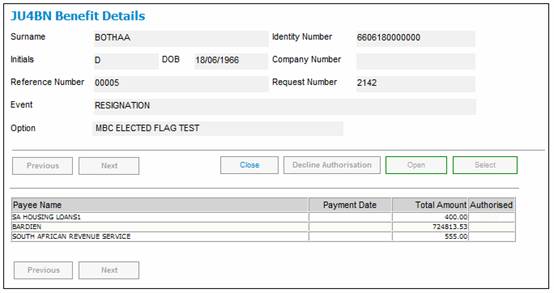

To authorise the payment for only the payee selected on the JU4BN Benefit Details screen, select Authorise Benefit > Authorise Individual Payment.

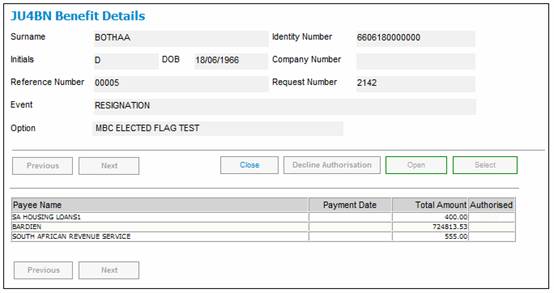

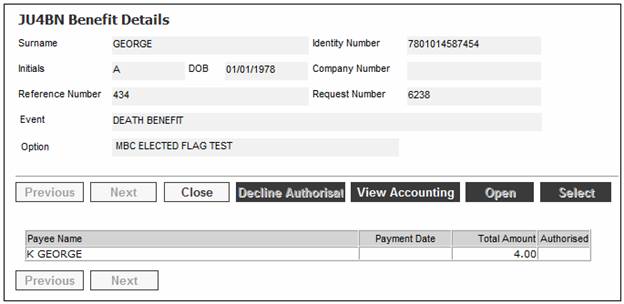

The JU4BN Benefit Details Maintain screen will be displayed.

This screen displays payment instruction details already defined for the payee selected.

If the disposal instruction is for the net benefit payment, i.e. it is not for a prior claim or for tax, the screen will include interest details.

|

Swift Code |

Society for Worldwide Interbank Financial Telecommunication Bank Identifier Code. |

|

|

Iban Number |

International Bank Account Number. |

|

|

Status |

Bank account numbers are validated prior to processing where the payment is being made by EFT. The status may be one of the following:

- Not Validated - Validated - Rejected - User Validated

Note: The account holder validation (AHV) via LDC only validates account numbers for ABSA, First National Bank (FNB) and Standard Bank (SBSA). Where the account is held at any other bank, the status will be able to be updated to MANUAL VALIDATE and the user ID of the person who updated the status will be displayed. The authorizer can take this into account when checking the status of the account. |

|

|

Payment Reference |

The Payment Reference that must appear on the recipient’s Bank Statement when payments are made via EFT. |

|

|

Interest Details |

|

|

|

Interest Date |

If interest after date of exit must be included then the date to which interest must be calculated must be captured. This is included at this point as it is at the time of authorisation that the date on which payment will take place can be most accurately established. Interest will be calculated from date of exit in the case of non-unitised investment portfolios and from the date of the realisation of the member’s units in the case of unitised portfolios. Note: The system will ask for this value to be supplied if the Manual Interest Calculation field is ticked. |

|

|

Benefit Amount |

The benefit amount calculated |

|

|

Manual Interest Calculation |

If interest is to be calculated on any other basis then the Manual Interest Calculation check box must be ticked. |

|

|

Interest Amount |

The amount of interest calculated, or If the Manual Interest Calculation check box is ticked then the capture of the manually calculated interest amount is enabled. |

|

|

Payment Details |

||

|

Currency |

The currency in which the payment must be made. |

|

|

Forex Deal Number |

The number of the deal arranged for the exchange rate.

Note: This field will only be enabled if the Currency selected is not equal to the Currency for the Scheme to which the Membership is linked. |

|

|

Foreign Currency Amount |

The amount payable in foreign currency. |

|

|

Exchange Rate |

The exchange rate arranged with Foreign Exchange for the payment.

Note: This field will only be enabled if the Currency selected is not equal to the Currency for the Scheme to which the Membership is linked. |

|

|

Cheque Number |

The cheque number for this payment. |

|

|

Payment Date |

The date on which the payment was made. |

|

Click OK.

If the value for Currency is not equal to the Currency for the Scheme and there is no value for Forex Deal Number or Exchange Rate, the system will read the Exchange Rate table and find the Exchange Rate for the Currency and with an Effective Date equal to current date and calculate the foreign currency value using this rate.

If an Exchange Rate with an Effective Date equal to current date is not found the following error message will be displayed:

No foreign exchange rate found for the currency selected for current date.

The system will read the value for Foreign Payment Cut-off Time on the Credit (From) Bank Account and if the current time is greater than the value found, the following error message will be displayed:

It is after the cut-off time for foreign currency payments, please authorise this transaction on the next working day.

Note:

The OK button must be selected before the Authorise button otherwise the system will authorise the original calculation without interest.

To authorise the payment, click AUTHORISE, otherwise click CLOSE.

If the payment being authorised is the last individual payment, i.e. all other Disposal Instructions for the member have been authorised, the following message will be displayed:

Is this the member’s final payment?

If NO is selected, the Membership Status field will be updated to LIVE.

If YES is selected, the following message will be displayed:

The member’s status will be changed to EXIT FINALISED. Do you wish to continue?

If NO is selected, the system will return to the JU4BN Benefit Details screen.

If YES is selected, processing will continue. The Membership Status field will be changed to EXIT FINALISED and the Date of Exiting Scheme field will be update with the Calculation Effective Date on the Benefit Request.

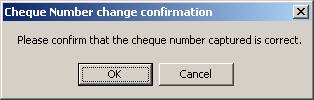

If a cheque number has been provided, a confirmation message will be displayed.

Please confirm that the cheque number captured is correct.

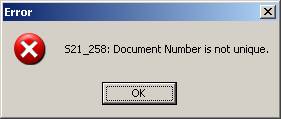

If the cheque number provided has already been used, an error message will be displayed.

Document Number is not unique.

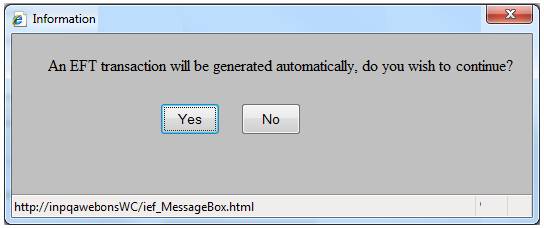

If the Method of Payment selected is EFT, then the following message will be displayed:

An EFT transaction will be generated automatically, do you wish to continue?

Click YES to confirm the automatic generation of an EFT.

If the Payment Method selected is EFT, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF.

If the current time is greater than the value found and the Transaction Date is equal to the current date, the following message will be displayed:

It is after the cut-off time for EFT payments. The transaction date will be set to the next working day

When the OK button is selected on the message, the Business Transaction will be created with the Transaction Date and Effective Date equal to the next working day.

If the next working day is a Saturday, the Transaction Date will be set to the next working day after the Saturday.

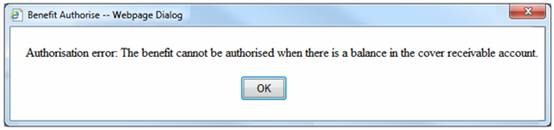

The authorization of a Death or Disability payment will not be allowed if the Cover Receivable Account for a member has not been cleared.

Death Claims

When a payment of a death benefit claim is being authorised, the system will read for a BSV (Benefit Structure Version) Purpose of Insured linked to the Benefit Event Category of Death where an Underwriter is associated to the Product.

The system will read for a balance in the Cover Receivable Account for the scheme and the membership reference number. Where the balance is not equal to zero, the following message will be displayed:

Authorisation error: The benefit cannot be authorised when there is a balance in the cover receivable account.

Where the balance is equal to zero, the authorisation of the payment will be allowed.

If no BSV Purpose of Insured is found, the authorisation of the payment will be allowed.

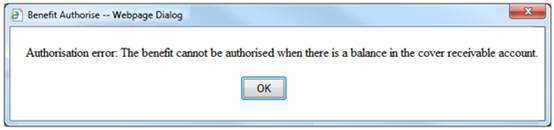

Disability Claims

When a payment of a disability benefit claim is being authorised, the system will read for a BSV (Benefit Structure Version) Purpose of Insured linked to the Benefit Event Category of Disability where an Underwriter is associated to the Product.

The system will read for a balance in the Cover Receivable Account for the scheme and the membership reference number. Where the balance is not equal to zero, the following message will be displayed:

Authorisation error: The benefit cannot be authorised when there is a balance in the cover receivable account.

Where the balance is equal to zero, the authorisation of the payment will be allowed.

If no BSV Purpose of Insured is found, the authorisation of the payment will be allowed.

Once all validation has been passed, the Authorisation screen will be re-displayed.

The payment for the payee has now been authorized, and you may select the next individual payment for authorization.

Note:

If this is a Workflow case, and the benefit has been authorised, then the Decline Authorization button will be enabled to reverse the authorisation.

To decline an authorisation, highlight a payment line and click DECLINE AUTHORISATION.

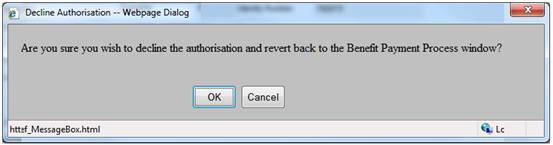

The following message will be displayed:

Are you sure you wish to decline the authorisation and revert back to the Benefit Payment Process window?

Click OK to confirm that the authorisation must be declined.

Note:

If the scheme uses the flexible benefit rules, a View Accounting button will be displayed on the JU4BN Benefit Details screen. For more information, refer to

Processes

Benefits (Insurance Products)

Benefit Payments Processing

Benefit Payment Update Types

Benefit Payment Authorization

When the BENEFIT PAYABLE Update Type is processed on the JU4CN Benefit Payment Process screen, the system will read the Agreement Contract Relationship records for the Scheme and if there is a record with an Agreement Contract Relationship Type of LINKED TRUST, create a Benefit Disposal Instruction record with a Disposal Type of LINKED FUND TRF. The system will find the Scheme linked to the Scheme for which the Benefit Payment is being processed with an Agreement Contract Relationship Type of LINKED TRUST and read the DTI Account details for the DTI Account for the Fund DTI Account and create a Benefit Disposal Instruction record.

When the Disposal Instruction is authorised, the system will update the Benefit Disposal Instruction record and create the Business Transactions (BT’s) as per other Benefit Disposal Instructions and in addition create a Membership record for the linked scheme as per the following.

The system will create a Membership record for the linked Scheme with a Type of Fund of BENEFICIARY FUND with a Membership Reference Number equal to the Membership Reference Number of the Membership for which the Benefit Payment is being processed and linked to the same Natural Person record.

The Membership record will be created with the following details:

- CAR Start Date First day of the month following current month

- Membership Status DECEASED

The system will read the Scheme default Investment Allocation for the Income Type TRC.

The system will create the following BT with a Transaction Date, Effective Date, Due Date, Amount and User ID equal to the equivalent value for the BENTRANSFER BT and with the Scheme Code of the linked Scheme with a Type of Fund of BENEFICIARY FUND and the Membership Reference Number of the new BENFICIARY FUND Membership created and, Portfolio equal to the Portfolio linked to the Scheme default Investment Allocation for the Income Type TRC:

|

BENEFICAIRY INV |

MAINMEMINV |

FUND |

DR |

BANK |

|

|

|

|

CR |

BENINVCONTRL |

|

|

|

MEMBER |

DR |

INVESTMEMB |

|

|

|

|

CR |

MEM DEPOSIT |

Note:

The Member level Accounting Rule above must only be added to the MAINMEMINV Accounting Activity if it is intended to calculate interest on unallocated amounts and to allocate the total amount including interest when the investment amount is apportioned.

This process has been designed to enable interest to be included or not by including the investment BT’s for the deceased member or not so that system changes are not required to cater for this or not.

My Work

A Service Request will be created in My Work with a Process of BENEFICIARY INV, Activity Name of BENEFICIARIES and with the Scheme Code and Membership Number of the Beneficiary Fund Membership created and a Status of OPEN.