This covers the processing of electronic fund transfers (EFT’s) via Nedbank’s Corporate Payment System (CPS).

When the JU2BQ_NBKCPS batch job is executed for the Nedbank CPS Interface, the system will read all of the transactions on the EFT INSTRUCTION for which the Status is not P (Processed) and for which the Interface Type on the Bank Account is NEDBANK CPS. The system will read the Interface Type for the DTI Account on the Business Transaction (BT) for which the Account is BANK on the BT to which the EFT Instruction is linked.

Separate files for payments, collections and credit card collections will be created.

If the Credit Account on the BT linked to the EFT Instruction is BANK, the EFT Instruction in the payments file will be extracted.

If the Debit Account on the BT linked to the EFT Instruction is BANK and the Account Type on the Debit DTI Account on EFT Instruction is not CREDIT CARD, the EFT Instruction in the collections file will be extracted.

If the Debit Account on the BT linked to the EFT Instruction is BANK and the Account Type on the Debit DTI Account on EFT Instruction is CREDIT CARD, the EFT Instruction in the credit card collections file will be extracted.

A fixed format file will be created with a name according to the following naming convention:

PNGG00.CDPACK.**I000.D0.SQ320

Where:

** equals the Client Identifier code i.e. the value for the first two characters of the Usercode on the DTI Account Interface record for the Scheme’s bank account.

00 is a sequential number starting from 01 for each file submitted per day.

- The file may not contain a duplicate file name / sequence number. If it does, the file will not be processed.

For future testing purposes, the P at the start of the file name must be replaced with a Q i.e. the file name convention must be QNGG00.CDPACK.**I000.D0.SQ320

Format Notes:

Every field in the file must be in a fixed format.

Numeric fields must be right justified with leading zeroes and Alpha fields must be left justified with trailing spaces.

Every record length must equal 320 characters and unused characters at the end of any record must be filled with Hex 00 characters.

After each record a new line must be started.

The data for each field in the file will be extracted as per the details in the Description / Value column in the table below:

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

01 – Header record identifier Default to 01 |

|

Client profile number |

N |

10 |

Y |

Usercode on the DTI Account Interface record for the Scheme’s Bank Account. |

|

File Sequence Number |

N |

24 |

Y |

Unique number per file. First 10 digits must be the Client Profile Number; the next 8 digits must be the date on which the file is submitted (YYYYMMDD), followed by a 6 digit sequential number.

Read the Transmission Number on the Extract Control table for Extract Type NEDBANK CPS for the sequential number (last 6 digits). |

|

File Type |

N |

2 |

Y |

01 – Transaction instructions 02 – Disallow instructions Default to 01 |

|

Nominated account number |

N |

16 |

Y |

Corporate Client’s account number. Must be a Nedbank account. Payments DTI Account Number for the Debit DTI Account on EFT Instruction where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked. Collections DTI Account Number for the Credit DTI Account on EFT Instruction where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked. Find the Bank for the DTI Account Number and it is not NEDBANK do not extract the EFT Instruction and create an error message in the error log. EFT Collections If the value for Type of Account for the Debit DTI Account (Destination Account) on EFT Instruction is CREDIT CARD where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked set this to the value for User Sequence Number on the DTI Account Interface record for the Credit DTI Account. |

|

Charges account number |

N |

16 |

Y |

Corporate client’s account number. Must be a Nedbank account. Nominated account number above. |

|

Statement Narrative |

A/N |

30 |

|

The narrative that will appear on the corporate client’s statement where accumulated entries have been chosen. If a filler is used the file number will appear on the statement. Set this to spaces. |

|

Filler |

A/N |

220 |

Y |

Spaces |

|

New line feed |

Special |

|

|

A new line must be started after this record |

Item layout

|

FIELD NAME |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record Identifier |

N |

2 |

Y |

02 – transaction record identifier Default to 02 |

|

Nominated account number |

N |

16 |

|

Corporate Client’s account number. Must be a Nedbank account. This will override the nominated account number in the header for this transaction. Payments Debit DTI Account Number on EFT Instruction where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked. Collections Credit DTI Account Number on EFT Instruction where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked. Find the Bank for the DTI Account Number and it is not NEDBANK do not extract the EFT Instruction and create an error message in the error log. EFT Collections If the value for Type of Account for the Debit DTI Account (Destination Account) on EFT Instruction is CREDIT CARD where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked set this to the value for User Sequence Number on the DTI Account Interface record for the Credit DTI Account. |

|

Payment reference number |

N |

34 |

Y |

Unique number per transaction. First 24 digits must be the file sequence number and the last 10 a sequential number for each item. |

|

Destination branch code |

N |

6 |

Y |

Payments Credit Bank Sort Code for the Credit DTI Account on EFT Instruction where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked. Collections Credit Bank Sort Code for the Debit DTI Account on EFT Instruction where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked. |

|

Destination account number |

N |

16 |

Y |

Payments Credit DTI Account Number for the Debit DTI Account on EFT Instruction where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked. Collections Debit DTI Account Number for the Credit DTI Account on EFT Instruction where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked. |

|

Amount |

N |

12 |

Y |

Amount on EFT Instruction |

|

Action date |

N |

8 |

Y |

Date on which transaction is to be actioned (YYYYMMDD). Validation: Must be a valid working day. Date Effective on EFT Instruction. |

|

Reference |

A/N |

30 |

Y |

For dated service transactions the first 20 characters is the description that will be displayed on the destination accountholder’s bank statement. This number must be unique, and the last 10 characters must be spaces. Must be upper case alpha characters. For same day service (SDV) transactions the full 30 characters can be used. Concatenation of the following fields: 1-20: First 20 characters of the Description on EFT Instruction 21-30: spaces See note below. |

|

Destination accountholder’s name |

A/N |

30 |

Y |

Surname followed by initials. Must be upper case. Payments Name on the DTI Account records for the Credit DTI Account on EFT Instruction where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked, followed by Initials on the DTI Account. Collections Name on the DTI Account records for the Debit DTI Account on EFT Instruction where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked, followed by Initials on the DTI Account. |

|

Transaction type |

N |

4 |

Y |

0000: Debit – Movement of funds from destination account to nominated account. 9999: Credit – Movement of funds from nominated account to destination account. Set to 0000 where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked (Note: This will be the credit account on the EFT Instruction). Set to 9999 where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked (Note: This will be the debit account on the EFT Instruction). |

|

Client type |

N |

2 |

Y |

01 – Financial institution 02 – Private client 03 – Private non-resident client Set to 01 |

|

Charges account number |

N |

16 |

Y |

Nedbank account from which CPS charges/fees are drawn for this transaction only. Set this to the value for Charges Account Number in the File Header |

|

Service Type |

N |

2 |

Y |

01 – Same Day Service (SDV) 02 – Real time line (RTL) (credits only) 03 – 1 Day 04 – 2 day 10 – Non-authenticated early debit order system (NAEDOS) 11 – Credit card collections Read the Description for the Scheme Parameter EFT Service linked to the Scheme. If the Value for the Type of Account for the Destination Account Number is CREDIT CARD and the value for Transaction Type is 0000 set this to 11 (Credit card collections) |

|

Original payment reference number |

N |

34 |

|

Spaces if the file type is 01 Payment reference number of the original transaction if the file type is 02 Set to spaces |

|

Entry Class |

N |

2 |

Y |

ACB entry class codes: Credit Transactions 81 – Payment to creditor Debit Transactions 22 – Pension fund contribution Where the Account BANK is the Credit Account on the BT to which the EFT Instruction is linked set this to 81 Where the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked set this to 22 If the Service Type is 11 set this to 44 |

|

Filler |

A/N |

106 |

Y |

Spaces |

|

New line feed |

Special |

NA |

Y |

A new line must be started after each record |

Note:

When Business Transactions (BT’s) are created for which the Payment Type is EFT, a unique number is written to the Document Number field on the BT. The batch parameter BATCHNO is read and incremented by 1. This number is then recorded in the first 7 characters of the Description field on the EFT Instruction record when the EFT file is created.

File Trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

03 – trailer record identifier Default to 03 |

|

Total number of transactions |

N |

8 |

Y |

Total number of transactions in the file, excluding header and trailer records. |

|

Total value |

N |

18 |

Y |

Total value of all transactions within the file, excluding header and trailer records |

|

Hash total |

A/N |

256 |

Y |

Padded with trailing Hex 00 characters if it is less than the allocated 256 spaces. Where security level 6 (Hash Totals) has been selected: 1. The formula is the sum of Item Layout (Destination Account Numbers + Amount) 2. Where the value does not equal 256 characters the hash total must be captured without trailing zeros. |

|

Filler |

A/N |

220 |

Y |

Spaces |

|

New line feed |

Special |

|

|

A new line must be started after each record |

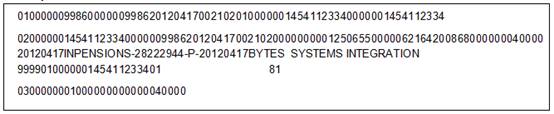

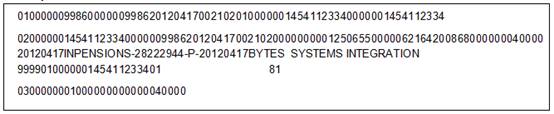

Sample file

Transaction instruction file authentication failure

If a transaction instruction file fails the file authentication, or the number of rejections in the transaction instruction file exceeds 25% (or a defined percentage), a NACK file will be received with just a header and trailer record and a file security record.

The file will contain the header and trailer of the failed transaction instruction file with the following additional fields:

- File status

- Rejection reason

- Hash total

The NACK file will be named as follows:

PNGG00.CDPACK.**N000.D0.SQ320

Where:

** equals the Client Identifier code i.e. the value for Description on the Global Parameter CPS CLIENT ID, N indicates it is a NACK file and the 00 is the same sequential number as the original file that has failed authentication.

For future testing purposes, the P at the start of the file name will be replaced with a Q i.e. the file name convention will be QNGG00.CDPACK.**N000.D0.SQ320

The file layout is detailed in the tables below:

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Client profile number |

N |

10 |

Y |

As per original file |

|

File Sequence Number |

N |

24 |

Y |

As per original file |

|

File Type |

N |

2 |

Y |

As per original file |

|

Nominated account number |

N |

16 |

Y |

As per original file. |

|

Charges account number |

N |

16 |

Y |

As per original file |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Total number of transactions |

N |

8 |

Y |

As per original file |

|

Total value |

N |

18 |

Y |

As per original file |

|

Filler |

N |

52 |

Y |

Zero filled |

|

File Status |

String |

8 |

Y |

Value = Rejected |

|

Reason |

String |

30 |

Y |

Reason for the file being rejected |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Security Record layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

04 – File security |

|

Hash total |

A/N |

256 |

Y |

|

|

New line feed |

Special |

|

|

A new line must be started after each record |

Transaction instruction file rejections exceeding defined percentage

If the number of rejections in the transaction instruction file exceeds 25% (or a set percentage defined in the Client profile), a NACK file will be received with the header, item and trailer record of the failed transaction instruction file with the following additional fields and a file security record:

|

Transaction status |

Item record |

|

Reason |

Item record |

|

File status |

Trailer |

|

Rejection reason |

Trailer |

|

Hash total |

Security record |

The NACK file will be named as follows:

PNGG00.CDPACK.**N000.D0.SQ320

Where:

** equals the Client Identifier code i.e. the value for Description on the Global Parameter CPS CLIENT ID, N indicates it is a NACK file and the 00 is the same sequential number as the original file that has failed authentication.

For future testing purposes, the P at the start of the file name will be replaced with a Q i.e. the file name convention will be QNGG00.CDPACK.**N000.D0.SQ320

The file layout is detailed in the tables below.

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

||

|

Record identifier |

N |

2 |

Y |

As per original file |

||

|

Client profile number |

N |

10 |

Y |

As per original file |

||

|

File Sequence Number |

N |

24 |

Y |

As per original file |

||

|

File Type |

N |

2 |

Y |

As per original file |

||

|

Nominated account number |

N |

16 |

Y |

As per original file. |

||

|

Charges account number |

N |

16 |

Y |

As per original file |

||

|

New line feed |

Special |

|

|

A new line must be started after each record |

||

Item layout

|

FIELD NAME |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

||||

|

Record Identifier |

N |

2 |

Y |

As per original file |

||||

|

Nominated account number |

N |

16 |

|

As per original file |

||||

|

Payment reference number |

N |

34 |

Y |

As per original file |

||||

|

Destination branch code |

N |

6 |

Y |

As per original file |

||||

|

Destination account number |

N |

16 |

Y |

As per original file |

||||

|

Amount |

N |

12 |

Y |

As per original file |

||||

|

Action date |

N |

8 |

Y |

As per original file |

||||

|

Reference |

A/N |

30 |

Y |

As per original file |

||||

|

Destination accountholder’s name |

A/N |

30 |

Y |

As per original file |

||||

|

Transaction type |

N |

4 |

Y |

As per original file |

||||

|

Client type |

N |

2 |

Y |

As per original file |

||||

|

Charges account number |

N |

16 |

Y |

As per original file |

||||

|

Service Type |

N |

2 |

Y |

As per original file |

||||

|

Original payment reference number |

N |

34 |

|

As per original file |

||||

|

Transaction status |

A/N |

8 |

Y |

REJECTED or ACCEPTED |

||||

|

Reason |

String |

30 |

Y |

Reason for rejection |

||||

|

New line feed |

Special |

NA |

Y |

A new line must be started after each record |

||||

File Trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Total number of rejected transactions |

N |

8 |

Y |

Total number of rejected transactions |

|

Total value of rejected transactions |

N |

18 |

Y |

Total value of rejected transactions |

|

Total number of accepted transactions |

N |

8 |

Y |

Total number of accepted transactions |

|

Total value of accepted transactions |

N |

18 |

Y |

Total value of accepted transactions |

|

Total number of transactions in original file |

N |

8 |

Y |

Total number of all transactions received in the original file |

|

Total value of transactions in original file |

N |

18 |

Y |

Total value of all transactions received in the original file |

|

File Status |

String |

8 |

Y |

REJECTED |

|

Reason |

String |

30 |

Y |

Reason for the file being rejected |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Security Record layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

04 – File security |

|

Hash total |

A/N |

256 |

Y |

|

|

New line feed |

Special |

|

|

A new line must be started after each record |

If a file is sent that contains a duplicate file name a duplicate file will be received with just a header and trailer record and a file security record with the following additional fields:

- File status

- Rejection reason

- Hash total

The NACK file will be named as follows:

PNGG00.CDPACK.**D000.D0.SQ320

Where:

** equals the Client Identifier code i.e. the value for Description on the Global Parameter CPS CLIENT ID, D indicates it is a Duplicate file response file and the 00 is the same sequential number as the original file that is a duplicate.

For future testing purposes, the P at the start of the file name will be replaced with a Q i.e. the file name convention will be QNGG00.CDPACK.**N000.D0.SQ320

The file layout is detailed in the tables below:

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Client profile number |

N |

10 |

Y |

As per original file |

|

File Sequence Number |

N |

24 |

Y |

As per original file |

|

File Type |

N |

2 |

Y |

As per original file |

|

Nominated account number |

N |

16 |

Y |

As per original file. |

|

Charges account number |

N |

16 |

Y |

As per original file |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Total number of transactions |

N |

8 |

Y |

As per original file |

|

Total value |

N |

18 |

Y |

As per original file |

|

Filler |

N |

52 |

Y |

Zero filled |

|

File Status |

String |

8 |

Y |

Value = REJECTED |

|

Reason |

String |

30 |

Y |

Reason for the file being rejected |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Security Record layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

04 – File security |

|

Hash total |

A/N |

256 |

Y |

|

|

New line feed |

Special |

|

|

A new line must be started after each record |

A file is returned after the individual transaction instructions have been validated. The file returned depends on the rejection transaction option selected.

The NACK file will be named as follows:

PNGG00.CDPACK.**A000.D0.SQ320

Where:

** equals the Client Identifier code i.e. the value for Description on the Global Parameter CPS CLIENT ID, A indicates it is an Acknowledge file and the 00 is the same sequential number as the original transaction instruction file.

For future testing purposes, the P at the start of the file name will be replaced with a Q i.e. the file name convention will be QNGG00.CDPACK.**A000.D0.SQ320

The file layout is detailed in the tables below:

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

As per original file |

|

Client profile number |

N |

10 |

Y |

As per original file |

|

File Sequence Number |

N |

24 |

Y |

As per original file |

|

File Type |

N |

2 |

Y |

As per original file |

|

Nominated account number |

N |

16 |

Y |

As per original file. |

|

Charges account number |

N |

16 |

Y |

As per original file |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Total number of transactions |

N |

8 |

Y |

As per original file |

|

Total value |

N |

18 |

Y |

As per original file |

|

Filler |

N |

52 |

Y |

Zero filled |

|

File Status |

String |

8 |

Y |

Value = ACCEPTED |

|

Reason |

String |

30 |

Y |

Blank |

|

New line feed |

Special |

|

|

A new line must be started after each record |

File Security Record layout

|

DATA ELEMENT |

A/N |

LENGTH |

MANDATORY |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

Y |

04 – File security |

|

Hash total |

A/N |

256 |

Y |

|

|

New line feed |

Special |

|

|

A new line must be started after each record |

An Unpaids file will be received for transactions that have been rejected by the internal Nedbank systems for Nedbank account transactions and ACB for non-Nedbank account transactions.

The Unpaids file will be named as follows:

PNGG00.CDPACK.**O000.D0.SQ320

Where: ** equals the Client Identifier code i.e. the value for Description on the Global Parameter CPS CLIENT ID, O indicates it is an Unpaids file and the 00 is the same sequential number as the original transaction instruction file.

For future testing purposes, the P at the start of the file name will be replaced with a Q i.e. the file name convention will be QNGG00.CDPACK.**O000.D0.SQ320

The file layout is detailed in the tables below:

File Header layout

|

DATA ELEMENT |

A/N |

LENGTH |

DESCRIPTION / VALUE |

|

Record identifier |

N |

2 |

01 – Header record identifier |

|

Client profile number |

N |

10 |

|

|

File Sequence Number

|

N |

24 |

Unique number per file. First 10 digits must be the Client Profile Number; the next 8 digits must be the date on which the file is submitted (YYYYMMDD), followed by a 6 digit sequential number. |

|

File Type |

N |

2 |

03 – CPS unpaid file |

|

New line feed |

Special |

|

A new line must be started after each record |

Item layout

|

FIELD NAME |

A/N |

LENGTH |

DESCRIPTION / VALUE |

|

Record Identifier |

N |

2 |

02 – transaction record identifier |

|

Record Type |

N |

2 |

01 – unpaid 02 – homeback 03 – redirect 05 – iVeri (credit card collections) |

|

Payment reference number |

N |

34 |

Payment reference number of the original transaction instruction |

|

Nedbank reference number |

N |

8 |

Internal Nedbank reference number |

|

Rejecting bank code |

N |

3 |

The code of the bank rejecting the transaction instruction. Will be blank if the record type is 02 or 03 |

|

Rejecting branch code |

N |

6 |

The code of the bank branch rejecting the transaction instruction. Will be blank if the record type is 02 or 03 |

|

New destination branch code |

N |

6 |

The new destination branch code if the original transaction instruction has been redirected. Will be blank if the record type is 01 or 02 |

|

New destination account number |

N |

16 |

The new destination account number if the original transaction instruction has been redirected. Will be blank if the record type is 01 or 02 |

|

New destination account type |

N |

1 |

The account type of the new destination account if the original transaction instruction has been redirected. Will be blank if the record type is 01 or 02 |

|

Status |

A/N |

8 |

Status of the transaction instruction |

|

Reason |

A/N |

100 |

Reason description if the transaction instruction has been rejected |

|

Unpaid user reference |

A/N |

30 |

Original narrative sent on the input file |

|

Filler |

N |

1 |

|

|

Original homing account number |

N |

11 |

Destination account supplied on the input file |

|

Original account type |

N |

1 |

Account type on the original file |

|

Amount |

N |

10.2 |

Amount of the transaction |

|

Original action date |

N |

6 |

Date on which transaction was actioned |

|

Class |

N |

2 |

Entry class of original transaction |

|

Tax Code |

N |

1 |

0 |

|

Reason code |

N |

2 |

Unpaid reason code returned by ACB or iVeri |

|

Original homing account name |

A/N |

30 |

Original destination account name |

|

New sequence number |

N |

6 |

Sequence number number for a redirect, else 0 |

|

Number of times redirected |

N |

2 |

Number of times the transaction has been redirected |

|

New action date |

N |

6 |

The date on which the transaction should be unpaid or redirected |

|

Filler |

A/N |

106 |

Spaces |

|

New line feed |

Special |

NA |

A new line must be started after each record |

File trailer layout

|

DATA ELEMENT |

A/N |

LENGTH |

DESCRIPTION / VALUE |

|

Record identifier

|

N |

2 |

03 – trailer record identifier Default to 03 |

|

Total number of transactions |

N |

8 |

Total number of transactions in the file, excluding header and trailer records. |

|

Total value |

N |

18 |

Total value of all transactions within the file, excluding header and trailer records |

|

Hash total |

A/N |

256 |

Padded with trailing Hex 00 characters if it is less than the allocated 256 spaces. Where security level 6 (Hash Totals) has been selected: 1. The formula is the sum of Item Layout (Destination Account Numbers + Amount) 2. Where the value does not equal 256 characters the hash total must be captured without trailing zeros. |

|

New line feed |

Special |

|

A new line must be started after each record |

Not Acknowledged (NACK)

When the JU2AU_UNPEFT Unpaid EFT and Rejections batch job runs, the system will read the files in the designated folder and if the file name is PNGG00.CDPACK.**N000.D0.SQ320 i.e. it is a NACK file, find the original Transaction Instruction file i.e. the file with a file name of PNGG00.CDPACK.**I000.D0.SQ320 and for which the File Sequence Number in the Header record is the same as the File Sequence Number in the Header record of the NACK file.

The system will find the EFT Instruction records for the records in the original Transaction Instruction file and update the Status to C on each record.

Rejections exceeding defined percentage

When the JU2AU_UNPEFT Unpaid EFT and Rejections batch job runs, the system will read the files in the designated folder and if the file name is PNGG00.CDPACK.**N000.D0.SQ320 i.e. it is a NACK file, find the original Transaction Instruction file i.e. the file with a file name of PNGG00.CDPACK.**I000.D0.SQ320 and for which the File Sequence Number in the Header record is the same as the File Sequence Number in the Header record of the NACK file.

The system will find the EFT Instruction records for the records in the original Transaction Instruction file and update the Status to C on each record.

Duplicate File

When the JU2AU_UNPEFT Unpaid EFT and Rejections batch job runs, the system will read the files in the designated folder and if the file name is PNGG00.CDPACK.**D000.D0.SQ320 i.e. it is a Duplicate file response file, find the original Transaction Instruction file i.e. the file with a file name of PNGG00.CDPACK.**I000.D0.SQ320 and for which the File Sequence Number in the Header record is the same as the File Sequence Number in the Header record of the Duplicate file response file.

The system will find the EFT Instruction records for the records in the original Transaction Instruction file and update the Status to C on each record.

Unpaid

When JU2AU_UNPEFT Unpaid EFT and Rejections batch job runs, the system will read the files in the designated folder and if the File Type is 03 (CPS Unpaids file) process each transaction for which the Record Type is 01 or 05 as follows:

For each transaction, the system will find the BT where:

Credit DTI Account Number = Original homing account number

Credit Bank Sort Code = Rejecting bank branch code

Amount = Amount

Document Number = Payment reference number

The Reporting Table will be updated with the following information:

|

Report Type |

EFT Rejections |

|

Date |

New action date |

|

Process |

BT – Process |

|

Accounting Activity |

BT – Accounting Activity |

|

Transaction Date |

BT – Transaction Date |

|

Scheme Code |

BT – Scheme Code |

|

Reference Number |

BT – Membership Reference Number (where applicable) |

|

Credit DTI Account Number |

EFT Instruction - Credit DTI Account Number |

|

Credit Bank Branch Code |

EFT Instruction - Credit Bank Sort Code |

|

Amount |

EFT Instruction - Amount |

|

Payee |

Original homing account name |

|

User ID |

BT – User ID |

|

Rejection Reason |

Reason |

A message will be written to the error log to indicate that a report has been created and list the Admin Branches for which the report has been created.

Accounting Transactions

If the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked i.e. it is a payment, the following Accounting Activities will be created depending on the Process:

If the Process is BENEFIT PAYMENT:

|

Process |

Acc Activity |

Stakeholder |

Dr Account |

Cr Account |

|

UNPAID EFT |

UNPAIDBENEFT |

FUND |

BANK |

BENPAYABLE |

|

UNPAID EFT |

UNPAIDBENEFT |

MEMBER |

MEMDEPOSIT |

BENPAYABLE |

If the Process is not BENEFIT PAYMENT:

|

Process |

Acc Activity |

Stakeholder |

Dr Account |

Cr Account |

|

UNPAID EFT |

UNPAID EFT |

FUND |

BANK |

UNPAID EFT |

The Accounting Activity will be created with the dates, amount and all other details equal to the details on the original Accounting Activity.

Note:

These Accounting Activities will not be created with the Money Movement Indicator set.

These transactions will not be written to the EFT Instruction.

The BENEFIT PAYMENT accounting transactions are to be created with a different accounting activity so that the Credit entry can be created in the BENPAYABLE account. This will then mean that the transaction will be displayed on the Benefit Payment enquiry screens and on the Benefit Payment reports as these transactions are extracted from the Member’s BENPAYABLE account.

This will not be possible for other transactions as it will require a reversal entry for every payment accounting activity and will need to be derived from the Debit entry of the original transaction in each case and therefore it is preferable to create an entry in the UNPAID EFT account and to process the replacement payment from this account.

If the Account BANK is the Debit Account on the BT to which the EFT Instruction is linked i.e. it is a collection, the system will read the Pay Centre on the BT and find the Collection Instruction linked to the Pay Centre. If no Collection Instruction is found, the Accounting Activity below will be created depending on the Accounting Activity of the original (collection) BT as per the following:

|

Original Acc Activity |

Process |

Acc Activity |

Stake holder |

Dr Account |

Cr Account |

|

SFEFTPAY |

UNPAID EFT |

EFTPAYREV |

FUND |

CONTRIBFUND |

BANK |

|

SFEFTPAY |

UNPAID EFT |

EFTPAYREV |

FUND |

CONTRIBFUND |

BANK |

|

SFFEEIN |

UNPAID EFT |

FEEINREV |

FUND |

FEERECVABLE |

BANK |

|

SFPRMIN |

UNPAID EFT |

PRMINREV |

FUND |

PREMRECVABLE |

BANK |

If a Collection Instruction is found and the Collection Method is INDIVIDUAL DO the following Accounting Activities will be created:

|

Original Acc Activity |

Process |

Acc Activity |

Stake holder |

Dr Account |

Cr Account |

|

SFEFTPAY |

UNPAID EFT |

EFTPAYREV |

FUND |

CONTRIBFUND |

BANK |

|

SFCONTRIB |

UNPAID EFT |

CONTRIBREV |

MEMBER |

CONTRIBUTION |

MEMDEPOSIT |

|

SFCONINV |

UNPAID EFT |

CONINVREV |

MEMBER |

MEMDEPOSIT |

INVESTMEMB |

The Last Payment Date on the Membership Payment Detail record will be updated to the current value less 1 month.

For each payment the system will find the email address for the Team linked to the Scheme and create an E-mail with the E-mail address and with the heading EFT Rejection.

The following information will be displayed in the text of the E-mail:

|

Process |

BT – Process |

|

Accounting Activity |

BT – Accounting Activity |

|

Transaction Date |

BT – Transaction Date |

|

Scheme Code |

BT – Scheme Code |

|

Reference Number |

BT – Membership Reference Number (where applicable) |

|

Credit DTI Account Number |

EFT Instruction - Credit DTI Account Number |

|

Credit Bank Branch Code |

EFT Instruction - Credit Bank Sort Code |

|

Amount |

EFT Instruction - Amount |

|

Payee |

Original homing account name |

|

Rejection Reason |

Reason |

Redirect

When the JU2AU_UNPEFT Unpaid EFT and Rejections batch job runs, the system will read the files in the designated folder and if the File Type is 03 (CPS Unpaids file), process each transaction for which the Record Type is 03 (redirect) on the Unpaids file as follows:

For each transaction find the BT where:

Credit DTI Account Number = Original homing account number

Credit Bank Sort Code = Rejecting bank branch code

Amount = Amount

Document Number = Payment reference number

The Reporting Table will be updated with the following information:

|

Report Type |

EFT Redirections |

|

Date |

New action date |

|

Process |

BT – Process |

|

Accounting Activity |

BT – Accounting Activity |

|

Transaction Date |

BT – Transaction Date |

|

Scheme Code |

BT – Scheme Code |

|

Reference Number |

BT – Membership Reference Number (where applicable) |

|

Old Account Number |

BT – Credit DTI Account Number |

|

Old Bank Branch Code |

BT – Credit Bank Sort Code |

|

Amount |

BT – Amount |

|

New Account Number |

New destination account number |

|

New Bank Branch Code |

New destination branch code |

|

New Account Type |

New destination account type |

|

Payee |

Original homing account name |

|

User ID |

BT – User ID |

A message will be written to the error log to indicate that a report has been created and list the Admin Branches for which the report has been created.

EFT Rejection Report

When the EFT Rejections menu option is selected on the Financial menu on the Scheme Reports website, the reports created will be displayed as per the existing process for other interfaces.

For more information, refer to EFT Rejections in Rejections under

Reports

Financial