The realisation update process retrieves the balances from the member's investment account and moves them to the benefit payable account.

- For bonus schemes, interest is calculated on the investment balance and moved to the benefit payable account.

- For unitised schemes, the latest unitised position is retrieved and the market value is calculated based on the applicable unit price. The market value is then moved to the benefit payable account

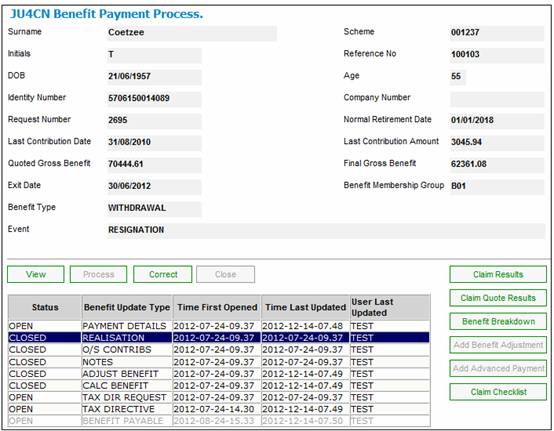

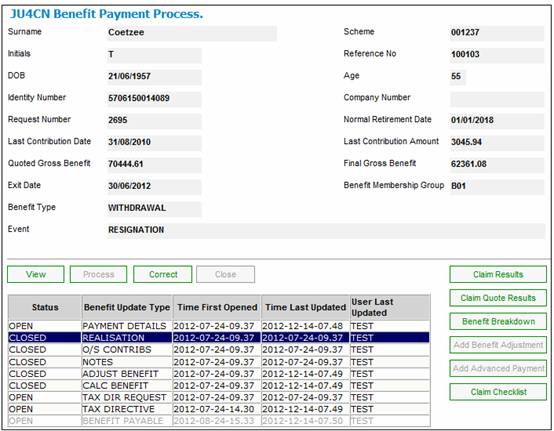

From the JU4CN Benefit Payment Process screen, highlight REALISATION, then click PROCESS.

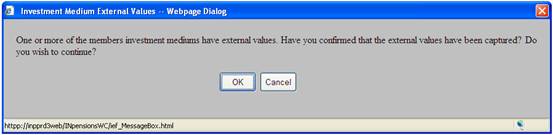

The following message will be displayed to indicate that external values exist for the portfolio/s:

One or more of the members investment mediums have external values. Have you confirmed that the external values have been captured? Do you wish to continue?

Click CANCEL to cancel the processing of the REALISATION Benefit Update Type, or click OK to continue processing.

If the benefit being processed is a retiral for a non-defined benefit scheme (refer Note below), the JU4CE Realisation Selection screen will be displayed.

Note:

The benefit referred to above is one where:

Benefit Event = NORMAL RETIRAL, EARLY RETIRAL, ILL-HEALTH RETIRAL or LATE RETIRAL

Type of Benefit = STD

Purchase Pension? = NO (unticked)

The following selections will be available, depending on the payment allocation:

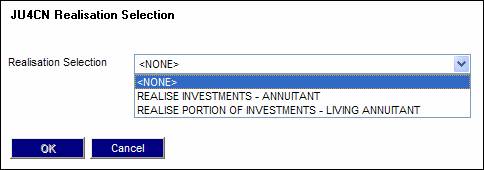

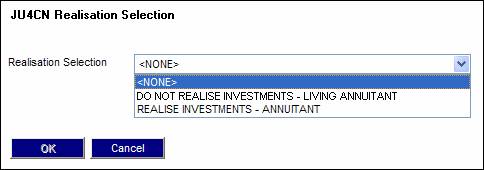

- REALISE INVESTMENTS - ANNUITANT

- REALISE PORTION OF INVESTMENTS – LIVING ANNUITANT

- DO NOT REALISE INVESTMENTS – LIVING ANNUITANT

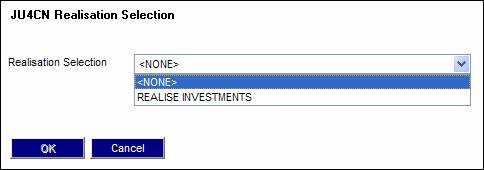

- REALISE INVESTMENTS

If the options selected on the PAYMENT ALLOCATION screen are

- CASH PERCENTAGE > 0 and < 100

- PAYABLE FROM FUND = YES

the following JU4CN Realisation Selection screen will be displayed.

If the options selected on the PAYMENT ALLOCATION screen are

- CASH PERCENTAGE = 0

- PAYABLE FROM FUND = YES

the following JU4CN Realisation Selection screen will be displayed.

If the option selected on the PAYMENT ALLOCATION screen is

- CASH PERCENTAGE = 100

the following JU4CN Realisation Selection screen will be displayed.

An explanation of the various options appears below.

|

REALISE INVESTMENTS - ANNUITANT

|

Select this when the member's benefit must be transferred to a fund reserve from which the monthly pension amount will be paid. No investment records will be maintained for the individual members. |

|

REALISE PORTION OF INVESTMENTS – LIVING ANNUITANT

|

Select this for living annuities where the member has elected a cash commutation. |

|

DO NOT REALISE INVESTMENTS - LIVING ANNUITANT

|

Select this for living annuities where the member's monthly pension amount must be paid from the member's investments and the member has not selected a cash commutation. |

|

REALISE INVESTMENTS

|

Select this if the member has selected a 100% cash commutation. |

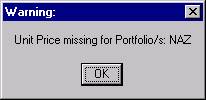

Click OK. If REALISATION SELECTION is one of the following

- REALISE INVESTMENTS

- REALISE INVESTMENTS – ANNUITANT

- REALISE PORTION OF INVESTMENTS – ANNUITANT

and some unit prices or bonus rates have not been captured, one of the following messages will be displayed:

Unit Price missing for Portfolio/s

Bonus Rate not found

Interim bonus rate not found

Click OK, and capture the necessary information. Refer to

Product Launch Requirements

Capturing Bonus Rates

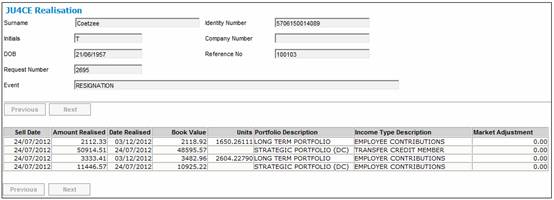

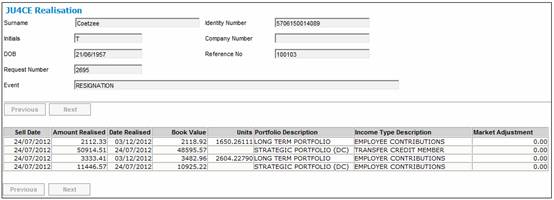

Once the realisation selection has been accepted, (or if you are processing a benefit other than a retiral for a non-defined benefit scheme), the JU4CE Realisation screen will be displayed, showing details of amounts realised after the unit prices for that particular sell date or bonus rates have been loaded.

Select![]() from the sub-menu on the left to return to the JU4CN Benefit Payment Process screen.

from the sub-menu on the left to return to the JU4CN Benefit Payment Process screen.

Click CLOSE to close this update type.

Note:

You can only close the realisation update type after the unit prices for that particular sell date are loaded.

When the REALISATION Update Type is processed in the Benefit Payment process, the Scheme Group Type Value for the Scheme Group Type of REALISATION DATE is read to determine the date to which interest must be calculated.

- If the value is NO, i.e. Interest To Exit Date is selected on the JU1BK Basic Product Data screen, then interest is calculated to date of exit.

- If the value is YES i.e. Interest To Realisation Date is selected on the JU1BK Basic Product Data screen, interest is calculated to realisation date.

- If the value for the Scheme Group Type Value for Scheme Group Type of REALISATION DATE for the Scheme is CLAIM FORM DATE i.e. Interest to Claim Form Date is selected on the JU1BK Basic Product Data screen, the system will calculate interest on the Member’s investments from the date interest was last calculated to the Date of Claim Form and create the realisation transaction with an Effective Date equal to the Claim Form Date.

Note:

Late payment interest is calculated on the balance in the Member’s BENPAYABLE account from the Effective Date of the transactions to the date defined in the Benefit Payment authorisation process and proportioned in relation to the payment amount. It is therefore important that the realisation transactions are created with the correct Effective Date in terms of the of the Realisation Date definition.

This will only ever be applicable to Bonus (interest) Portfolios. For Unitised Portfolios, the realisation date will always be the date that the REALISATION Update Type is processed or the next working day depending on the cut-off times as the value is dependent on the unit price of the date that the Asset Manager is notified of the disinvestment. If not, it will result in a mismatch of assets and liabilities.