Log in to the system from the Logon page.

Click ![]()

The Welcome screen will be displayed.

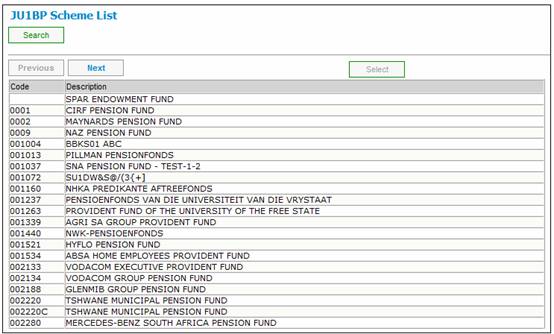

From the main menu on top, click Associations. The JU1BP Scheme List screen will be displayed.

Highlight the main product from the list, then select Select Scheme Association from the sub-menu on the left.

![]()

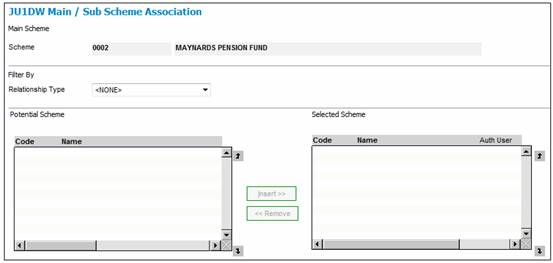

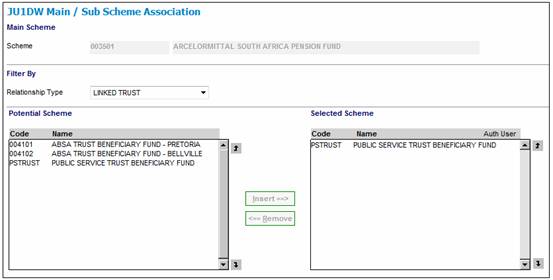

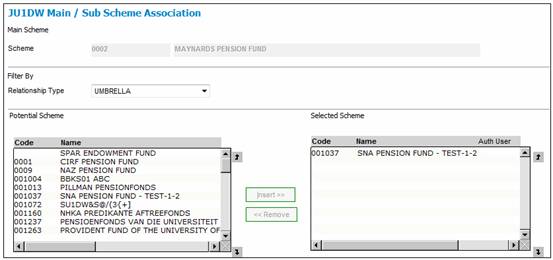

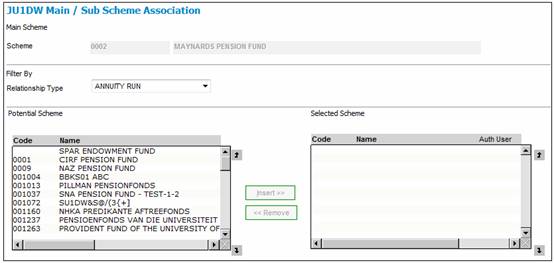

The JU1DW Main / Sub Scheme Association screen will be displayed.

Select the required relationship type from the drop-down box.

Set up an association between the Retirement Product and the Beneficiary Product to which death benefits must automatically be transferred.

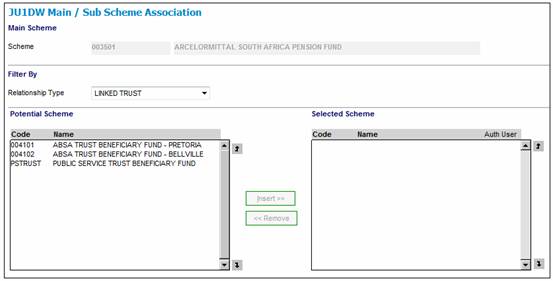

Select Relationship Type LINKED TRUST on the JU1DW Main / Sub Scheme Association screen. The JU1DW Main / Sub Scheme Association screen will display a list of all potential Beneficiary Products for selection.

A list of all the products currently associated to the selected product will be displayed under Selected Scheme.

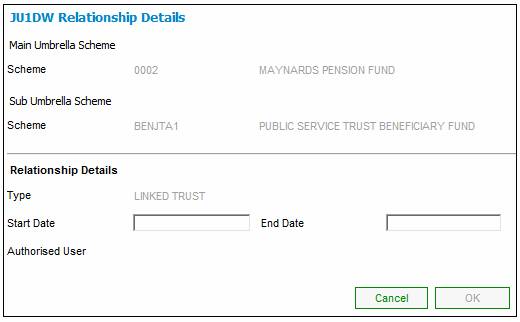

To associate a Retirement Product and a Beneficiary Product, highlight the required product from the Potential Scheme list and click INSERT. The JU1DW Relationship Details screen will be displayed.

Enter the START DATE and click OK.

The JU1DW Main / Sub Scheme Association screen will be re-displayed, showing the selection made.

Authorisation

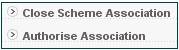

To authorize the selection, highlight the product under Selected Scheme, then select Authorise Association from the sub-menu on the left.

Note:

The Authorisor must be a user other than the user who created the association.

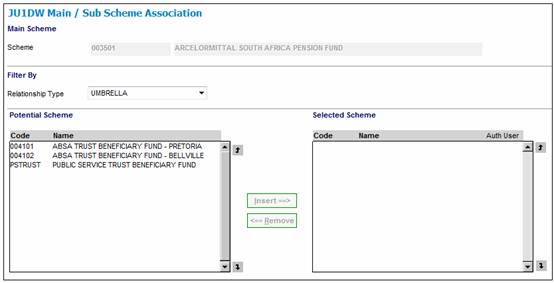

Select Relationship Type UMBRELLA on the JU1DW Main / Sub Scheme Association screen. The JU1DW Main / Sub Scheme Association screen will display a list of all products that have not already been associated to the selected main umbrella product, under Potential Scheme. A list of all the products currently associated to the selected product will be displayed under Selected Scheme.

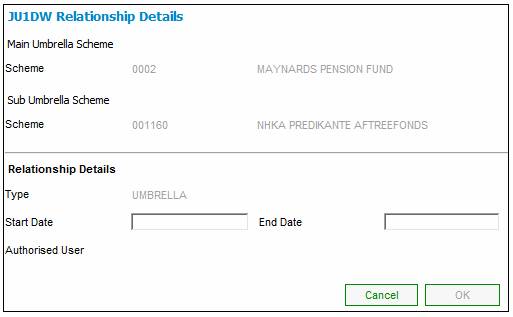

To associate a product to the main umbrella product, highlight the required product from the Potential Scheme list and click INSERT. The JU1DW Relationship Details screen will be displayed.

Enter the START DATE and click OK.

The following validation messages will be displayed:

Are you sure that the bank accounts exist under the main umbrella fund?

Sub Umbrella Scheme Investment Medium is not linked to Main Umbrella Scheme

The financial year end of the sub umbrella scheme must be the same as the main umbrella scheme

Click NO to cancel or click YES to confirm.

The JU1DW Main / Sub Scheme Association screen will be re-displayed, showing the selection made.

If there are no financial period records for the SUB UMBRELLA product, they will be created up to the latest record on the MAIN UMBRELLA product, with all of the same information as the MAIN UMBRELLA product records, i.e. with the same date and time for the following:

- Open on Date / Time

- Close on Date / Time

- Cash Book Close on Date / Time

- Final Close on Date / Time

If there are existing records for the SUB UMBRELLA product, then they will be created for the SUB UMBRELLA product from the date of the latest record, up to the latest record on the MAIN UMBRELLA product.

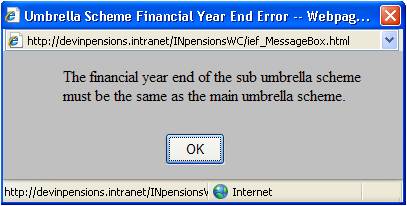

Validation error messages

If the Financial Year End field on the JU1BK Basic Product Data screen of the SUB UMBRELLA product is not the same as the Financial Year End of the MAIN UMBRELLA product, an error message will be displayed.

The financial year end of the sub umbrella scheme must be the same as the main umbrella scheme.

Click OK and change the financial year end of the SUB UMBRELLA product to be the same as the MAIN UMBRELLA product.

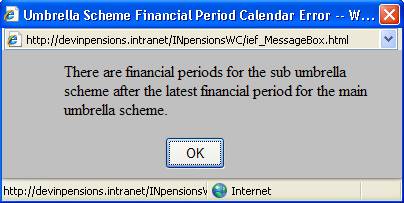

If the value for the Apply Financial Periods to Sub-products field on the JU1BK Basic Product Data screen of the MAIN UMBRELLA product is ticked (Yes), and the SUB UMBRELLA product financial period records have a date greater than the latest financial period record for the MAIN UMBRELLA product, an error message will be displayed.

There are financial periods for the sub umbrella scheme after the latest financial period for the main umbrella scheme.

Click OK and change the financial periods.

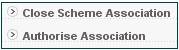

Authorisation

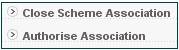

To authorize the selection, highlight the product under Selected Scheme, then select Authorise Association from the sub-menu on the left.

Note:

The Authorisor must be a User different to the User who created the association.

Select Relationship Type ANNUITY RUN on the JU1DW Main / Sub Scheme Association screen. The JU1DW Main / Sub Scheme Association screen will display a list of all products that have not already been associated to the selected main umbrella product, under Potential Scheme. A list of all the products currently associated to the selected product will be displayed under Selected Scheme.

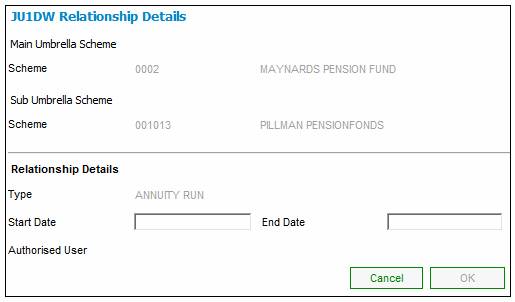

To associate a product to the annuity run, highlight the required product from the Potential Scheme list and click INSERT. The JU1DW Relationship Details screen will be displayed.

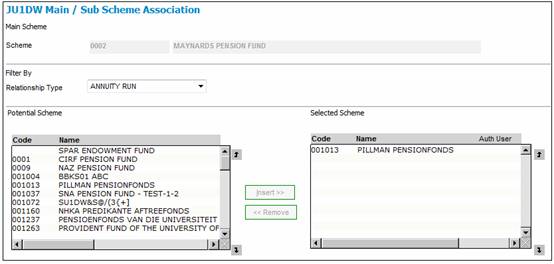

Enter the START DATE and click OK. The JU1DW Main / Sub Scheme Association screen will be re-displayed, showing the selection made.

To authorize the selection, highlight the product under Selected Scheme, then select Authorise Association from the sub-menu on the left.

The authorisor must be a user different to the user who created the association.

UK products must be able to offset death in service benefits in respect of members who were formerly a member of the Retirement Investment Scheme (RIS).

Rules must be defined within the Afterwork and RIS products in order to facilitate this benefit offset.

Rules for Offset Benefits

Select the product that the offsetting will occur in (this will be referred to as the calling product). Using the menu item scheme association, link the products where the benefits will be retrieved from and hence will be used to offset the member’s benefit.

If more than one product is linked in as more than one product will be used to offset, then the order of the linking is not important as the way that the calculation is defined will determine the order or way the offsetting will occur.

Select the product that the offsetting will occur in (referred to as the calling product). Using the Scheme Association menu item with a Relationship Type of LINKED BENEFIT, link the products where the benefits will be retrieved from and hence will be used to offset the member’s benefit.

If more than one product is linked in as more than one product will be used to offset, then the order of the linking is not important as the way that the calculation is defined will determine the order or way the offsetting will occur.

Benefit Package

The Benefit Package purpose of type OFFSET, will identify the calculation that will be linked to the benefit event in a Package combination in the “linked in” product and that will correspond with the same event on the product which has products linked to it.

On the Benefit Structure version authorize, the system will validate that the Package of type OFFSET will return only ONE value. In other words, an AND may not be in the highest level of the calculation. If there is, then the authorization will fail.

Calculation Method

The Calculation Method of OFFSET will be added to a benefit product for a product that has products linked to it with the association of ‘LINKED BENEFIT’ and then be linked to the Package.

For this type of Calculation Method, a list of the products that have been linked with the association of ‘LINKED BENEFIT’ will be provided on the scale. This will then provide the link for the calculation program to retrieve the benefit for the same event in a specific product.

If there is more than one product linked in on the scale, then this will advise the calculation method to sum the values from each product.

If the benefit from the one product is to be used in a different manner, then a separate benefit product can be setup. The Membership Group of the products is irrelevant in this lookup and only the event will be used where there is a Package of purpose OFFSET.

The OFFSET Calculation Method will do the following:

For memberships in other products as part of an umbrella:

- If the claim or quote that is being processed has a Package Calculation with a Benefit Product with a Calculation Method of OFFSET, then using the products that have been linked in on the scale, the system will do the following:

- Reference the product captured on the scale and find the product membership record for the person whose claim is being processed.

- Find the membership Category/Group in the lookup product.

- Using the Event Type equal to the Event being processed on the product with a claim/quote, find for that person’s Membership Category/Group record, the Package with a purpose of ‘OFFSET’.

- Calculate the value defined in the Package and insert into the looked up product, a benefit request record of QUOTE.

- Only a single value may be returned. This will be the history record on the “linked in” product for the users to review the details of how the calculation was done. This will not be duplicated on the “calling product” as the “calling product” will only refer to a single value returned on the Membership Value record. Insert OFFSET into the “linked in” product, for the membership, a membership value record of type =, include the following values ‘product code of the claim/quote that called for the value of the OFFSET benefit, the benefit request number of the calling product and the benefit request number of the one stored above as QUOTE. This will be used as an audit record. Insert into the calling product on the members record, a member value of type ‘OFFSET’ and store the same values as above. The calculation module to determine the result will thus use the lookup on the Member Value with a type of OFFSET in the calling product Membership Reference to obtain the value for the benefit request that is being processed.

For memberships in the same product:

- The system will read to determine if an additional membership record with a DEF ANNUITANT status within the same product exists and if the membership group is linked to a package of OFFSET. If so, then the same as above will be applied.