flow report in the same way as the BT’s are retrieved for the DEPOSITALLOC and PAYMENTALLOC accounts. The Sub-Umbrella Product Code will be displayed on the report.

If the Pooling Status of the Product selected is Sub-Umbrella, the system will retrieve the BT’s from the BANK account and the BANK ALLOC account. For the BT’s retrieved from the BANK ALLOC account the system will find the other leg of the BT to find the Accounting Activity or Account to include in the Cash Flow report in the same way as the BT’s are retrieved for the DEPOSITALLOC and PAYMENTALLOC accounts.

If the other leg of a BT retrieved from the BANK account is DEPOSITALLOC or PAYMENTALLOC, the system will find the BT for which the other leg is not BANK account to find the Accounting Activity or Account to display in the Cash Flow report as per the current functionality.

Note:

If the BANK account transactions are processed at a Main Product level then there should not be any BT’s retrieved from the BANK at a Sub-Umbrella Product level as the BANK account transactions will be processed with the Main Umbrella Product Code and the BANK ALLOC account transactions processed with the Sub-Umbrella Product Code. However there may be exceptions to this where payments are made or deposits receipted for a specific Sub-Umbrella Scheme.