Bank statements are received from the bank as paper documents. To facilitate reconciliation between the bank statement and the bank account within the system, the relevant details must be captured.

This facility allows you to capture bank statement data for bank accounts and to trigger an automated bank reconciliation. Entries that cannot be automatically reconciled can be manually associated by supplying a unique number to them.

Bank statement transactions cannot be captured with transaction dates that fall into a closed financial period. For more information on financial periods, refer to Product Update Type: Financial Period Calendar under

Product Launch Requirements

Product Update

Bank reconciliation reports can be generated at both detailed and summary levels.

The cash flow report can be used for the purposes of supporting the bank reconciliation. Refer to Cash Flow Report.

Note:

For an umbrella product, bank accounts may exist at either main product or sub- product level. For some products, bank accounts can be defined at both levels. In this case, the sub- product bank accounts are used as clearing accounts to the main product account, e.g. a contribution clearing account.

Bank statement items may be captured at either the main product level using the main product code, or for each sub- product using the sub- product codes.

The bank reconciliation for an umbrella product must be done for the following:

– The main product bank account, where the main product bank account is used by all of the sub- product /s (participating contracts).

OR

– Each sub-product account, where the sub- product has bank accounts only used by itself.

OR

– Both the main and sub-product accounts, where the main product bank account is used by the sub- product, and the sub- product has clearing accounts for the main product.

Note:

When a Bank Statement is electronically uploaded, each transaction loaded will be matched against the transactions in the bank account on the system.

If the transaction date, document number and amount on the bank statement match a transaction with the same date, amount and document number on the system, the transactions will be automatically reconciled.

For more information refer to

Bank Interfaces

Bank Statement Upload

ABSA

Nedbank

Standard Bank

Enquiries are available on bank account transactions without selecting a product. These transactions can be requested for a specified period and balances can be viewed as at a specified date.

Transactions and balances can be requested based on the following specific criteria:

- Date and time stamp

- Actual transaction date

- Due date

- Business effective date

Note:

When using the date and time stamp, ensure that the time is captured, otherwise the date will be treated as 00:00 hours on the date captured.

For examples of accounting transactions (T-accounts), refer to

Supplements

Accounting Transaction Examples

Log in to the system from the Logon page.

Click ACCOUNTING.

The Welcome screen will be displayed.

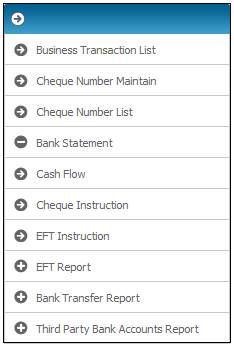

From the main menu on top, select Bank. A sub-menu will be displayed on the left.