To authorise the payment for all payees in respect of the member selected on the JU4CO Process Benefit Payments screen, select Authorise All Payments from the sub-menu on the left.

Note:

When this option is selected, no individual payment details will be displayed. The system will authorise all payments not yet authorised.

The following message will be displayed:

Is this the member’s final payment?

If NO is selected, the Membership Status field will be updated to LIVE.

If YES is selected, the following message will be displayed:

The member’s status will be changed to EXIT FINALISED. Do you wish to continue?

If NO is selected, the system will return to the JU4BN Benefit Details screen.

If YES is selected, then processing will continue. The Membership Status field will be changed to EXIT FINALISED and the Date of Exiting Scheme field will be update with the Calculation Effective Date on the Benefit Request.

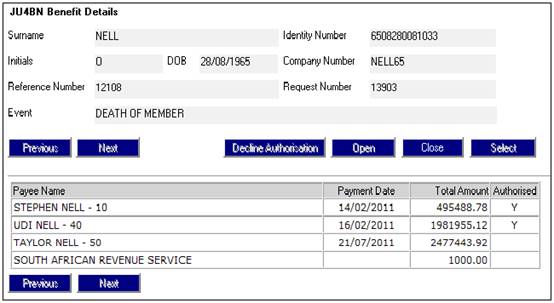

In the following example, the member has more than one payment to be authorised.

Instead of selecting each payment individually for authorisation, you can select Authorise All Payments from the sub-menu on the left.

Note:

If interest is to be included with any payment, then you must select Authorise Individual Payments in order to capture the interest date.

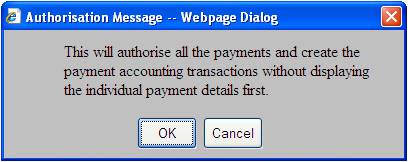

The following warning messages will be displayed:

This will authorise all the payments and create the payment accounting transactions without displaying the individual payment details first.

Click CANCEL to cancel the authorisation, or click OK to confirm that all payments can be authorised and create the accounting transactions without displaying the individual payments first.

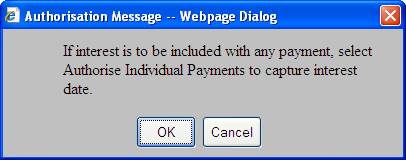

The following warning message will be displayed.

If interest is to be included with any payment, select Authorise Individual Payments to capture interest date.

If interest must be included with any payment, click OK, otherwise click CANCEL.

Note:

When the payment is authorised by either of the two methods above,

- the PAYMENT DATE on the Authorisation screen is updated with the current date

- A Y appears in the AUTHORISED column of the Authorisation screen

- An accounting activity will be created (BENEFIT PAYMENT BENPAYAMNT)

- If the TYPE OF DISPOSAL on the Authorisation Details screen is Benefit Tax, then the appropriate accounting activity will be created (e.g. if Benefit Tax then BENEFIT PAYMENT BENALPAYE)

Authorisation of the disposal instruction for PAYE will not result in a payment. A business transaction will be generated to credit a PAYE Payable account from which one payment will be made to SARS for the all the members for the month.

When all of the payment dates on the Authorisation screen have been updated with the current date, then:

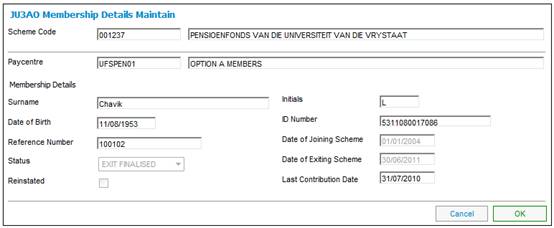

- The status on the JU3AO Membership Details Maintain screen will be updated to EXIT FINALISED.

- The status on the JU4AH Benefit Claim Request screen will be updated to FINALISED.

-

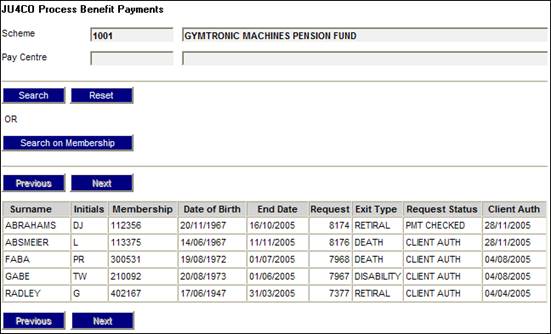

- The member will be removed from the list of benefit payments in progress on the JU4CO Process Benefit Payments screen.

Note:

If the Payment Method selected is EFT, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF.

If the current time is greater than the value found and the Transaction Date is equal to the current date, the following message will be displayed:

It is after the cut-off time for EFT payments. The transaction date will be set to the next working day

When the OK button is selected on the message, the Business Transaction will be created with the Transaction Date and Effective Date equal to the next working day.

If the next working day is a Saturday, the Transaction Date will be set to the next working day after the Saturday.

If a change is made to any information for a claim, then those users involved in the processing or amendment of the details of the claim may not authorise that claim.

When a Benefit Payment is authorised, the system will read the Ben Claim Auth record with a Claim User Type of DOER and if the User ID of the user authorising the Benefit Payment is equal to any of the User ID’s found, the following error message will be displayed:

Authoriser cannot be the same as doer.

Where second authoriser is required, the same validation will be applied.

For more information refer to the Benefit Payment Process section under

Security

Segregation of Duties

The authorization of a Death or Disability payment will not be allowed if the Cover Receivable Account for a member has not been cleared.

Death Claims

When a payment of a death benefit claim is being authorised, the system will read for a BSV (Benefit Structure Version) Purpose of Insured linked to the Benefit Event Category of Death where an Underwriter is associated to the Product.

The system will read for a balance in the Cover Receivable Account for the scheme and the membership reference number. Where the balance is not equal to zero, the following message will be displayed:

Authorisation error: The benefit cannot be authorised when there is a balance in the cover receivable account.

Where the balance is equal to zero, the authorisation of the payment will be allowed.

If no BSV Purpose of Insured is found, the authorisation of the payment will be allowed.

Disability Claims

When a payment of a disability benefit claim is being authorised, the system will read for a BSV (Benefit Structure Version) Purpose of Insured linked to the Benefit Event Category of Disability where an Underwriter is associated to the Product.

The system will read for a balance in the Cover Receivable Account for the scheme and the membership reference number. Where the balance is not equal to zero, the following message will be displayed:

Authorisation error: The benefit cannot be authorised when there is a balance in the cover receivable account.

Where the balance is equal to zero, the authorisation of the payment will be allowed.

If no BSV Purpose of Insured is found, the authorisation of the payment will be allowed.

When the BENEFIT PAYABLE Update Type is processed on the JU4CN Benefit Payment Process screen, the system will read the Agreement Contract Relationship records for the Scheme and if there is a record with an Agreement Contract Relationship Type of LINKED TRUST, create a Benefit Disposal Instruction record with a Disposal Type of LINKED FUND TRF. The system will find the Scheme linked to the Scheme for which the Benefit Payment is being processed with an Agreement Contract Relationship Type of LINKED TRUST and read the DTI Account details for the DTI Account for the Fund DTI Account and create a Benefit Disposal Instruction record.

When the Disposal Instruction is authorised, the system will update the Benefit Disposal Instruction record and create the Business Transactions (BT’s) as per other Benefit Disposal Instructions and in addition create a Membership record for the linked scheme as per the following.

The system will create a Membership record for the linked Scheme with a Type of Fund of BENEFICIARY FUND with a Membership Reference Number equal to the Membership Reference Number of the Membership for which the Benefit Payment is being processed and linked to the same Natural Person record.

The Membership record will be created with the following details:

- CAR Start Date First day of the month following current month

- Membership Status DECEASED

The system will read the Scheme default Investment Allocation for the Income Type TRC.

The system will create the following BT with a Transaction Date, Effective Date, Due Date, Amount and User ID equal to the equivalent value for the BENTRANSFER BT and with the Scheme Code of the linked Scheme with a Type of Fund of BENEFICIARY FUND and the Membership Reference Number of the new BENFICIARY FUND Membership created and, Portfolio equal to the Portfolio linked to the Scheme default Investment Allocation for the Income Type TRC:

|

BENEFICAIRY INV |

MAINMEMINV |

FUND |

DR |

BANK |

|

|

|

|

CR |

BENINVCONTRL |

|

|

|

MEMBER |

DR |

INVESTMEMB |

|

|

|

|

CR |

MEM DEPOSIT |

Note:

The Member level Accounting Rule above must only be added to the MAINMEMINV Accounting Activity if it is intended to calculate interest on unallocated amounts and to allocate the total amount including interest when the investment amount is apportioned.

This process has been designed to enable interest to be included or not by including the investment BT’s for the deceased member or not so that system changes are not required to cater for this or not.

My Work

A Service Request will be created in My Work with a Process of BENEFICIARY INV, Activity Name of BENEFICIARIES and with the Scheme Code and Membership Number of the Beneficiary Fund Membership created and a Status of OPEN.