Cash flow reports can be generated at an account level or a sub-account level.

These extracts are not real-time and do not replace the existing accounting enquiries.

The cash flow reports produced here contain only transactions that have been posted.

Note:

The Bank Account Balance report (see below), provides a view of the current cash flow situation as at a specified date. The primary purpose of this report is to enable Administrators to ensure that there will be sufficient funds in the scheme’s bank account to cover the benefit payments authorized on any day.

A cash flow report can also be generated from the Accounting menu. This cash flow report differs in that it contains all transactions, whether or not they have been posted.

Refer to

Accounting

Bank

Cash Flow Report

The report is produced in two stages:

- input the selection criteria and submit the job

Note:

The reports are not displayed automatically.

- view the completed reports

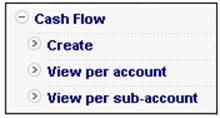

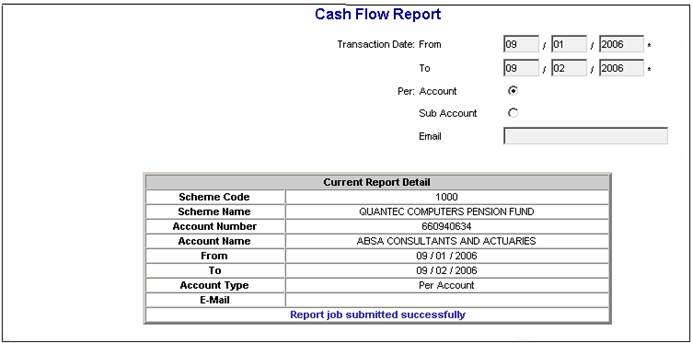

From the Financial menu, click ![]() alongside Cash Flow on the sub-menu on the left. Additional options will be displayed.

alongside Cash Flow on the sub-menu on the left. Additional options will be displayed.

Click Create below Cash Flow. The Cash Flow Report screen will be displayed.

The bank accounts applicable to the scheme will be displayed.

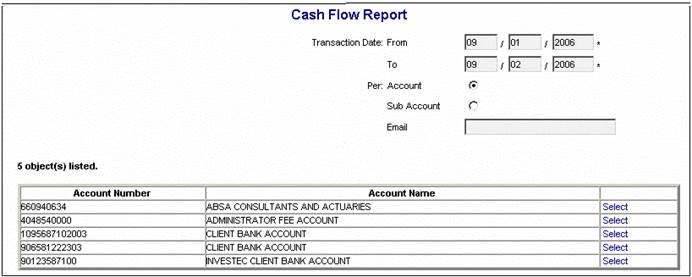

Select the required transaction dates (from and to), and use the radio button to indicate the type of report required. These fields are mandatory. If you want to be notified once the report has been created, enter your e-mail address (this is optional).

To select a report, click on the hyperlinked Select alongside the appropriate selection.

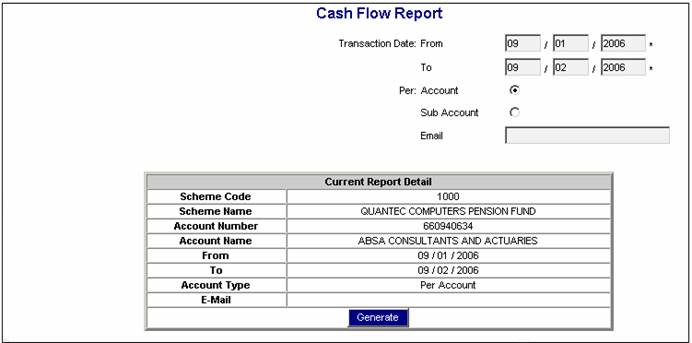

The current report detail will be displayed on the lower portion of the screen. Click GENERATE.

A message will indicate once the job has been successfully submitted (and an e-mail will be sent to you, if you requested to be notified).

Reports will be available under this option if the ACCOUNT radio button was selected when the report was created (refer Create above).

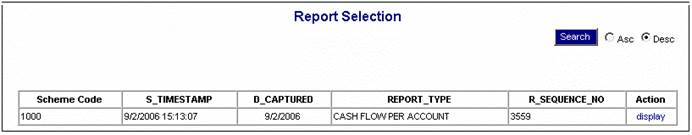

Click View per account below Cash Flow. The Report Selection screen will be displayed.

To select a report, click on the hyperlinked display in the Action column alongside the appropriate selection.

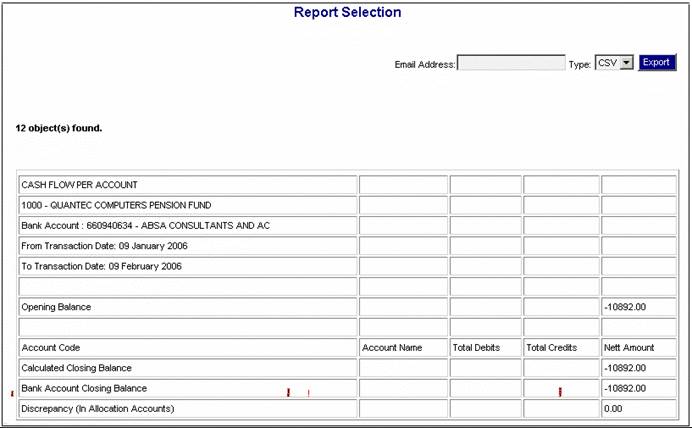

The CASH FLOW PER ACCOUNT report will be displayed.

Reports will be available under this option if the SUB ACCOUNT radio button was selected when the report was created (refer Create above).

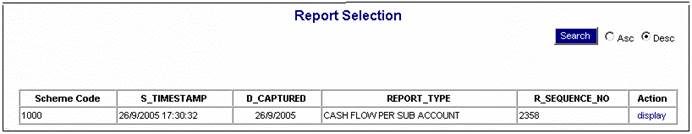

Click View per sub-account below Cash Flow. The Report Selection screen will be displayed.

To select a report, click on the hyperlinked display in the Action column alongside the appropriate selection.

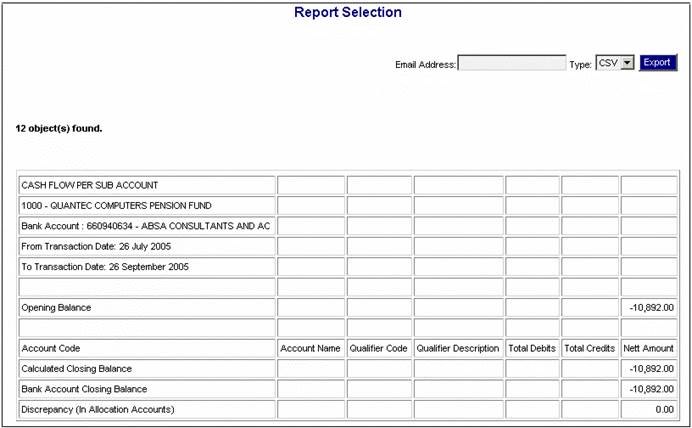

The CASH FLOW PER SUB ACCOUNT report will be displayed.

When retrieving the other leg of the Business Transactions (BT’s) in the BANK account for the Cash Flow reports, if the account for the other leg of the BT is BANK ALLOC then the system will retrieve the BT’s for which the Debit or Credit account is BANK ALLOC and the account for the other leg of the BT is not BANK, to determine the Accounting Activity or Account to include in the Cash Flow report in the same way as the BT’s are retrieved for the DEPOSITALLOC and PAYMENTALLOC accounts. The Sub-Umbrella Scheme Code will be displayed on the report.

If the Pooling Status of the Scheme selected is Sub-Umbrella, the system will retrieve the BT’s from the BANK account and the BANK ALLOC account. For the BT’s retrieved from the BANK ALLOC account the system will find the other leg of the BT to find the Accounting Activity or Account to include in the Cash Flow report in the same way as the BT’s are retrieved for the DEPOSITALLOC and PAYMENTALLOC accounts.

If the other leg of a BT retrieved from the BANK account is DEPOSITALLOC or PAYMENTALLOC, the system will find the BT for which the other leg is not BANK account to find the Accounting Activity or Account to display in the Cash Flow report as per the current functionality.

Note:

If the BANK account transactions are processed at a Main Scheme level then there should not be any BT’s retrieved from the BANK at a Sub-Umbrella Scheme level as the BANK account transactions will be processed with the Main Umbrella Scheme Code and the BANK ALLOC account transactions processed with the Sub-Umbrella Scheme Code. However there may be exceptions to this where payments are made or deposits receipted for a specific Sub-Umbrella Scheme.