The following are the requirements for the initial setup of a Beneficiary Fund.

The following chart details the security codes that need to be allocated for the beneficiary trust.

Abbreviations used in the chart are:

- D - Delete

- A - Add

- C – Authorize

- U - Update

- R – Reject

- AU - Authorize

- UA - Unauthorize

|

TRANSACTION CODE |

DESCRIPTION |

D |

A |

C |

U |

R |

AU |

UA |

|

CSJU3EN |

Investment amount |

ü |

ü |

ü |

ü |

|

|

|

|

CSJU3EO |

Regular payment |

ü |

ü |

ü |

ü |

|

|

|

|

CSJU3EP |

Authorize regular payment |

ü |

ü |

ü |

ü |

|

|

|

|

CSJU3EQ |

Authorize regular payment |

ü |

ü |

ü |

ü |

|

|

|

|

CSJU2EM |

Ben payment authorise |

ü |

ü |

|

|

ü |

ü |

|

|

CSJU2EN |

Adhoc payment amount |

ü |

ü |

|

|

ü |

ü |

|

|

CSJU2EO |

PDF display |

ü |

ü |

|

|

|

ü |

ü |

Refer to

Security

Functional

Templates

Administrators that administer products from which money will be received must be set up as participating employers. The code must be the same as the administrator code, and the description must be the same as the administrator name.

Pay centres must be set up, and the codes must be the same as the product code of the products from which money will be received. The descriptions must be the same as the name of the products, and they must be linked to the administrator that administers the product (participating employer). The pay centres (products) must be linked to the beneficiary fund via the participating employers (administrator).

Refer to

Infrastructure

System Entities

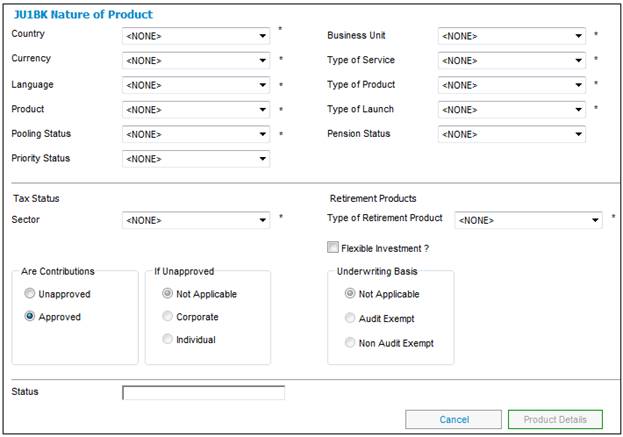

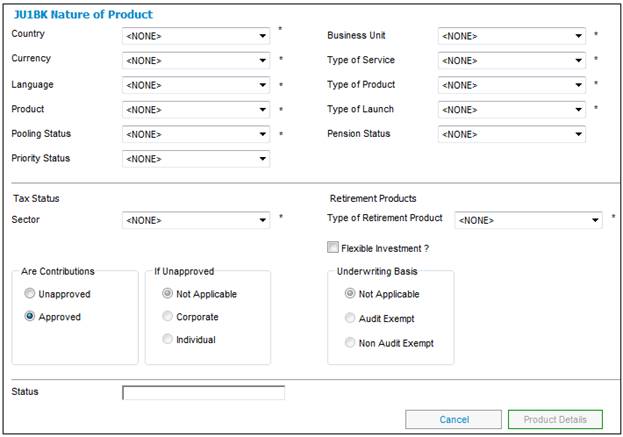

On the JU1BK Nature of Product screen, the product must be set up as a beneficiary fund by selecting BENEFICIARY FUND from the drop-down list for the following fields:

- Type of Product

- Product

- Type of Retirement Product.

Refer to

Product Launch Requirements

Product Launch

Launching a Product

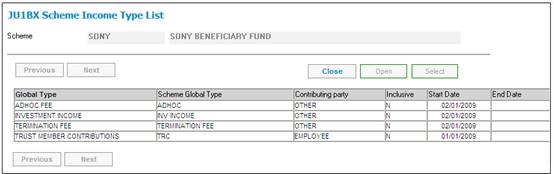

On the JU1BX Scheme Income Type List screen, add income types of ADHOC FEE and TERMINATION FEE.

Refer to

Products

Beneficiary Fund

Termination

Refer to

Product Launch Requirements

Product Update

Product Update Type: Income

Auxiliary Activities

Adding a New Income Type

Add a new Income Type to a Scheme (Funds)

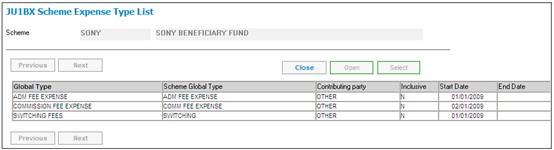

On the JU1BX Scheme Expense Type List screen, add expense types of ADMIN FEE and COMMISSION FEE.

Refer to

Product Launch Requirements

Product Update

Product Update Type: Expenses

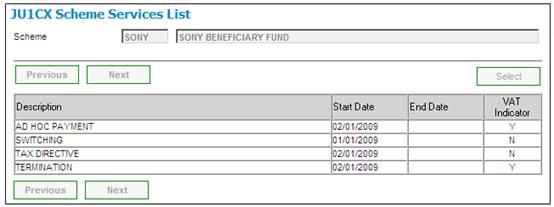

On the JU1CX Scheme Services List screen, add a termination fee.

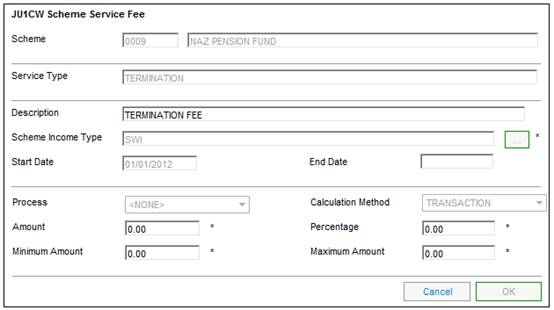

On the JU1CW Scheme Service Fee screen, set up the termination fee details (percentage, etc.) for the termination.

Refer to

Products

Beneficiary Fund

Termination

Refer to

Product Launch Requirements

Product Update

Product Update Type: Service / Fees

For details of the calculation and processing for Expense Billing using the JU3BH_BILL Expense Billing batch job, refer to Processing under

Processes

Expense Billing

Expense Billing

New

For details of the calculation and processing for Expense Billing using the JU3BR_COMM Commission Billing batch job, refer to Processing for commission billing under

Processes

Expense Billing

Commission

New

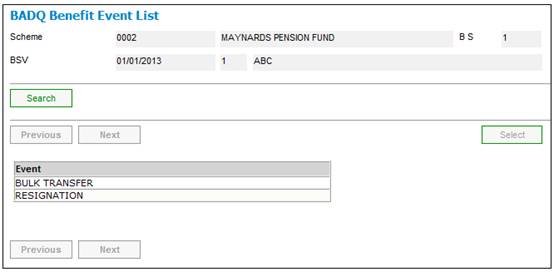

On the BADQ Benefit Event List screen, add a benefit event of WITHDRAWAL (RESIGNATION). This is needed in order to be able to terminate a member.

Note:

Terminations are processed as benefit payments with a benefit event of WITHDRAWAL, as the calculation and realisation of the balance on the member's investment accounts and the calculation and deduction of a termination fee is required for beneficiary funds.

Refer to

Product Launch Requirements

Product Update

Product Update Type: Maintain Scheme Benefit Rules

Accounting rules must be set up for the following accounting activities:

|

PROCESS |

ACCOUNTING ACTIVITY |

PURPOSE CLASS |

|

ACCOUNT |

|

BENEFICIARY INV |

MEM CONTRIB |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

CONTRIBUTION |

|

|

|

FUND |

DR |

CONTRECVABL |

|

|

|

|

CR |

CONTRIBFUND |

|

BENEFICIARY INV |

MEM COMM |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

FUND DEPOST |

|

|

|

FUND |

DR |

COMMISSION |

|

|

|

|

CR |

COMM PAYABLE |

|

BENEFICIARY INV |

MEM COMM |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOST |

|

|

|

FUND |

DR |

FEEEXPENSE |

|

|

|

|

CR |

FEEPAYABLE |

|

BENEFICIARY INV |

MEMVATONCOMM |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

COMMISSION |

|

|

|

|

CR |

COMM PAYABLE |

|

BENEFICIARY INV |

MEMINVADMFEE |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

FEEEXPENSE |

|

|

|

|

CR |

FEEPAYABLE |

|

BENEFICIARY INV |

MEMVATONADM |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

FEEEXPENSE |

|

|

|

|

CR |

FEEPAYABLE |

|

BENEFICIARY INV |

MEM INVSTMNT |

MEMBER |

DR |

INVESTMEMB |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

INVESTMENT |

|

|

|

|

CR |

INVESTTRANST |

|

BENEFICIARY PMT |

ADHOCPAYMENT |

MEMBER |

DR |

BENEFITS |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

BENEFITS |

|

|

|

|

CR |

BANK |

|

BENEFICIARY PMT |

ADHOCDISINV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

INVESTMEMB |

|

|

|

FUND |

DR |

DISINVTRANST |

|

|

|

|

CR |

INVESTMENT |

|

BENEFICIARY PMT |

ADHOCPMTFEE |

MEMBER |

DR |

BENEFITS |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

FEERECEIVED |

|

|

|

|

CR |

FEEPAYABLE |

|

BENEFICIARY PMT |

ADHOCDISINV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

INVESTMEMB |

|

|

|

FUND |

DR |

DISINVTRANST |

|

|

|

|

CR |

INVESTMENT |

|

BENEFICIARY PMT |

REGULAR PMT |

MEMBER |

DR |

BENEFITS |

|

|

|

|

CR |

MEM DEPOSIT |

|

BENEFICIARY PMT |

FUND REG PMT |

FUND |

DR |

BENEFITS |

|

|

|

|

CR |

BANK |

|

BENEFICIARY PMT |

REGPMTDISINV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

INVESTMEMB |

|

BENEFICIARY PMT |

FNDPMTDISINV |

FUND |

DR |

DISINVTRANST |

|

|

|

|

CR |

INVESTMENT |

|

MANUAL INITIATE |

REGULARPMTRV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

BENEFITS |

|

MANUAL INITIATE |

FUNDREGPMTRV |

FUND |

DR |

BANK |

|

|

|

|

CR |

BENEFITS |

|

MANUAL INITIATE |

DISINV REV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

INVESTMEMB |

|

MANUAL INITIATE |

FNDDISINVREV |

FUND |

DR |

INVESTMENT |

|

|

|

|

CR |

INVESTTRANST |

|

MANUAL INITIATE |

ADHOCPMTREV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

BENEFITS |

|

|

|

FUND |

DR |

BANK |

|

|

|

|

CR |

BENEFITS |

|

MANUAL INITIATE |

ADHOCDISINVR |

MEMBER |

DR |

INVESTMEMB |

|

|

|

|

CR |

MEMDEPOSIT |

|

|

|

FUND |

DR |

INVESTMENT |

|

|

|

|

CR |

INVESTTRANST |

|

MANUAL INITIATE |

ADHOCPMTFEER |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

BENEFITS |

|

|

|

FUND |

DR |

FEEPAYABLE |

|

|

|

|

CR |

FEERECEIVED |

|

BENEFIT PAYMENT |

TERMINATE FEE |

MEMBER |

DR |

BENPAYABLE |

|

|

|

|

CR |

BENEFITS |

|

|

|

|

DR |

TRF TO/F FND |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

FEERECEIVED |

|

|

|

|

CR |

FEEPAYABLE |

|

|

|

|

DR |

BENPAYABLE |

|

|

|

|

CR |

BENEFITS |

|

BENEFIT PAYMENT |

TERMINATEFEER |

MEMBER |

DR |

BENEFITS |

|

|

|

|

CR |

BENPAYABLE |

|

|

|

|

DR |

MEM DEPOSIT |

|

|

|

|

CR |

TRF TO/F FND |

|

|

|

FUND |

DR |

FEEPAYABLE |

|

|

|

|

CR |

FEERECEIVED |

|

|

|

|

DR |

BENEFITS |

|

|

|

|

CR |

BENPAYABLE |

|

MANUAL INITIATE |

MEMCOMMREV |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

CONTRIBUTION |

|

|

|

FUND |

DR |

FEEPAYABLE |

|

|

|

|

CR |

FEEEXPENSE |

Refer to

Product Launch Requirements

Product Update

Product Update Type: Bank Account Rule

Note:

Commission reversed in the Benefit Payments Process is offset. For more information refer to

Processes

Benefits (All Products)

Commission Claw Back and Refund of Future Premiums

Fee structure

Beneficiary funds are set up as a single product with a large number of benefit membership groups that represent a combination of the trust product, e.g. income, balanced or growth, and the previous fund, i.e. the fund from which money was transferred. This has been done as the different types of fees are applied to the different trust products and are based on the previous fund or previous administrator.

To be able to report on the fees for each of the various trust products, the fees for each product are created with a different expense type.

Batch job

The JU3BH_BILL expense billing batch job calculates fees and premiums and produces a report of the fees and premiums payable. Once authorization of the calculated fees and premiums has taken place, the necessary accounting transactions will be generated.

The process is as follows:

- The JU3BH_BILL batch selection for expenses is captured on the batch schedule (under the batch group of EXPENSES) with a selection period

- The JU3BH_BILL expense billing batch job calculates the premiums based on the criteria entered as well as the product rules effective for the period, and stores the data. This data can be viewed under income administration.

Regular payments

When the JU3BH_BILL expense billing batch job runs, the expense rules for which the regularity on the expense type is REGULAR, are read.

If the formula type is PERCENTAGE, and the FORMULA APPLIED TO for the expense type is MARKET VALUE, the monetary and unit balances on the member's INVSTEMUNIT accounts per portfolio and income type will be retrieved as at the effective date of the expense billing run.

Unit Price

If the earning allocation code for the portfolio is UNITISED, the authorised unit price for the portfolios with an effective date equal to the effective date of the expense billing run is used.

If the earning allocation code is BONUS, the bonus rate applicable as at the effective date of the expense billing run is used.

Market value

The market value of the member's investments per portfolio will be calculated depending on the earning allocation code:

- If the earning allocation code is UNITISED, the unit balance will be multiplied by the unit price.

- If the earning allocation code is BONUS, interest from the date interest was last calculated to the effective date of the expense billing run will be calculated and added to the monetary balance

The percentage on the scale on the expense rule for the benefit membership group to which the member is linked is read, and the percentage of market value per portfolio and income type is calculated.

The minimum and maximum values are read and if the percentage of market value is less than the minimum, the value is set to the minimum amount.

If the fee is greater than the maximum, the value will be set to the maximum amount.

If the type of scale is SLIDING SCALE, the percentage of market value will be calculated according to the applicable scales.

Business Transactions

The business transactions (BT’s) for the percentage of market value per portfolio and income type will be created with the same accounting activities as for other expenses that are applied at the member level, i.e. MEMEXPENSE and MEMEXPREAL.

The product transactions (FEEBILLING) for the sum of the member transactions will be created.

Note:

If the number of units to be disinvested must be calculated using the unit price as at the effective date of the expense billing run, the transactions will be created with a transaction date equal to the effective date of the expense billing run.

Capital budget

When the JU3BH_BILL Expense Billing batch job is run the system will read the Expense Rules for the Expense Types for which the Global Group Type is CAPITAL BUDGET in addition to the Expense Types currently included in the Expense Billing batch job.

Where there is a Rate Table Type on the Expense Rule and there is a value for Maximum on the Scale linked to the Rate Table, the Member expense will be calculated based on the Expense Rule and the Scale. If the value calculated is greater than the value for Maximum on the Scale, the calculated value will be set to the Maximum value.

Similarly if there is a value for Minimum on the Scale and the calculated value is less than the value for Minimum on the Scale, the calculated value will be set to the Minimum value.

If the Calculation Method is CAPITAL BUDGET, the system will retrieve the BT’s in the Member’s CAP BUDGET account with a Due Date greater than the first day of the current year. If no BT is found, a value will be calculated for the Membership and proportioned for the period from the Membership CAR Start Date to the last day of the current year as follows:

Calculated value / 12 x number of months from CAR Start Date to last day of current year

If the Global Group Type for the Expense Type is CAPITAL BUDGET, Business Transactions (BT’s) will be created with the MEMBERBUDGET Accounting Activity. A Fund level BT will not be created.

Ad hoc payments

When the fee for ad hoc payments is calculated, the expense rule for which the FORMULA APPLIED TO is PAYMENT REQUEST for the benefit membership Group to which the member is linked, is read.

For more detailed information, refer to

Processes

Expense Billing

Expense Calculation and Billing

For details of the calculation and processing for Expense Billing using the JU3BH_BILL Expense Billing batch job, refer to Processing under

Processes

Expense Billing

Expense Billing

New

For details of the calculation and processing for Expense Billing using the JU3BR_COMM Commission Billing batch job, refer to Processing for commission billing under

Processes

Expense Billing

Commission

New