Provides for the capture or amendment of the member's tax details.

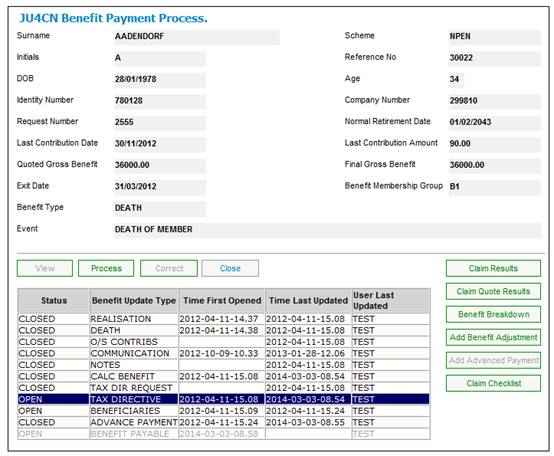

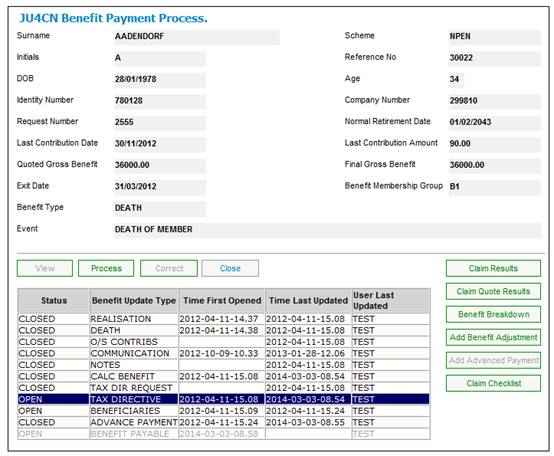

From the JU4CN Benefit Payment Process screen, highlight TAX DIRECTIVE, then click PROCESS.

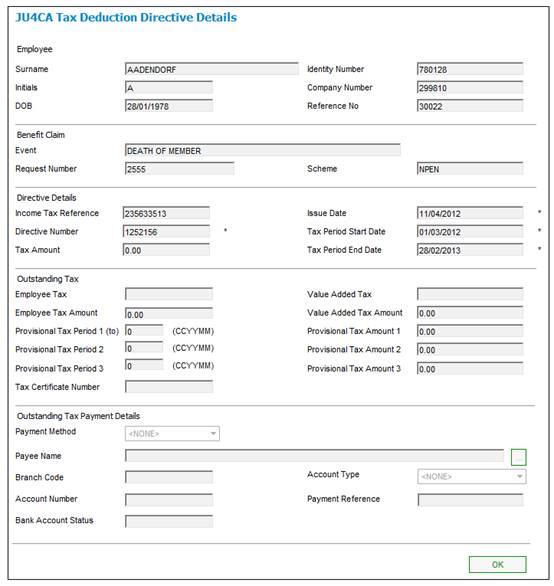

The JU4CA Tax Deduction Directive Details screen will be displayed.

Descriptions of the input fields appear below.

|

Benefit Claim |

|

|

Event |

The event applicable for this claim. |

|

Request Number |

The number identifying the claim that is generated by the system. |

|

Scheme |

The scheme to which the member belongs. |

|

Directive Details |

|

|

Income Tax Reference |

The member’s tax number. |

|

Directive Number |

The number assigned by the Receiver. This is a mandatory field. |

|

Tax Amount |

The amount of tax due, to be deducted from the benefit. The default value will be zero. |

|

Issue Date |

The date the directive was issued. This is a mandatory field. |

|

Tax Period Start Date |

The date from which the directive is valid. The default value will be the first day of the tax year in which the date of exit falls.

This is a mandatory field. |

|

Tax Period End Date |

The date until which the directive is valid. . The default value will be the last day of the tax year in which the date of exit falls.

The date captured must be a date one year, less one day, later than the Tax Period Start Date.

This is a mandatory field. |

|

Outstanding Tax |

|

|

Employee Tax |

The member’s tax number. |

|

Employee Tax Amount |

The amount of tax due to be deducted for arrears tax. |

|

Value Added Tax |

(Ignore - not relevant for pension fund claims). |

|

Value Added Tax Amount |

(Ignore - not relevant for pension fund claims). |

|

Provisional Tax Period 1 (to) |

The year and month for the first period. |

|

Provisional Tax Amount 1 |

The amount of provisional tax due for the first period. |

|

Provisional Tax Period 2 |

The year and month for the second period. |

|

Provisional Tax Amount 2 |

The amount of provisional tax due for the second period. |

|

Provisional Tax Period 3 |

The year and month for the third period. |

|

Provisional Tax Amount 3 |

The amount of provisional tax due for the third period. |

|

Tax Certificate Number |

The number of the member’s Tax Certificate. Note: The tax certificate number can be updated after a claim has been authorized. |

|

Outstanding Tax Payment Details |

|

|

Payment Method |

The method by which payment must be made. Click on the drop-down box and select a payment method from the list, e.g. - BANK TRANSFER - CHEQUE - EFT - FOREIGN DRAFT - GROUP PAYMENT |

|

Payee Name |

The name of the payee, e.g. SARS or South African Revenue Services. Click LINK to select a Bank Account from the JU1CC Product Bank Account List screen. |

|

Branch Code |

The bank branch coded. This is mandatory if the payment method is EFT. |

|

Account Type |

Type of bank account. Select from the drop-down list. This information is required if the PAYMENT METHOD is EFT. |

|

Account Number |

The account number. This is mandatory if the payment method is EFT. |

|

Payment Reference |

The Payment Reference number requires 10 digits exactly and will then be formatted to match the pattern: 9999999999T00000000. |

|

Bank Account Status |

The status of the account holder validation for the bank account, e.g. NOT VALIDATE, VALIDATED, REJECTED, USER VALIDATED, etc. Note: The account holder validation (AHV) via LDC only validates account numbers for ABSA, First National Bank (FNB) and Standard Bank (SBSA). Where the account is held at any other bank, the status will be able to be updated to MANUAL VALIDATE and the user ID of the person who updated the status will be displayed. The authorizer can take this into account when checking the status of the account. |

After the Tax Deduction Directive Details screen has been completed, click OK to save the details.

When OK is selected, the system will perform certain validations on the data captured, or the data missing from the JU4CA Tax Deduction Directive Details screen.

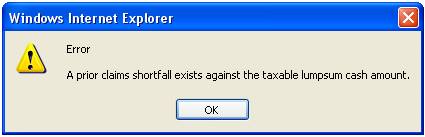

If the cash portion is not greater than the total of the surety and tax amounts, the following error message will be displayed:

A prior claims shortfall exists against the taxable lumpsum cash amount.

Click OK to remove the message and investigate the discrepancy.

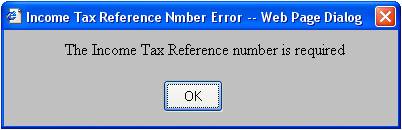

The value of the INCOME TAX REFERENCE field must be a non-zero number. If this value is not present, the following error message will be displayed:

The Income Tax Reference number is required

Click OK to remove the message and capture or amend the required data on the JU4CA Tax Deduction Directive Details screen.

The value of the INCOME TAX REFERENCE field must be a non-zero number. If this value is not present, the OK button will not be enabled. Capture a valid number and click OK.

The value of the ISSUE DATE field must be a valid date, and later than the month of exit. If this value is not present, the OK button will not be enabled. Capture a valid date and click OK.

The value of the DIRECTIVE NUMBER field must be a non-zero number. If this value is not present, the OK button will not be enabled. Capture a valid number and click OK.

If no value has been captured for the AMOUNT TAX field, the OK button will not be enabled. Capture a valid value and click OK.

If no value has been captured for the TAX PERIOD START DATE or the TAX PERIOD END DATE fields, the OK button will not be enabled. Capture a valid value and click OK.

The Payment Reference number requires 10 digits exactly and will then be formatted to match the pattern: 9999999999T00000000

Click OK to remove the message and capture or amend the required data on the JU4CA Tax Deduction Directive Details screen.

Return to the JU4CN Benefit Payment Process screen, then click CLOSE to close this update type.

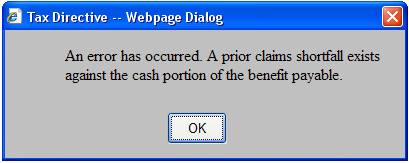

If a prior claim discrepancy still exists between the amount of tax and the benefit amount, the system will not allow the TAX DIRECTIVE benefit payment update type to be closed. The following error message will be displayed:

An error has occurred. A prior claims shortfall exists against the cash portion of the benefit payable.

Click OK to remove the message and investigate the discrepancy.

For additional tax information, refer to

Supplements

SARS Interface