This section applies only to those products using the standard benefit rules.

Note:

If the product uses the flexible benefit rules, refer to Benefit Product (Flexible Benefit Rules).

Instead of creating a new BSV, an existing BSV can be copied. Refer to Copy a BSV below.

From the sub-menu on the left, select Benefit Product.

Note:

The Calculation menu option will not be enabled if the selected product uses the standard benefit rules.

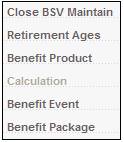

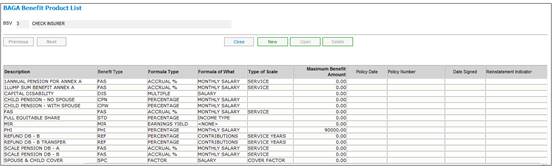

The BAGA Benefit Product List screen will be displayed. Benefit products previously assigned (if any) will be shown.

To link a new benefit product, click NEW. The BAGA Benefit Product Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Benefit Product |

|

|

Description |

The name by which the product will be known. |

|

Maximum Benefit Amount |

The maximum benefit amount that is allowed in terms of the rules. |

|

Underwriter |

The name of the corporate client who is underwriting this benefit product.

Note: This is the underwriter from whom risk amounts will be recovered.

Click LIST at the end of the line. Note: This field will only be enabled when the TYPE OF BENEFIT selected is an insured benefit. |

|

Type of Benefit |

The type of calculation that the system must perform.

Click LIST at the end of the line. The following are examples of some options that may be available: DISABILITY (DIS) PHI BENEFIT (PHI) GROUP LIFE ASSURANCE (GLA) FINAL AVG SALARY (FAS) STANDARD BENEFIT – SCHEME CREDIT (STD) REFUND CONTRIBS (REF) ACCIDENT DEATH BENEFIT (ADB) HOME LOAN GUARANTEE (HLN)

Refer to Calculation Components |

|

Formula Applied to |

The particular type of value against which the selected formula must be applied in a calculation, i.e. what information is needed to apply the Formula Type selected.

The drop down box displays a list of value types to which the formula should apply. The following are examples of some options that may be available: ACCOUNTING ANNUITY AMT CONTRIBUTIONS EARNINGS INCOME TYPE MEMBER CHOICE RETIREMENT DATE SALARY SPOUSE TERRITORY

Refer to Calculation Components |

|

Formula Type |

The key parameter upon which the formula is based. The drop down box displays a list of the different types of formulae available. The following options may be selected: NONE ACCRUAL % ACCRUAL % TO NRD AMOUNT CALC TYPE CALCTYPELOOP EARNINGS YIELD FACTOR INDEX LINKED MANUAL * MEM ANN FEE PER MEM INT ADM PR MEM INIT FEE PR MULTIPLE PERCENTAGE

MANUAL * *If the formula is such that it cannot be accommodated by the system (and therefore requires a manual calculation when a claim takes place), it should be set to MANUAL, in which case a system-generated note will be produced at the time of the claim, stating that a manual calculation is required.

Refer to Calculation Components |

|

Type of Scale |

The type of variable upon which a scale of parameter values is based.

This allows for a scale to be further defined. Example: If GLA is defined as a multiple of salary, this could further be defined by a scale of ages: Age 30 to 45 = 4 X salary Age 46 to 50 = 3 X salary Age 51 to 70 = 2 X salary

The drop down box displays a list of the different scale types available. The following are examples of some options that may be available: NONE AGE AGE FACTOR AGE FACT EXACT AGENEAR-YRDOB AMOUNT MONTHS RATE TABLE SALARY SERVICE SERVICE YEARS SLIDING SCALE SLIDING TOT MV

Refer to Calculation Components |

|

Purchase from Underwriter |

Defines whether the benefit must be purchased from the underwriter, or whether it may be purchased elsewhere. The following options are available in the drop-down box: ALWAYS NEVER SOMETIMES

Note: If NEVER is selected, the member can never transfer money out. The member will become a Living Annuitant and the system will create specific accounting entries for this. The NEVER selection also drives the way that the Realisation Process is performed by the system. |

|

Cash/Annuity |

How the benefit must be paid. The following options are available in the drop-down box: FUND PROFIT ANNUITY CASH |

|

Guarantee Period (optional) |

The period (in months) for which payment of the annuity is guaranteed. |

|

Policy |

|

|

Date |

The effective date of the policy. |

|

Date signed |

The date on which the policy was signed. |

|

Number |

The number uniquely identifying the policy |

|

Reinstatement Indicator |

|

Refer to

Supplements

MIR Calculated Value

After the relevant details have been captured, click OK to save the information. The BAGA Benefit Product List screen will be re-displayed.

After all the benefit products have been linked as above, the BAGA Benefit Product List screen will display as follows:

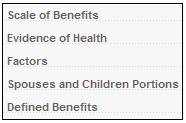

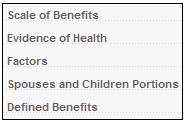

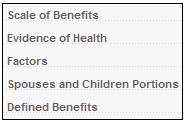

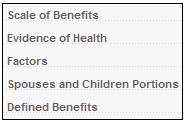

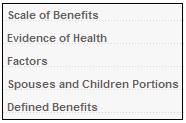

For each benefit product on the BAGA Benefit Product List screen, highlight a benefit product and some or all of the following sub-menu options will be displayed on the left:

- Scale of Benefits

- Evidence of Health

- Factors

- Spouses and Children Portions

- Defined Benefits

Note:

These sub-menu options may not all be enabled. The enablement of these options is determined by the TYPE OF BENEFIT, FORMULA APPLIED TO, FORMULA TYPE, and TYPE OF SCALE combinations that have been defined for the particular benefit product selected. For example, if TYPE OF BENEFIT = Refund of Contributions, then Evidence of Health will not be enabled.

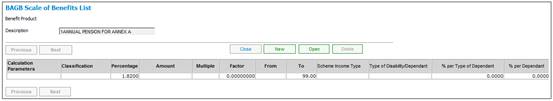

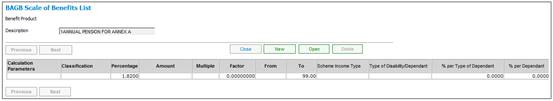

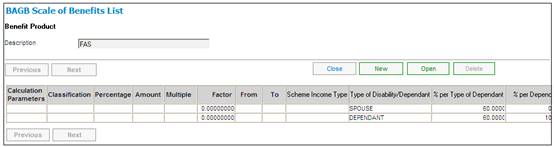

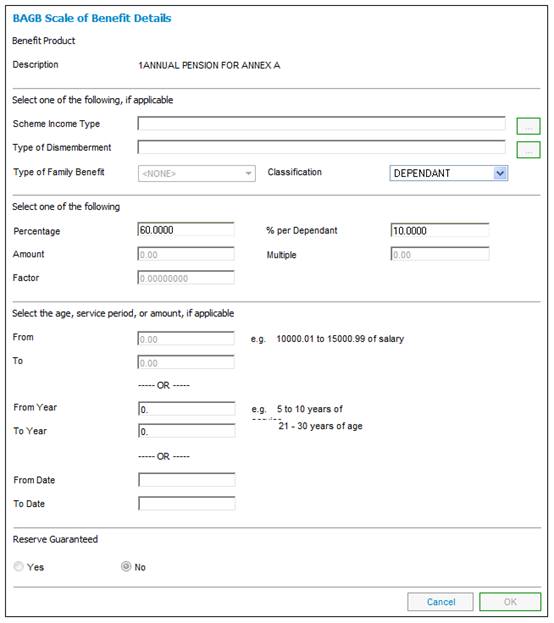

To code the scale of benefits for a product, highlight the required benefit product, then select Scale of Benefits from the sub-menu on the left.

The BAGB Scale of Benefits List screen will be displayed. Scales of benefits previously coded (if any) will be shown.

To add a new scale of benefits, click NEW.

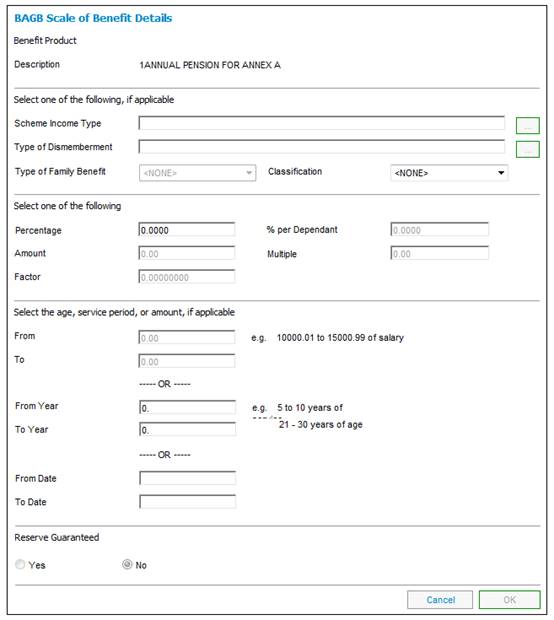

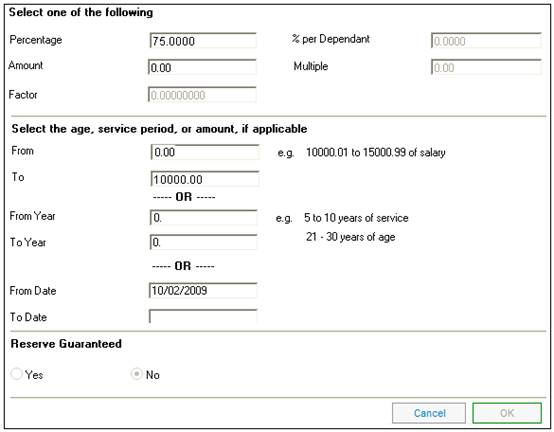

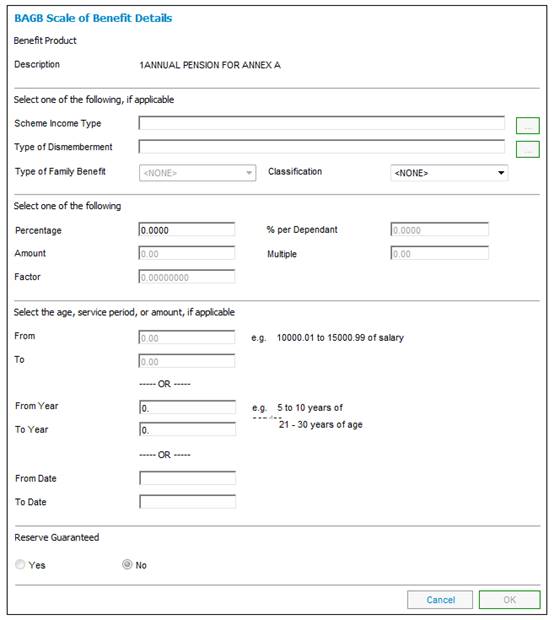

The BAGB Scale of Benefit Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

This section will not be applicable to all benefit products.

|

Scheme Income Type |

Click LIST at the end of the line. |

|||

|

Type of Dismemberment |

Click LIST at the end of the line. |

|||

|

Type of Family Benefit |

The dependant for whom the family benefit applies. The following options are available in the drop-down box: SPOUSE CHILD STILLBORN MEMBER 2 CHILDREN |

|||

|

Classification |

Classifies additional monthly salary.

This field is only enabled when Formula Applied To is MONTHLY SALARY.

The following options are available in the drop-down box: BASIC BPB SHIFT etc.

Refer to Calculation Components |

|||

|

Select one of the following (only the field that was specified under FORMULA TYPE when the benefit product was defined, will be enabled) |

|

|||

|

Percentage |

The percentage that must be used in the formula. |

|||

|

Amount |

The amount that must be used in the formula. |

|||

|

% per Dependant |

The percentage applicable per dependant. |

|||

|

Factor |

The factor that must be used in the formula. |

|||

|

Multiple |

The multiple that must be used in the formula. |

|||

|

Select the age, service period. or amount, if applicable. |

|

|||

|

From |

The amount FROM which the formula will apply. |

|||

|

To |

The age, period or amount TO which the formula will apply. |

|||

|

From Year |

The year FROM which the formula will apply. Note: This field will only be enabled if the Type of Scale is YEARS TO NRD. |

|||

|

To Year |

The year TO which the formula will apply. Note: This field will only be enabled if the Type of Scale is YEARS TO NRD. |

|||

|

From Date |

The date from which the age, service period or amount must be applied.

Note: A value must be captured for either the From Date or the To Date, but it is not mandatory to capture a value for both.

If only a From Date is captured it will be treated as date greater than or equal to. |

|||

|

To Date |

The date to which the age, service period or amount must be applied.

Note: A value must be captured for either the From Date or the To Date, but it is not mandatory to capture a value for both.

If only a To Date is captured, it will be treated as date less than or equal to. |

|||

|

Reserve Guaranteed |

|

|||

|

Yes / No |

Indicates whether there is a guarantee of the actuarial reserve after a certain number of years of service, i.e. the member would be entitled to the greater of the actuarial reserve and the normal benefit. This option is available only for the refund of contributions benefit in a defined benefit product. Select the appropriate radio button. This only applies when the benefit product selected is REFUND OF CONTRIBUTIONS. The reserve guaranteed fields will be disabled for all other benefit products. Note: If RESERVE GUARANTEED is coded as YES, then at the time that a claim is processed, a system-generated note will be produced stating that a manual calculation is required, and manual intervention will be enforced by the system. |

|||

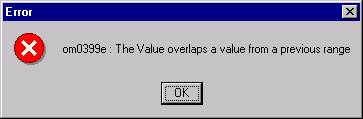

Note:

The values coded in the FROM and TO fields on the series of screens may not overlap. For example, if the first screen is coded FROM 10000.00 TO 20000.00, and the second screen is coded FROM 15000.00 TO 30000.00, an error message will be displayed.

Click OK and correct the overlapping value.

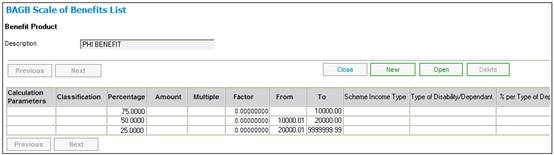

After the last BAGB Scale of Benefits Details screen has been coded, the captured scale(s) will appear as a line in the BAGB Scale of Benefits List screen, as shown below:

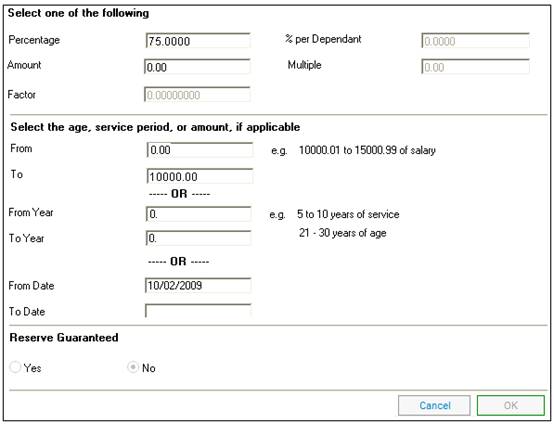

Permanent Health Insurance (PHI)

The benefit is

75% of the first R10000 of salary

plus

50% of the next R10000 of salary

plus

25% of the balance,

with a maximum benefit of R20000

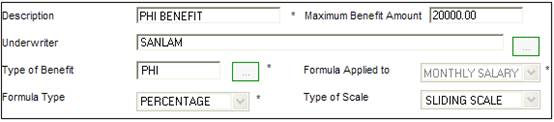

On the Benefit Product Details screen:

|

MAXIMUM BENEFIT AMOUNT |

= 20000 |

|

TYPE OF SCALE |

= SLIDING SCALE |

On the Scale of Benefits List screen:

Click NEW.

|

PERCENTAGE |

= 75 |

|

FROM |

= 0.00 |

|

TO |

= 10000.00 |

Click OK.

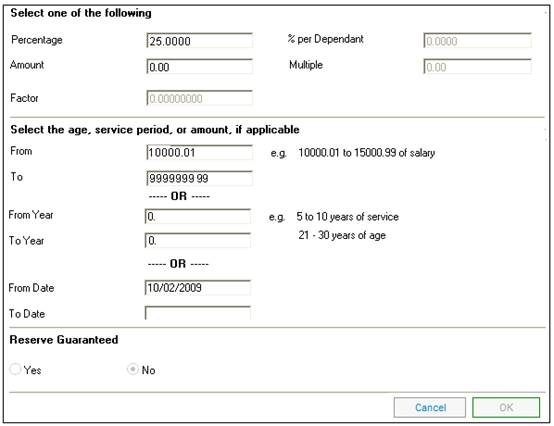

Click NEW.

|

PERCENTAGE |

= 50 |

|

FROM |

= 10000.01 |

|

TO |

= 20000.00 |

Click OK.

Click NEW.

|

PERCENTAGE |

= 25 |

|

FROM |

= 20000.01 |

|

TO |

= 9999999.99 |

Click OK.

The Scale of Benefits List screen should look as follows:

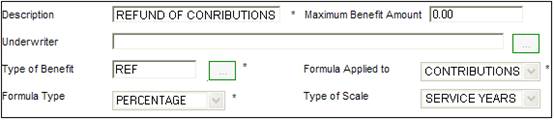

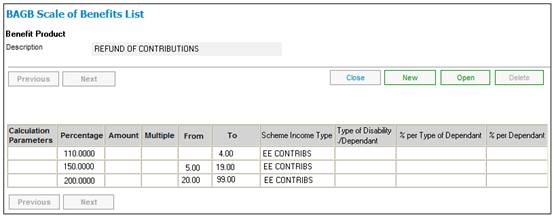

The scale of benefits facility can also be used to code a refund of contributions (also known as a withdrawal benefit). This is typically where the refund benefit may be increased by an additional percentage which is dependant upon the member’s length of service.

Multiple screens are also coded for this type of benefit.

Refund of contributions (scale in a defined benefit product)

|

Years of service |

Additional % |

|

Up to 5 |

10 |

|

5 to 20 |

50 |

|

20 or more |

100 |

On the Benefit Product Details screen:

|

MAXIMUM BENEFIT AMOUNT |

= 0.00 |

|

TYPE OF SCALE

|

= SERVICE YEARS |

On the Scale of Benefits List screen:

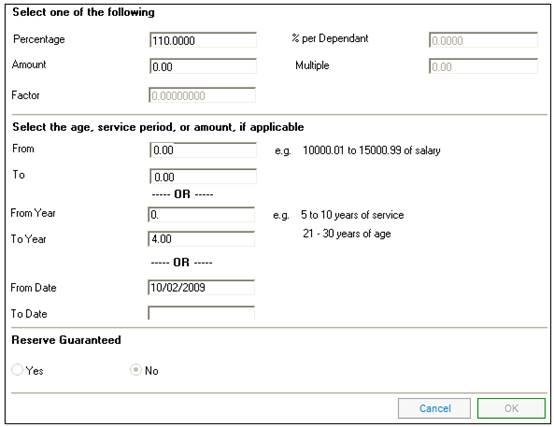

Click NEW.

|

PERCENTAGE |

= 110 |

|

FROM |

= 0 |

|

TO |

= 4 |

Click OK.

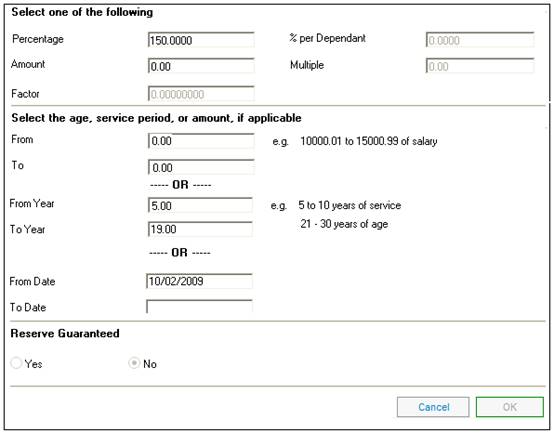

Click NEW.

|

PERCENTAGE |

= 150 |

|

FROM |

= 5 |

|

TO |

= 19 |

Click OK.

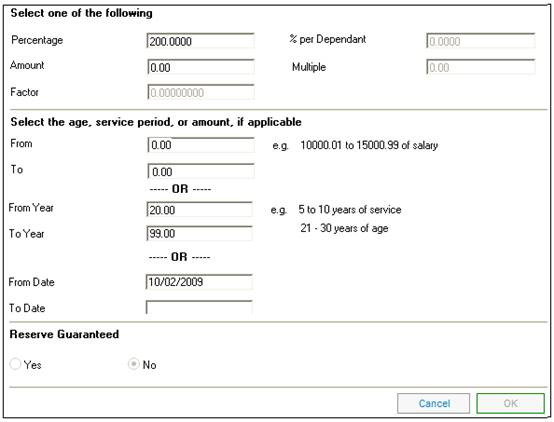

Click NEW.

|

PERCENTAGE |

= 200 |

|

FROM |

= 20 |

|

TO |

= 99 |

Click OK.

The Scale of Benefits List screen should look as follows:

Refund of contributions (standard scheme credit)

This is a defined contribution (DC) benefit. In this case, the benefit is 100% of the benefit payable for employee contributions, employer contributions and employee additional premiums.

To code this benefit, multiple screens should be coded (i.e. one for each scheme income type). The section for scale of benefits is disabled, and the only fields available are SCHEME INCOME TYPE and PERCENTAGE.

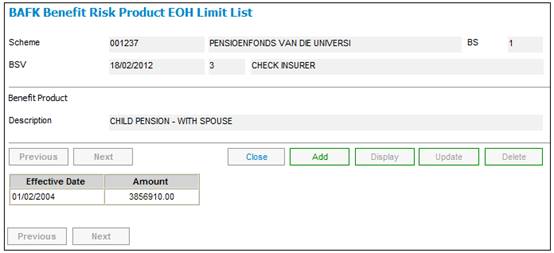

To code the evidence of health details for a product, highlight the required product.

After the product has been highlighted, select Evidence of Health from the sub-menu on the left.

The BAFK Benefit Risk Product EOH Limit List screen will be displayed.

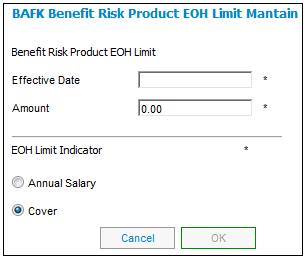

To add a new evidence of health limit, click ADD. The BAFK Benefit Risk Product EOH Limit Maintain screen will be displayed.

Descriptions of the input fields on this screen appear below.

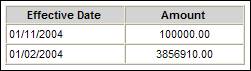

|

Effective Date |

The date from which an evidence of health (EOH) limit is applicable for a benefit. |

|

Amount |

The amount of a benefit above which EOH is required by the insurer. |

|

EOH Limit Indicator |

Click on the appropriate button to indicate whether the amount entered is: - an annual salary amount limit - a cover amount limit |

Click OK. The BAFK Benefit Risk Product EOH Limit List screen will be re-displayed, and the amount and its effective will be shown in the table of limits.

This table will show the history of the amounts and their effective dates over time.

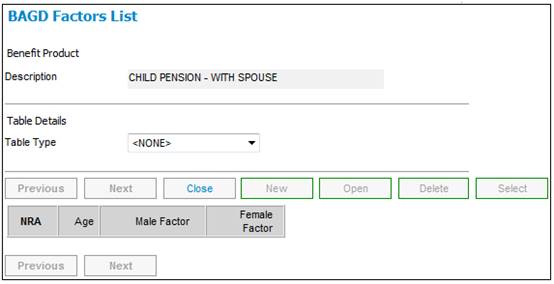

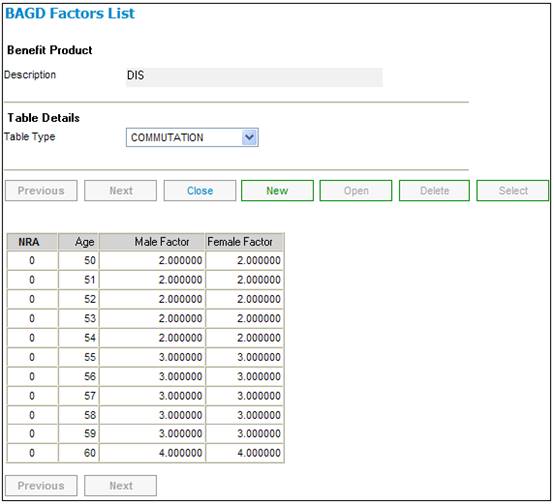

In order to provide for flexible risk benefits and spouses and children’s benefits, it is necessary to store age and gender-based factors, which are multiplied by the salary to arrive at the insured cover amount. Similarly, in order to provide for commutation benefits at retirement, it is necessary to store fixed commutation factors, which are multiplied by the commuted pension in order to arrive at the commutation amount.

Either cover factors or commutation factors (for final average salary benefits) may be coded using this facility. Values for both males and females must be captured.

To code the factors necessary for the calculation of insured cover for a product, highlight the required benefit product.

After the product has been highlighted, select Factors from the sub-menu on the left.

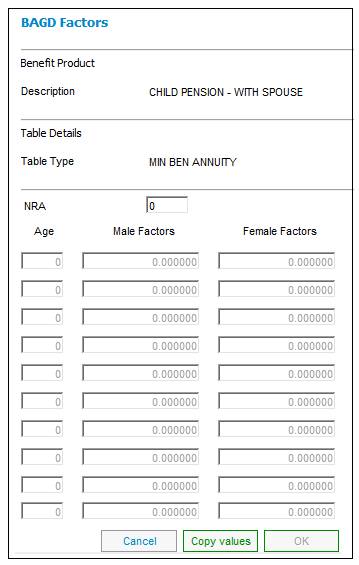

The BAGD Factors List screen will be displayed.

Select the required table type from the drop-down box. The following options are available:

- ANNUITY CAP VAL (annuity factors for capital value)

- ANNUITY PEN AMT (annuity factors for pension amount)

- MIN BEN ANNUITY (discounted annuity factors)

- COMMUTATION (commutation factors)

- COVER (cover factors)

Note:

COVER is only available if the BENEFIT TYPE is PHI

Factors previously coded (if any) will be shown.

To code a new set of factors, click NEW.

The BAGD Factors screen will be displayed.

Enter the age and the male and female factors for that age.

Note:

If the male and female factors are exactly the same, the values can be copied. Once the ages have been entered into the Male Factors column, click COPY VALUES. The values will be copied into the Female Factors column.

Click OK. The BAGD Factors screen will be re-displayed, and the factors entered will be shown.

To return to the Benefit Product List screen, click OK. Continue entering factors for the benefit products, as required.

The spouse's and children's pension is a percentage of the pension that the member would have received had the member retired as at the date of death or at the normal retirement date. This section describes how to maintain the spouses and children portions.

To maintain the percentage allocations for the spouses and children, highlight the required product on the BAGA Benefit Product List screen.

Select Spouses and Children Portions from the sub-menu on the left.

The BAGB Scale of Benefits List screen will be displayed.

Information already added will be displayed. To add new details, click NEW. The BAGB Scale of Benefits Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

This section will not be applicable to all benefit products.

|

Scheme Income Type |

Click LIST at the end of the line. |

||

|

Type of Dismemberment |

Click LIST at the end of the line. |

||

|

Type of Family Benefit |

The dependant for whom the family benefit applies. The following options are available in the drop-down box: SPOUSE CHILD STILLBORN MEMBER 2 CHILDREN |

||

|

Type of Dependant |

Whether the dependant is a dependant or a spouse. The following options are available in the drop-down box: DEPENDANT SPOUSE |

||

|

Select one of the following (only the field that was specified under FORMULA TYPE when the benefit product was defined, will be enabled) |

|

||

|

% per Type of Dependant |

Enter the maximum percentage of the benefit that must be shared between the types of dependants defined.

Note: Where the Type of Dependant selected is SPOUSE, only the % per Type of Dependant value is used. The percentage of this value that applies to the Spouse must be captured on the Spouses & Children Details screen in the Claims Process. |

||

|

Amount |

The amount that must be used in the formula. |

||

|

% per Dependant |

The percentage that each Dependant gets of the percentage in the % per Type of Dependant field (above).

Note: This field only applies for a Type of Dependant of Dependant or a Disabled Dependant. |

||

|

Factor |

The factor that must be used in the formula. |

||

|

Multiple |

The multiple that must be used in the formula. |

||

|

Select the age, service period. or amount, if applicable. |

|

||

|

From |

The amount FROM which the formula will apply. |

||

|

To |

The age, period or amount TO which the formula will apply. |

||

|

From Year |

The year FROM which the formula will apply.

Note: This field will only be enabled if the Type of Scale is YEARS TO NRD. |

||

|

To Year |

The year TO which the formula will apply.

Note: This field will only be enabled if the Type of Scale is YEARS TO NRD. |

||

|

From Date |

The date from which the age, service period or amount must be applied.

Note: A value must be captured for either the From Date or the To Date, but it is not mandatory to capture a value for both.

If only a From Date is captured it will be treated as date greater than or equal to. |

||

|

To Date |

The date to which the age, service period or amount must be applied.

Note: A value must be captured for either the From Date or the To Date, but it is not mandatory to capture a value for both.

If only a To Date is captured, it will be treated as date less than or equal to. |

||

|

Reserve Guaranteed |

|

||

|

Yes / No |

Indicates whether there is a guarantee of the actuarial reserve after a certain number of years of service, i.e. the member would be entitled to the greater of the actuarial reserve and the normal benefit. This option is available only for the refund of contributions benefit in a defined benefit product. Select the appropriate radio button. This only applies when the benefit product selected is REFUND OF CONTRIBUTIONS. The reserve guaranteed fields will be disabled for all other benefit products. Note: If RESERVE GUARANTEED is coded as YES, then at the time that a claim is processed, a system-generated note will be produced stating that a manual calculation is required, and manual intervention will be enforced by the system. |

||

Click OK. The BAGB Scale of Benefits List screen will be re-displayed, and the captured information will be shown.

To view or change details already captured, highlight the required line, then click OPEN. The BAGB Scale of Benefits Details screen will be displayed.

Note:

Only the percentages can be changed here.

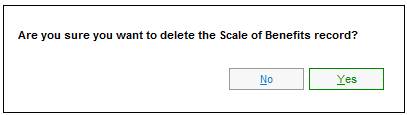

To delete types of dependants, highlight the required line, then click DELETE. The following confirmation message will be displayed:

Are you sure you want to delete the Scale of Benefits record?

Click NO to cancel the deletion, or click YES to confirm the deletion. The BAGB Scale of Benefits List screen will be re-displayed, and the deleted record will no longer appear.

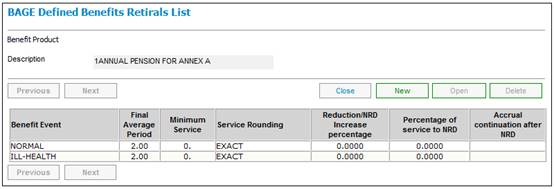

To code additional parameters required for a defined benefit pension product, highlight the required product on the BAGA Benefit Product List screen.

Select Defined Benefits from the sub-menu on the left.

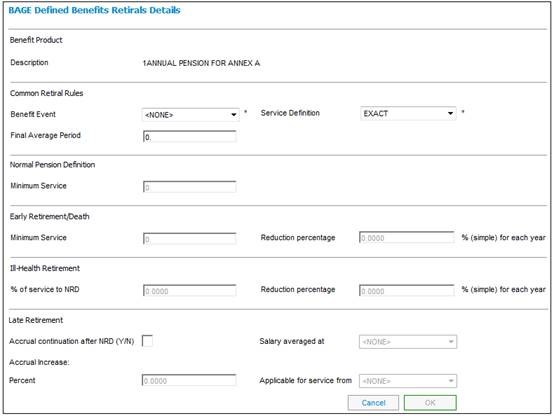

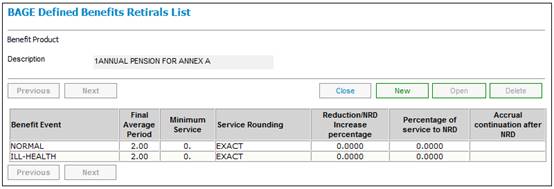

The BAGE Defined Benefits Retirals List screen will be displayed.

Retiral rules for the defined benefit product previously coded (if any) will be shown.

To code a new defined benefit, click NEW. The BAGE Defined Benefit Retirals Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Common Retiral Rules (Rules applicable to all retiral events) |

|

||

|

Benefit Event |

The specific event at which a benefit may apply. The drop-down box displays a list of the different types of benefit events available for retiral (including beneficiary pensions on death). The following are examples of some options that may be available for the final average salary benefit product: EARLY ILL-HEALTH LATE NORMAL

Note: Depending on the selection made at this point, the system will disable those portions of the screen that do not apply. For example, if BENEFIT EVENT = NORMAL is selected, then the sections of the screen dealing with early, ill-health and late retirement will be disabled. |

||

|

Service Definition |

The definition of the pensionable service parameter to be used in the calculation of a pension. The drop-down box displays a list of the different service definitions available. The following are examples of some options that may be available: EXACT YRS / MNTHS LAST YRS / MNTHS NEXT

Example If a member dies or retires on 20/09/2003, then pensionable service will be calculated on the following basis: If EXACT, then calculate service up to 20 September. If YRS / MNTHS LAST, then calculate service up to the end of the previous month, i.e. 31 August. If YRS / MNTHS NEXT, then calculate service up to the end of the current month, i.e. 30 September |

||

|

Final Average Period |

The period in years, over which a member’s final salaries must be averaged. This is to determine the salary to be used in a pension calculation. |

||

|

Normal Pension Definition (Rules applicable to normal retirement) |

. |

||

|

Minimum Service |

The minimum service that a member must have completed in order to qualify for a normal retirement pension. |

||

|

Early Retirement/Death (Rules applicable to early retirement) |

|

||

|

Minimum Service |

The minimum service that a member must have completed in order to qualify for an early pension. |

||

|

Reduction Percentage |

The percentage by which a member’s pension must be reduced due to early retiral (usually a fixed percentage for each year, or part thereof, prior to the normal retirement date). |

||

|

Ill-Health Retirement (Rules applicable to ill-health retirement) |

|

||

|

% of service to NRD |

The percentage of service, from date of retirement up to the normal retirement date that will be taken into account in the calculation of a member’s pension for ill-health retiral.

Example: If 50 is coded, then the member will be credited with 50% of the period of service between the ill-health and normal retirement dates. |

||

|

Reduction percentage |

The percentage (for each year of service), by which a member’s pension must be reduced due to early retiral. This is usually a fixed percentage for each year prior to the normal retiral date. |

||

|

Late Retirement (Rules applicable to late retirement) |

|

||

|

Accrual continuation after NRD (Y / N) |

Whether a member’s pension must continue to accrue for service beyond normal retirement date. |

||

|

Salary average at |

The end of period date as at which the salary will be averaged. The drop-down box displays a list of the available end of period dates for salary averaging. The following options are available: - NRD ONLY (at the normal retirement date only) - LRD ONLY (at the late retirement date only) - LRD & NRD (at both the late retirement and normal retirement dates) |

||

|

Accrual Increase: Percent |

The percentage by which a member’s pension accrual (or part thereof) must be increased due to late retiral. This is usually a fixed percentage for each year by which the retirement is late (i.e. the number of years between NRD and LRD) and will be applied to all or some of the member's accrual. Refer to APPLICABLE FOR SERVICE FROM below. Note: It is possible that an increase percentage may not apply. If the increase percentage is zero, then the selection of the APPLICABLE FOR SERVICE FROM drop-down box will be disabled. |

||

|

Applicable for service from |

The period to which the accrual increase percent should be applied. The drop-down box displays a list of the service periods available. The following options are available: - DOE – NRD (Date of Entry (pensionable service date) to Normal Retirement Date) - NRD – LRD (Normal Retirement Date to Late Retirement Date) - DOE – LRD (Date of Entry (pensionable service date) to Late Retirement Date Note: The selection of this field will be disabled if no increase percentage is applicable. |

||

Refer to Examples of Coding for DB Late Retirement.

Click OK. The BAGE Defined Benefits Retirals List screen will be re-displayed, and the rules captured for the event(s) will be shown.

Note:

For each defined benefit final average salary product selected in the BAGA Benefit Product List screen, a separate defined benefit rule must be defined for each retiral event (i.e. for each value in the BENEFIT EVENT drop-down box on the BAGE Defined Benefit Retirals Details screen (early, ill-health, late, normal retiral) separate rules must be defined).

Once rules for all the events have been defined, click CANCEL on the BAGA Defined Benefits Retirals List screen. The BAGA Benefit Product List screen is re-displayed. If there are no more benefit products to be defined, click CANCEL. TheBACJ BSV Maintain screen is re-displayed.