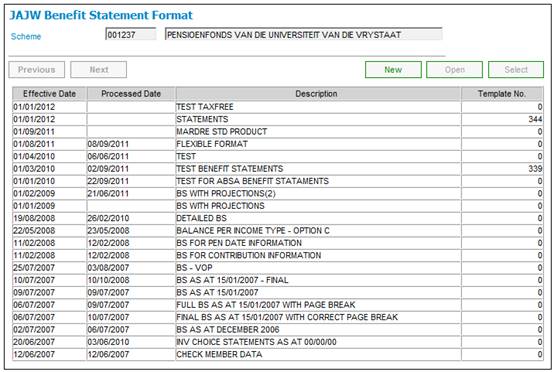

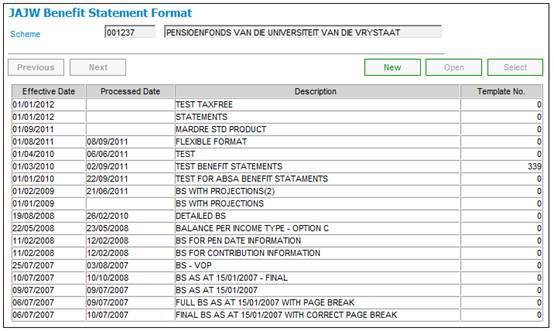

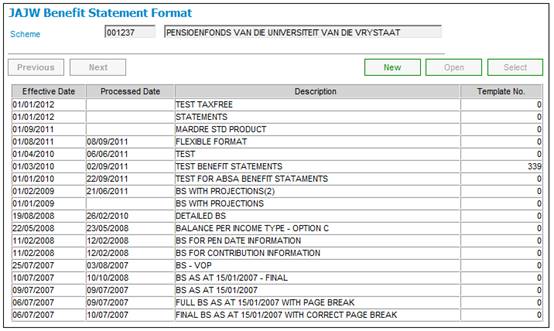

From the JU1BK List screen, select a product and then select Formats>Benefit Statement Formats from the sub-menu on the left.

The JAJW Benefit Statement Format screen will be displayed.

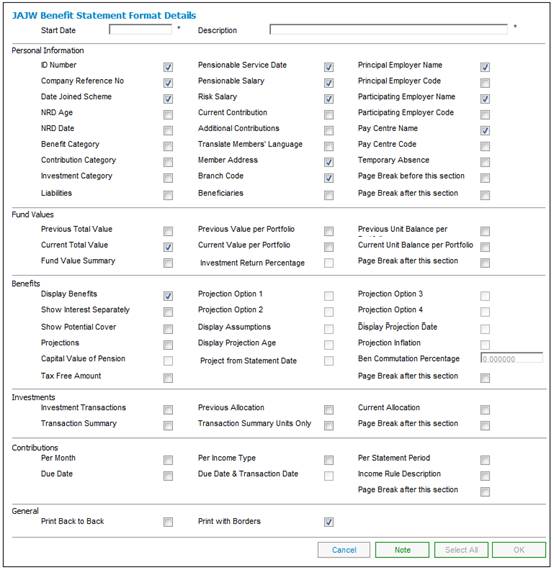

To add the format details of a benefit statement, click NEW. The JAJW Benefit Statement Format Details screen will be displayed.

Note:

The system will not allow this screen to be updated if the benefit statement batch process has used it.

This screen enables you to customize the member benefit statements for the members of a product, by selecting from a list of items. Only those items selected will be displayed on the member benefit statements. Items are selected by clicking the check box. A tick (![]() ) shows that the item will be selected for display.

) shows that the item will be selected for display.

Descriptions of the input fields on this screen appear below.

|

Start Date |

The date of the member benefit statement. |

|||||||||||||||||

|

Description |

Free form text describing this member benefit statement. |

|||||||||||||||||

|

Personal Information |

|

|||||||||||||||||

|

ID number |

The national identity number of an employee. |

|||||||||||||||||

|

Company Reference No |

The unique number allocated to an employee by the employer. |

|||||||||||||||||

|

Date Joined Scheme |

The date on which the employee joined the product as a member. |

|||||||||||||||||

|

NRD Age |

The age as at the normal retirement date. |

|||||||||||||||||

|

NRD Date |

The normal retirement date |

|||||||||||||||||

|

Benefit Category |

The category to which the member is allocated for benefit purposes. |

|||||||||||||||||

|

Contribution Category |

The category to which the member is allocated for contribution purposes. |

|||||||||||||||||

|

Investment Category |

The category to which the member is allocated for investment purposes. |

|||||||||||||||||

|

Liabilities |

The liabilities for the member. |

|||||||||||||||||

|

Pensionable Service Date |

The date the member's pensionable service started (brought forward from the member's previous product). |

|||||||||||||||||

|

Pensionable Salary |

The member's monthly pensionable salary. The amount displayed will be the actual earning (of type BASIC) x 12. |

|||||||||||||||||

|

Risk Salary |

The member's monthly salary used for risk benefits. The amount displayed will be the actual earning (of type RISK) x 12. |

|||||||||||||||||

|

Current Contribution |

The current monthly employee and employer contribution. |

|||||||||||||||||

|

Additional Contributions |

The total of all contributions that are defined as voluntary and either of the following, next to voluntary contributions:· - Ad hoc - Regular |

|||||||||||||||||

|

Translate Member's Language |

Translate the data to display in the chosen language of the member. |

|||||||||||||||||

|

Member Address |

The member's address. Note: The system will display the following address details, depending on what has been coded on the system: - the client address associated to the member - the client address associated to the pay center - the client address associated to the participating employer. |

|||||||||||||||||

|

Branch Code |

The code of the branch to which the member belongs. |

|||||||||||||||||

|

Beneficiaries |

The beneficiaries of the member. |

|||||||||||||||||

|

Principal Employer |

The name of the Principal Employer. |

|||||||||||||||||

|

Principal Employer Code |

The code that identifies the Principal Employer. |

|||||||||||||||||

|

Participating Employer Name |

The name of the Participating Employer. |

|||||||||||||||||

|

Participating Employer Code |

The code that identifies the Participating Employer. |

|||||||||||||||||

|

Pay Centre Name |

The name of the Pay Centre to which the member belongs. |

|||||||||||||||||

|

Pay Centre Code |

The code that identifies the pay centre to which the member belongs. |

|||||||||||||||||

|

Temporary Absence |

A period of temporary absence taken by an employee in the context of an employment relationship. If the Temporary Absence box is ticked, all periods of Temporary Absence will be displayed under the PERSONAL INFORMATION section of the benefit statement. The following Temporary Absence fields will be displayed: Temporary Absence Type Start Date End Date |

|||||||||||||||||

|

Page Break before this section |

Tick this box to create a page break before this section. |

|||||||||||||||||

|

Page Break after this section |

Tick this box to create a page break after this section. |

|||||||||||||||||

|

Fund Values Note: If any of the FUND VALUES options are selected, the current and previous options must match. For example - CURRENT TOTAL VALUE must only be selected with PREVIOUS TOTAL VALUE - CURRENT TOTAL VALUE must not be selected together with e.g. PREVIOUS VALUE PER PORTFOLIO - Only previous options or only current options can be selected, e.g. CURRENT TOTAL VALUE, CURRENT VALUE PER PORTFOLIO and CURRENT UNIT BALANCE PER PORTFOLIO. |

||||||||||||||||||

|

Previous Total Value |

The total of the market value balances, in the member's investment accounts, per investment portfolio, as at the date of the previous benefit statement. |

|||||||||||||||||

|

Current Total Value |

The total of the market value balances, in the member's investment accounts, per investment portfolio, as at the current date. |

|||||||||||||||||

|

Fund Value Summary |

The fund value summary.

For more information refer to the Preservation funds section below. |

|||||||||||||||||

|

Previous Value Per Portfolio |

The market value per portfolio, used in the calculation of the previous CURRENT TOTAL VALUE. |

|||||||||||||||||

|

Current Value Per Portfolio |

The market value per portfolio, used in the calculation of the CURRENT TOTAL VALUE. |

|||||||||||||||||

|

Investment Return Percentage |

The percentage of investment return achieved. |

|||||||||||||||||

|

Previous Unit Balance Per Portfolio |

The balances in the member's investment unit accounts, per investment portfolio, as at the date of the previous benefit statement. |

|||||||||||||||||

|

Current Unit Balance Per Portfolio |

The balances in the member's investment unit accounts, per investment portfolio, as at the current date. |

|||||||||||||||||

|

Page Break after this section |

Tick this box to create a page break after this section. |

|||||||||||||||||

|

Benefits |

|

|||||||||||||||||

|

Display Benefits |

Display the member’s benefits. |

|||||||||||||||||

|

Show Interest Separately |

The interest calculated for a withdrawal benefit can be shown separately for contributions and total contributions. Note: The value for EVENT CATEGORY must be WITHDRAWAL and the value for BENEFIT TYPE must be REFUND OF CONTRIBUTIONS. |

|||||||||||||||||

|

Show Potential Cover |

The member's full potential cover can be shown for death and disability benefits (i.e. the amount that the member would be insured for if the evidence of health limit did not apply).

This field will be disabled once a format has been processed. |

|||||||||||||||||

|

Projections |

The projected benefit for each of the product’s benefit events.

If Projections is ticked, and none of the Projection Option 1 to Projection Option 4 fields are ticked, projection will be based on Projection Option 1 using either the parameters set up by the Administrator or the Parameters.

Note: Projected benefit calculated If the value of the FORMULA TYPE field is ACCRUAL %, then the projected monthly pension amount after commutation, (annual pension amount / 12), will be calculated. The following will be displayed on the benefit statement: - Projected commutation amount - Projected monthly pension

If the value of the FORMULA TYPE field is not ACCRUAL %, then the total inflation adjusted capital value will be calculated. The following will be displayed on the benefit statement: - Projected commutation amount - Projected value available for purchase of a pension.

Displaying the benefits The system will display the benefit product description and benefit amount. These values will be displayed under the following headings, according to the event category of the benefit event to which the benefit product is associated, as indicated below:

Enabling other fields The following fields will only be enabled when the PROJECTIONS field has been selected: - Projection Options - Display Assumptions - Display Projection Age - Display Projection Date - Ben Commutation Percentage |

|||||||||||||||||

|

Capital Value of Pension |

The capital value of the pension. |

|||||||||||||||||

|

Tax Free Amount |

The tax free portion of the benefit.

Note: When the Benefit Statement Batch job is run and the value for Display Tax Free Amount is Y, the system will extract the data as per the table below and store the data on the Benefit Statement table as per the value in the Field column.

|

|||||||||||||||||

|

Projection Option 1 |

The projected benefit for each of the product’s benefit events, using the investment return assumption percentage.

If Projections is ticked, and none of the Projection Option 1 to Projection Option 4 fields are ticked, projection will be based on Projection Option 1 using either the parameters set up by the Administrator or the Parameters.

Note: This field will only be enabled when the PROJECTIONS field is selected. Note: If the product is a UK product, refer to the Projection Option and Special note for UK Products sections below. |

|||||||||||||||||

|

Projection Option 2 |

The system will use the investment return assumption percentage value stored in the INVEST_RETURN_2 field, under the Batch Parameters menu option. This percentage will be applied to the projected benefit calculated, (see PROJECTIONS above).

If PROJECTION OPTION 2 is selected, and if no value is found in the INVEST_RETURN_2 field, then no percentage will be applied to the projected benefit calculated (see PROJECTIONS above). Note: If the product is a UK product, refer to the Projection Option and Special note for UK Products sections below. |

|||||||||||||||||

|

Projection Option 3 |

Note: If the product is a UK product, refer to the Projection Option and Special note for UK Products sections below. |

|||||||||||||||||

|

Projection Option 4 |

Note: If the product is a UK product, refer to the Projection Option and Special note for UK Products sections below. |

|||||||||||||||||

|

Display Assumptions |

The assumptions used in the benefit projection calculation. Note: This field will only be enabled when the PROJECTIONS field is selected.

If the PROJECTIONS and PROJECTION ASSUMPTIONS fields are both selected, the following assumptions will be displayed:

* Note: If this fields is selected (under BENEFITS), then this assumption will also be displayed. |

|||||||||||||||||

|

Display Projection Age |

The age used in the benefit projection calculation.

This field will only be enabled when the PROJECTIONS field is selected. |

|||||||||||||||||

|

Projection from Statement Date |

Calculate the projection from the benefit statement date. |

|||||||||||||||||

|

Display Projection Date |

The projection date used in the benefit projection calculation.

This field will only be enabled when the PROJECTIONS field is selected. |

|||||||||||||||||

|

Projection Inflation |

Indicates if a projected real value must be calculated using the inflation rate parameter.

This field will be disabled once a format has been processed. |

|||||||||||||||||

|

Ben Commutation Percentage |

The benefit commutation percentage used in the benefit projection calculation.

This field will only be enabled when the PROJECTIONS field is selected. |

|||||||||||||||||

|

Page Break after this section |

Tick this box to create a page break after this section. |

|||||||||||||||||

|

Investments Note: The investment details, as selected below, will be displayed as schedules in the benefit statement. |

|

|||||||||||||||||

|

Investment Transactions |

The business transactions and balances retrieved from the member's account per portfolio. Note: The transactions for the same portfolio and with the same transaction date and accounting activity, are summed, and displayed as schedules in the benefit statement. |

|||||||||||||||||

|

Transaction Summary |

The transaction summary. |

|||||||||||||||||

|

Previous Allocation |

The member's investment allocation/s used in the previous benefit statement. |

|||||||||||||||||

|

Transactions Summary Units Only |

The transaction summary in Units. |

|||||||||||||||||

|

Current Allocation |

The member's current investment allocation/s. |

|||||||||||||||||

|

Page Break after this section |

Tick this box to create a page break after this section. |

|||||||||||||||||

|

Contributions Note: The contribution details, as selected below, will be displayed in schedules in the benefit statement. |

|

|||||||||||||||||

|

Per Month |

The member's transactions for each month of the benefit statement period. The transactions will be summed per month. |

|||||||||||||||||

|

Due Date |

The member's transactions as at the due date. This will be summed. Note: To display the member's transactions for each month of the benefit statement period, the tick must be removed from the check box. |

|||||||||||||||||

|

Per Income Type |

The member's transactions for each month, for each income type, of the benefit statement period. |

|||||||||||||||||

|

Due Date & Transaction Date |

The sum of the member's transactions with the same due date and transaction date. These will be displayed as the DUE MONTH and TRANSACTION DATE. |

|||||||||||||||||

|

Per Statement Period |

The balance in the member's contribution account for the benefit statement period. |

|||||||||||||||||

|

Income Rule Description |

If this box is ticked, the income rule description for the contribution category to which the member is associated will be used as the description for the current contributions shown on the benefit statement. |

|||||||||||||||||

|

Page Break after this section |

Tick this box to create a page break after this section. |

|||||||||||||||||

|

General |

|

|||||||||||||||||

|

Print Back to Back |

Print the benefit statement in the back to back format. |

|||||||||||||||||

|

Print with Borders |

Print the benefit statement pages with borders. |

|||||||||||||||||

Projection Option

Where the Product is a UK Product, the values for Projection Option fields 1, 2, 3 and 4 on the JAJW Benefit Statement Format Details screen will be interpreted as per the table below:

|

Projection Assumption 1 |

Parameter Type PROJ ASSUMPTION and Sub Type of INV RET LOW |

|

Projection Assumption 2 |

Parameter Type PROJ ASSUMPTION and Sub Type of INV RET CORE |

|

Projection Assumption 3 |

Parameter Type PROJ ASSUMPTION and Sub Type of INV RET HIGH |

|

Projection Assumption 4 |

Parameter Type PROJ ASSUMPTION and Sub Type of SMPI INV RETURN |

In order to include SMPI projections and projections using a medium return, the Projection Assumption 2 and Projection Assumption 4 check boxes must be ticked.

Also refer to Special note for UK Products below.

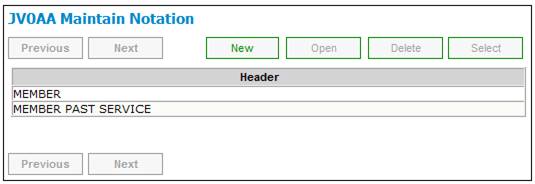

To add comments to the benefit statement format details, click NOTE. The JV0AA Maintain Notation screen will be displayed.

For further information regarding the notes facility, refer to Notes.

Once all details on the JAJW Benefit Statement Format Details screen have been captured, click OK.

Note:

If an invalid combination of FUND VALUES has been selected, an error message will be displayed.

Incorrect Fund Values selected. Please reselect.

Click OK then correct the selection.

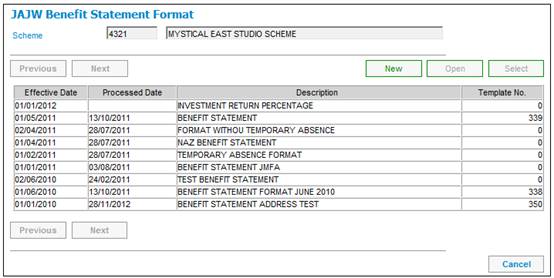

The JAJW Benefit Statement Format screen will be re-displayed with the details captured.

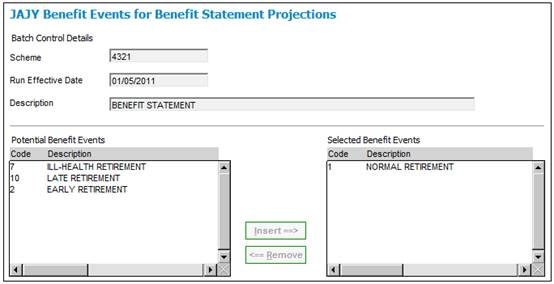

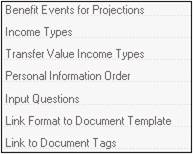

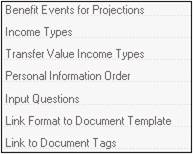

To select the benefit events associated to the product, and that must be used for projections, highlight a benefit statement format, then select Benefit Events for Projections from the sub-menu on the left.

The JAJY Benefit Events for Benefit Statement Projections screen will be displayed.

Note:

Only those benefit events with an event category of RETIRAL will be displayed.

The Potential Benefit Events pane on the left displays all the benefit events that are available for selection. Highlight the required benefit event and click INSERT to move it to the Selected Benefit Events pane on the right. Repeat this process until all selections have been made.

In order to remove a benefit event from the Selected Benefit Events pane, highlight the relevant event and click REMOVE.

Once all selections have been made, select CLOSE from the sub-menu on the left.

![]()

The JAJW Benefit Statement Format screen will be re-displayed.

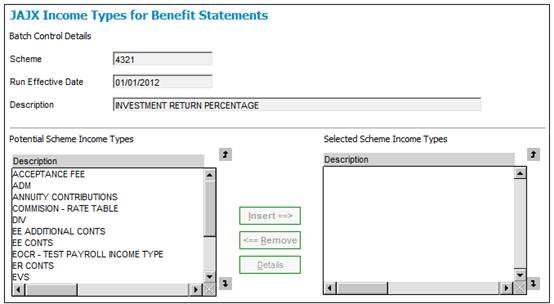

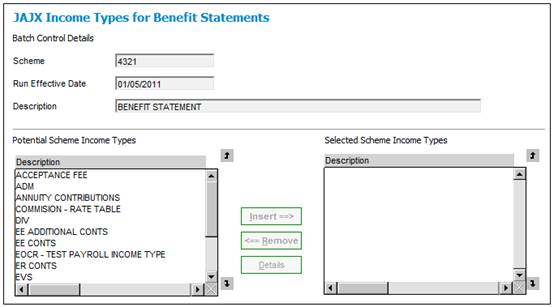

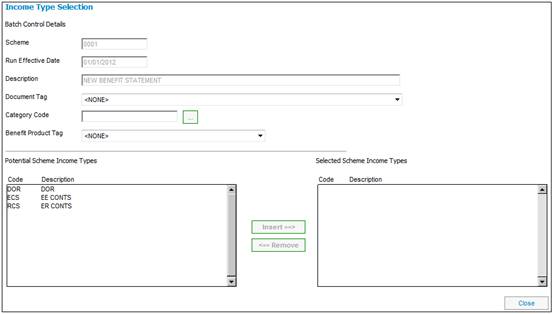

To select the specific income types that should be displayed on the benefit statement, highlight a benefit statement format, then select Income Types from the sub-menu on the left.

The JAJX Income Type for Benefit Statements screen will be displayed.

This screen displays a list of income types associated to the product.

The Potential Scheme Income Types pane on the left displays all the income types that are available for selection. Highlight the required income type and click INSERT to move it to the Selected Scheme Income Types pane on the right. Repeat this process until all selections have been made.

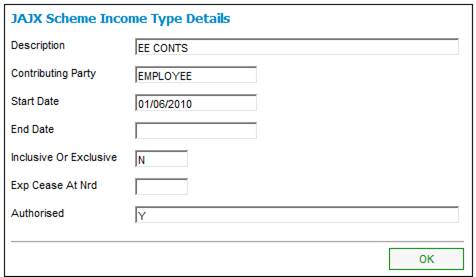

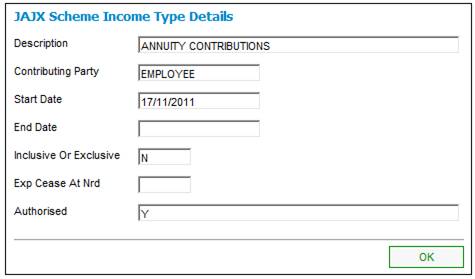

To view details of a selected scheme income type, click DETAILS. The JAJX Scheme Income Type Details screen will be displayed.

To return to the JAJX Income Types for Benefit Statements screen, click OK.

In order to remove an income type from the Selected Scheme Income Types pane, highlight the relevant type and click REMOVE.

Once all selections have been made, select CANCEL. The JAJW Benefit Statement Format screen will be re-displayed.

To select the specific income types that should be displayed on the benefit statement for transfer values, highlight a benefit statement format, then select Transfer Value Income Types from the sub-menu on the left.

The JAJX Income Types for Benefit Statements screen will be displayed.

This screen displays a list of income types associated to the product.

The Potential Scheme Income Types pane on the left displays all the income types that are available for selection. Highlight the required income type and click INSERT to move it to the Selected Scheme Income Types pane on the right. Repeat this process until all selections have been made.

To view details of a selected scheme income type, click DETAILS. The JAJX Scheme Income Type Details screen will be displayed.

To return to the JAJX Income Types for Benefit Statements screen, click OK.

In order to remove an income type from the Selected Scheme Income Types pane, highlight the relevant type and click REMOVE.

Once all selections have been made, select CANCEL. The JAJW Benefit Statement Format screen will be re-displayed.

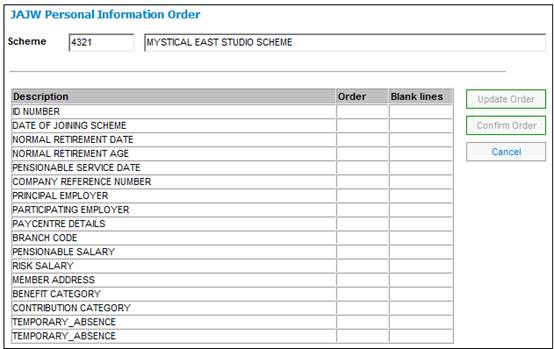

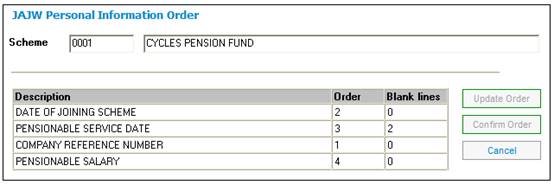

To select the order in which the personal information fields are displayed on the benefit statement, or to be able to insert line spacing between the sequenced fields, highlight a benefit statement format, then select Personal Information Order from the sub-menu on the left.

The JAJW Personal Information Order screen will be displayed, showing all Personal Information previously selected from the JAJW Benefit Statement Format Details screen.

If this screen is being accessed for the first time, then all the selected fields will be displayed in the original order and without any spacing (i.e. no blank lines).

If the screen is being accessed after any sequencing has taken place previously, then all the fields in the previously sequenced order will be displayed with any relevant spacing.

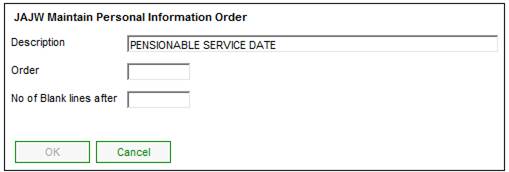

Select a field by selecting on the line and click UPDATE ORDER. The JAJW Maintain Personal Information Order screen will be displayed.

Capture data as follows:

|

Order

|

Enter a positive numeric value to indicate the sequence in which the selected field must be displayed. |

|

No of Blank lines after |

Enter a numeric value to indicate the number of blank lines that must be displayed after the selected field. |

Click OK.

The JAJW Personal Information Order screen will be redisplayed showing the sequence and blank lines that were captured.

Once the order has been defined for all of the fields, click CONFIRM ORDER. The system will return to the JAJW Benefit Statement Format screen.

In addition to the standard formats and selections for benefit statements, an extract of information for inclusion in the benefit statements for UK products is required.

The data to be extracted is defined in a flexible benefit statement template and is set up as a table in which the data to be extracted for each column is defined by the selection of a field tag. The tags to be selected are provided from the following sources:

- system Tags linked to the Benefit Products included in the Benefit Packages for the benefit calculations to be included in a benefit statement.

- user Defined tags linked to the Benefit Products included in the Benefit Packages for the benefit calculations to be included in a benefit statement.

- tags defined for information that is not included in Benefit Packages.

All of these tags are available for selection in the set up of the benefit statement template for UK products.

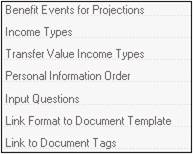

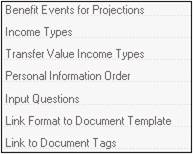

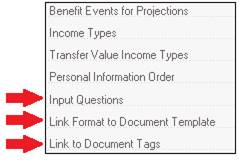

Certain of the information to be contained in the extract is defined in the Benefit Statement format. The following menu options further define the information that will be extracted:

|

Input Questions |

To supply the answers to the questions that would be included in on-line projections. |

|

Link Format to Document Template |

To define which document template must be used for the benefit statement format. |

|

Link to Document Tags |

To define e.g. which Income Types to include. |

These options are displayed in the sub-menu on the left.

Any information to be included in a benefit statement that requires a calculation must use the Event Category of BEN STATEMENT for the set up of calculations. They will be set up with a Benefit Event that describes the calculation module and with System Tags linked to the Benefit Products for which the output are required to be included in a benefit statement. These Benefit Events are not listed on the Benefit Quotes, Projections and Claim screens.

Preservation funds

When selecting the values for the Fund Value Summary, the system will extract the values as per the details in the table below.

|

Opening Balance |

Retrieve the balances on the members’ INVESTMEMUNIT and INVESTMEMB accounts per investment portfolio as at the From Effective Date less 1 day using Effective Date. Calculate market value as at From Effective Date less 1 day. For each investment portfolio read the Earnings Allocation Code for the associated investment medium. If UNITISED and Pricing Frequency is DAILY: Retrieve the authorised unit price with an effective date equal to the From Effective Date less 1 day. If not found stop processing and write a message to the error log. Calculate the market value (unit balance of member’s INVESTMEMUNIT account x unit price) If UNITISED and Pricing Frequency is MONTHLY: If the From Effective Date is the last day of the month retrieve the authorised unit price with an effective date equal to the From Effective Date plus 1 day. If not found stop processing and write a message to the error log. If the From Effective Date is not equal to the last day of the month retrieve the authorised unit price with an effective date equal to the first day of the month of the From Effective Date. If not found stop processing and write a message to the error log. Calculate the market value (unit balance of member’s INVESTMEMUNIT account x unit price)

If BONUS: Retrieve the balance on the member’s INVESTMEMB account as at the From Effective Date. Sum the values per portfolio and display the total. |

|

Contributions |

Retrieve all of the transactions from the member’s CONTRIBUTION account for which the Transaction Date is greater than or equal to the From Effective Date and Less than or equal to the To Effective Date and for which the Global Group Type is CONTRIBUTIONS. Sum all the transactions per income type. |

|

Costs |

Retrieve all of the SFCONDED and MEMEXPENSE accounting activities from the member’s CONTRIBUTION account for which the Transaction Date is greater than or equal to the From Effective Date and Less than or equal to the To Effective Date. Sum all the transactions. |

|

Withdrawals |

Retrieve all of the MEMBENRLINV accounting activities from the member’s INVESTMEMB account and all of the MEMBENRLUNT accounting activities from the member’s INVSTMEMUNIT account for which the Transaction Date is greater than or equal to the From Effective Date and Less than or equal to the To Effective Date. Sum all the transactions. |

|

Investment Return |

Calculate the return as follows: Closing Balance minus Total of Contributions plus Costs plus Withdrawals minus Opening Balance. |

|

Closing Balance |

Retrieve the balances on the members’ INVESTMEMUNIT and INVESTMEMB accounts per investment portfolio as at the To Effective Date using Effective Date. Calculate the market value as per the previous value above using the unit price as at the To Effective Date. Sum the values per portfolio and display the total. If the Earnings Allocation Code for the associated investment medium is BONUS calculate interest to the To Effective Date using the interim rate if interest has not been calculated at the final rate to the To Effective Date (see 2.3.2 below) |

|

Investment Return % |

If selection on the Benefit Statement Format for Investment Return Percentage is Y calculate the percentage as follows: ((2 X Investment Return) / (Opening Balance + Closing Balance – (Contributions – Costs - Withdrawals))) X 100 |

To select the specific income types for the definition of the Bookmarks (Tags) to be used for Benefit Statements, highlight a benefit statement format, then select Link to Document Tags from the sub-menu on the left.

The Income Type Selection screen will be displayed.

Capture and select data as follows:

|

Document Tag |

Select a Tag from the Document Tag field drop-down list. These are the Tags associated to the Process Type of BEN STATEMENT and for which the Type is INCOME.

Note: For a list of these Tags, refer to Supplements Tags Tags for Benefit Statements

When a Tag has been selected, a list of the Scheme Income Types with a Group Type of CONTRIBUTIONS or RESERVE will be displayed in the Potential Scheme Income Types pane for selection. |

|

Category Code |

Click LINK to flow to the JU1BR Scheme Membership Group List and select a Membership Group from the list. |

|

Benefit Product Tag |

The Benefit Product to be associated to the Document Tag.

Select a value from the drop-down list. |

|

Scheme Income Types |

Highlight the required income type and click INSERT to move it to the Selected Scheme Income Types pane on the right. Repeat this process until all selections have been made.

To remove an income type from the Selected Scheme Income Types pane, highlight the relevant type and click REMOVE. |

Once all of the selections have been made, click CLOSE to return to the JAJW Benefit Statement Format screen.

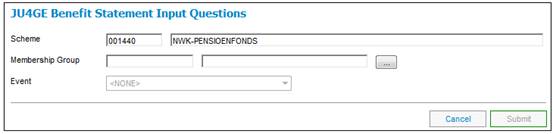

To supply the answers to the questions that would be included in on-line projections, highlight a benefit statement format, then select Input Questions from the sub-menu on the left.

The JU4GE Benefit Statement Input Questions screen will be displayed.

To create a new input question, click NEW.

The JU4GE Benefit Statement Input Questions screen will be displayed.

Capture data as follows:

|

Membership Group |

Click LINK to flow to the JU1BR Scheme Membership Group List screen. Select BENEFIT from the Membership Group Type drop-down list, and select a Membership Group. |

|

Event |

Select an Event from the drop-down list. This is a list of the Benefit Events linked to the Product.

Note: This field will not be enabled until a Membership Group has been selected. |

Click SUBMIT.

If no questions are found, then the system will display the message:

No questions found!

Click OK to remove the message.

The Benefit Statements Input screen will be displayed.

This screen provides the input questions for the Benefit Products linked to the Benefit Package for the Benefit and Benefit Membership Group selected, and for which Formula Applied To is MEMBER CHOICE, and the facility to provide the answer to be returned when the benefit calculation is performed.

To confirm the Input Questions, click SUBMIT.

The system will confirm the Input Question(s) by returning the message:

Data saved successfully!

To define which document template must be used for the benefit statement format, highlight a benefit statement format and select Link Format to Document Template from the sub-menu on the left.

To create a new input question, click NEW.

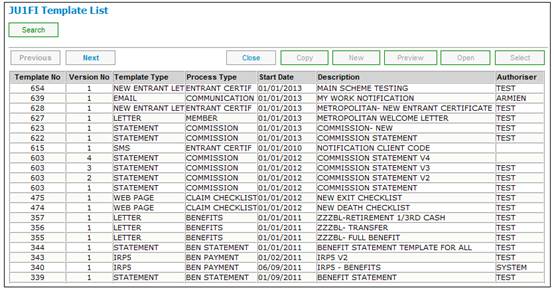

The JU1FI Template List screen will be displayed.

Select a Document Template with a Process Type of BEN STATEMENT and click SELECT.

The JAJW Benefit Statement Format screen will be displayed. The number of the selected Template will be displayed in the Template No column.