The banking industry offers electronic fund transfer (EFT) facilities that enable the electronic transfer of funds between bank accounts. The system can interface to one of the following:

- ACB

- Bank Transfer

- Barclays Kenya

- Barclays Zambia

- BIB (Business Internet Banking)

- Bureaufocus

- Cashfocus

- CPY

- IAT (Inter Account Transfer)

- IP (International Payment)

- FNB Online

- FNB PACS

- LDC

- Multidata

- Nedinform

- CPS

- SCT (Single Euro Payment Area (SEPA) Credit Transfer)

- SDP (Same Day Payment)

- SPD

When a bank account is captured on the system, the user has the option to interface this account with one of the bank EFT facilities.

From the JU1AP Corporate Client screen, highlight a Corporate Client and select Bank Accounts from the sub-menu on the left.

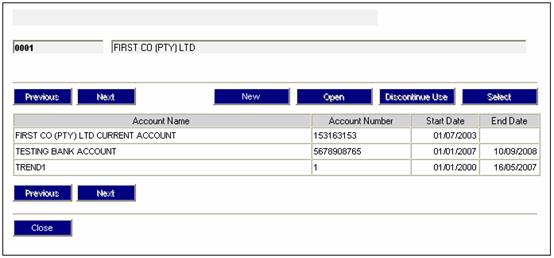

The JU1CN Bank Account List screen will be displayed.

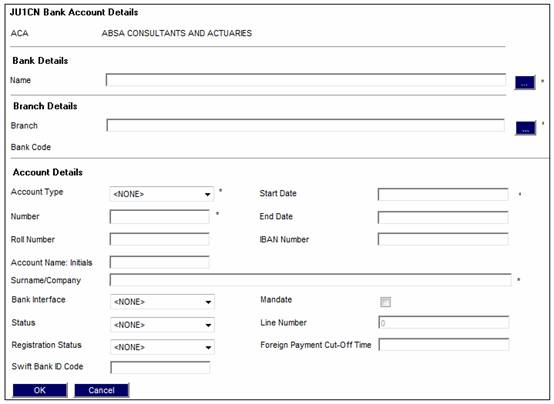

Highlight a Bank Account and click OPEN. The JU1CN Bank Account Details screen will be displayed. This screen allows the specification of bank account details for a corporate client or scheme.

The user must make a selection from the Bank Interface field drop down box. The following options are available for selection:

- <None>

- ACB

- Bank Transfer

- Barclays Kenya

- Barclays Zambia

- Cashfocus

- CPY

- IAT (Inter Account Transfer)

- Multidata

- IP (International Payment)

- Bureaufocus

- BIB (Business Internet Banking)

- FNB Online

- FNB PACS

- LDC

- Nedinform

- CPS

- SCT (Single Euro Payment Area (SEPA) Credit Transfer)

- SDP (Same Day Payment)

- SPD

Normal processing takes place daily, whilst in other cases, batch runs may be scheduled using the batch schedule facility. In the background, several batch processes are automatically triggered and run by the system.

For more information, refer to

Infrastructure

Batch

The batch processes dealt with here all concern the system interface to Cashfocus, Nedinform and FNB Online, and the processing of EFT’s.

When these batch programs are run, records for the EFT’s that must be actioned are created in an EFT instruction output file.

These EFT’s are generated under the following circumstances in the system:

|

When an income batch has been authorised. |

For more information, refer to the batch program B_JU3AH_TRANSMISSION_INCOME under Supplements Batch Programs Batch Jobs |

|

When a percentage of a member’s investment in one investment portfolio must be transferred into one or more other portfolios. |

For more information, refer to the batch program B_JU3AC_SWITCHING under Supplements Batch Programs Batch Jobs |

|

When a distribution amount must be apportioned to an exited member. |

For more information, refer to Processes Distribution |

|

When an investment advice is generated for each investment portfolio for the total amount to be disinvested per day. |

For more information, refer to Introduction Processes Batch Processing of Investment Transactions |

|

When a benefit claim is to be paid by EFT. |

For more information, refer to Introduction Processes Benefit Administration |

|

Annuities using EFT |

For more information, refer to Processes Annuities Annuity Payments |

|

Manual Initiate using EFT |

For more information, refer to Processes Annuities Annuity Payments Manual Pension Payments |

The following is a summary of the steps involved in the preparation of the EFT data for the interface with the bank:

- A record of all EFT’s required is created on the EFT instruction table.

- The money movement batch program polls (checks) the EFT instruction table and picks up all EFT records to be actioned.

- The EFT records are formatted in the required format for the bank EFT facility.

- The formatted records are written to a flat (text) file.

- The flat file is sent to the bank to process the EFT’s.