This facility is specifically for the preservation of members’ benefits, where the member decides to transfer a fixed monthly amount to another client for purposes of preservation, e.g. deferred annuity.

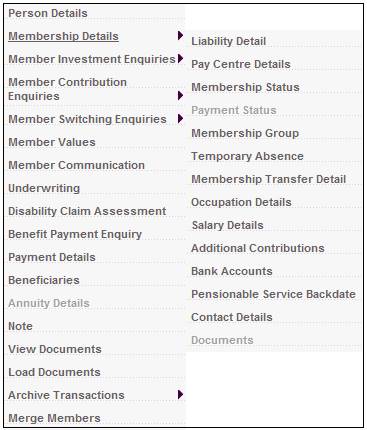

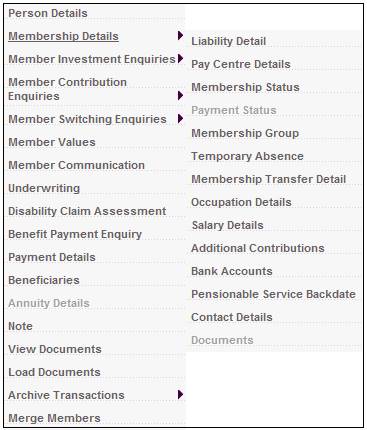

From the JU3AO List of Members for a Scheme/Pay Centre screen, highlight the required member, then select Membership Details>Bank Accounts.

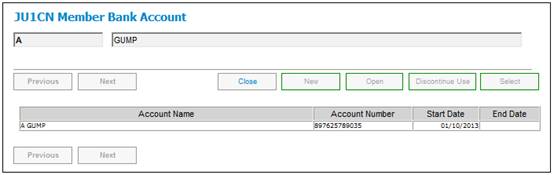

The JU1CN Member Bank Account screen will be displayed.

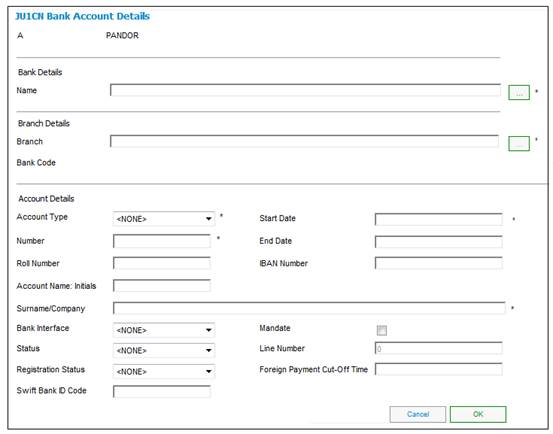

To add new bank account details, click NEW. The JU1CN Bank Account Details screen will be displayed.

Field notes:

* denotes mandatory fields

|

Bank Details |

|

|

Name |

Click LIST to display and select from a list of banks. |

|

Branch Details |

|

|

Branch Bank Code |

Click LIST to display and select from a list of bank branches for the bank already selected.

Note: The LIST button will only be enabled once a bank has been selected. |

|

Account Details |

|

|

Account Type |

Type of operating account, e.g. Current Account or Savings Account. |

|

Number |

Account number Do not capture spaces between the numbers into the Bank account number field or capture the member account Name in the numerical field. Note: The Account Type and Account number must be checked to be correct as allocated by the bank. This data is used in "downstream" processes making or receiving payments. Should it fail validation against the bank then the payment will NOT take place. |

|

Roll Number |

The Building Society Roll Number.

Note: If the Account Type selected is BUILDING SOCIETY, then Roll Number will be enabled for capture. This field will accept special characters.

This field has a sort code of 6 digits and an account number of 8 digits, and in addition a roll number of 15 characters, 5 digits followed by a forward slash and then 10 digits e.g. 0505/1111111111. The forward slash can be captured anywhere in the number. |

|

IBAN Number |

International Bank Account Number. |

|

Start Date |

Effective date from which account can be used |

|

End Date |

Terminate the use of the account |

|

Account Name: Initials |

The initials of a person who is the account holder. |

|

Surname /Company |

The surname of a person who is the account holder, or the name of the Company who is the account holder. |

|

Bank Interface |

The specific bank Interface mechanism used. E.g. ACB, Barclays Kenya, Barclays Zambia, Nedinform, CPS, LDC, CPY, FNB Online, etc. |

|

Mandate |

Indicate whether a mandate will be used to collect funds. Only needed if BANK INTERFACE is NEDINFORM. |

|

Line Number |

Activated where a mandate is used to collect funds. This is a unique number that authorises the collection of funds from the account. Note: In the case of regular payments to a foreign bank, e.g. annuity payments, this field will be used for the number used by the bank for the set up of the member’s banking details. In the case of UK this is known as the Line Sheet Number. |

|

Registration Status |

The FICA registration status of the bank account. |

|

Status |

The status of the account holder validation, e.g. NOT VALIDATE, VALIDATED, REJECTED, USER VALIDATED, etc.

When any of the fields on the bank account record are updated, the status field will be updated to NOT VALIDATED.

Only needed if BANK INTERFACE is LDC.

Note: The account holder validation (AHV) via LDC only validates account numbers for ABSA, First National Bank (FNB) and Standard Bank (SBSA). Where the account is held at any other bank, the status will be able to be updated to MANUAL VALIDATE and the user ID of the person who updated the status will be displayed. The authorizer can take this into account when checking the status of the account.

Note: If an existing Bank Account is selected under Bank Account (Name) above and the Status on the Bank Account is VALIDATED, the system will set the value for Status on the Bank Account to NOT VALIDATED. The Bank Account will then be picked up in the Account Holder Validation batch job and re-validated in the same way as if a new bank account had been captured. |

|

SWIFT Bank ID Code |

Society for Worldwide Interbank Financial Telecommunication Bank Identifier Code.

Note: This field is 15 characters long and can be alphabetical or numerical. |

|

Foreign Payment Cut-Off Time |

The cut-off time for foreign currency payments. |

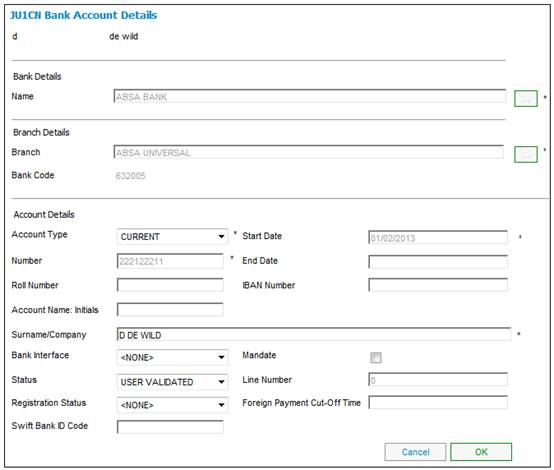

To view or update existing bank account details, highlight the required line, then click OPEN. The JU1CN Bank Account Details screen will be displayed.

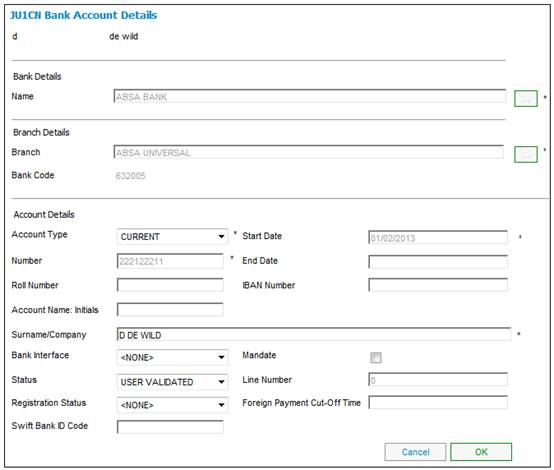

To discontinue a member's use of the bank account, highlight the account and select DISCONTINUE USE. The JU1CN Bank Account Details screen will be displayed.

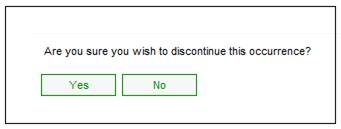

Click OK. A confirmation screen will be displayed.

Click YES to confirm deletion of the member's bank account.

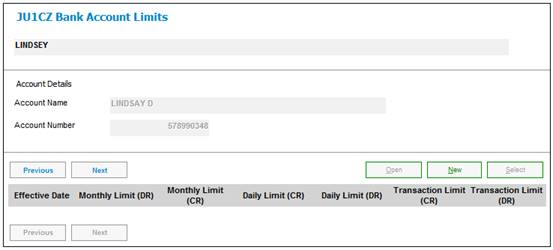

To view or update existing bank account limits, highlight the required line, then click the Account Limits List sub-menu on the left.

![]()

The JU1CZ Bank Account Limits screen will be displayed.

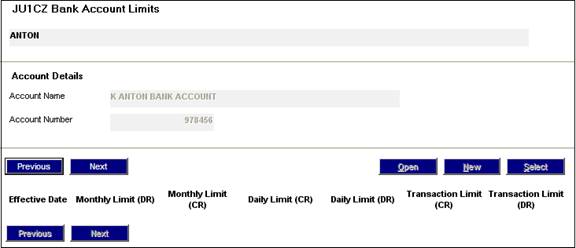

To add new bank account limit, highlight the required line, then click the Account Limits List sub-menu on the left.

![]()

The JU1CZ Bank Account Limits screen will be displayed.

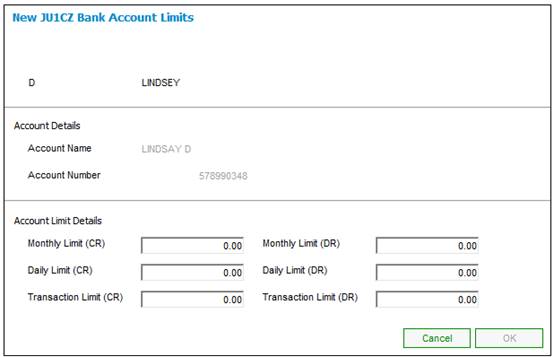

Click NEW. The New JU1CZ Bank Account Limits screen will be displayed.