The following provides guidelines for the process of matching the assets on the Asset Manager’s statement to the liabilities on the administration system.

For information on the capturing of the progress of the asset / liability matching process refer to

Processes

Investments

Asset and Liability Matching

Select accounting on the Main Menu.

The Welcome screen will be displayed.

Select Enquiries from the top menu, then select Business Transaction Balance List from the sub-menu on the left.

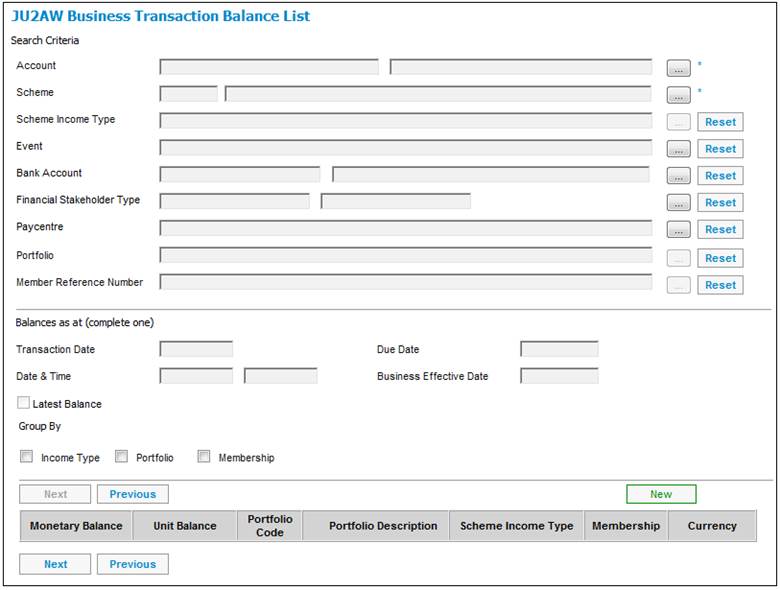

The JU2AW Business Transaction Balance List screen will be displayed.

Make selections or capture data on the screen as follows:

|

Search Criteria |

|

|

Account |

Select the INVSTMEMUNIT Accounting Activity from the drop down list. |

|

Scheme |

Select the applicable scheme from the drop down list. |

|

Balances as at (complete one) |

|

|

Business Effective Date |

Capture the end of the month that you are busy with in this field. This will be the date on the asset statement. |

|

Group By |

Tick the Portfolio box. This will enable the balances to be displayed per Investment Portfolio. |

Once you have completed all the relevant information above, select Retrieve Balances from the sub-menu on the left.

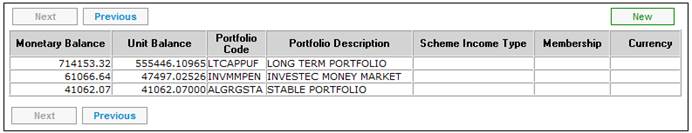

The relevant information will be displayed at the bottom of the screen.

These balances should tie up with the amounts on the asset statement.

- For unitised portfolios, the unit balance should tie up with the unit balance on the Asset Statement.

- For Bonus portfolios, the monetary amount should tie up with the monetary balance on the Statement.

Should you not balance; the Business Transaction Report can be used to identify the differences.

For more information, refer to

Accounting

Enquiries

Business Transactions

This report is updated each night with the transactions for the current day. Run the batch job first should you need to see this report immediately after processing a batch.

Select infrastructure on the Main Menu.

The Welcome screen will be displayed.

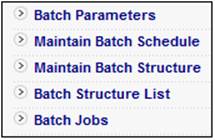

Select Batch from the top menu, then select Batch Jobs from the sub-menu on the left.

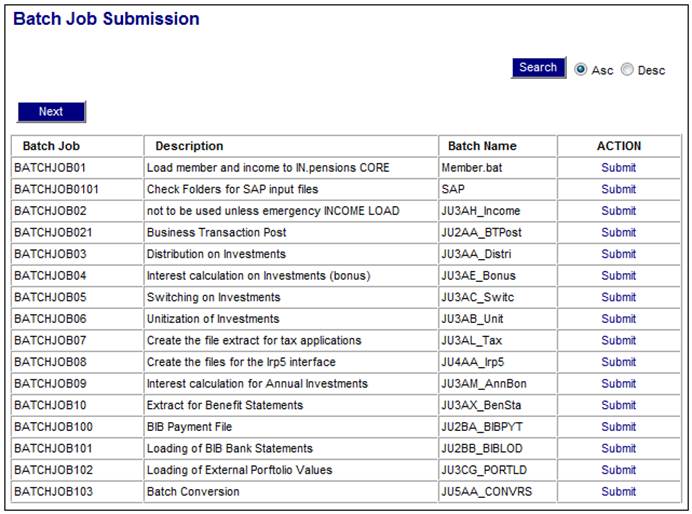

The Batch Job Submission screen will be displayed.

Select the JU2AA_BTPost Batch Job:

![]()

For more information refer to

Supplements

Batch Programs

Once the JU2AA_BTPost Batch Job has run, you can check the report below.

Select reports on the Main Menu.

The Scheme Selection screen will be displayed.

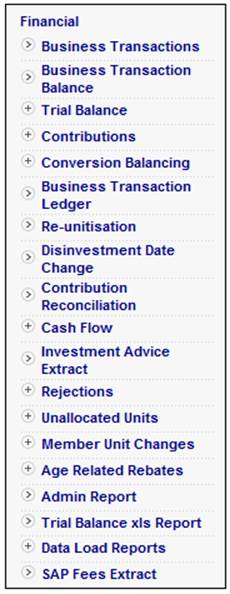

Select a scheme then select Financial from the top menu. Select Business Transactions from the sub-menu on the left.

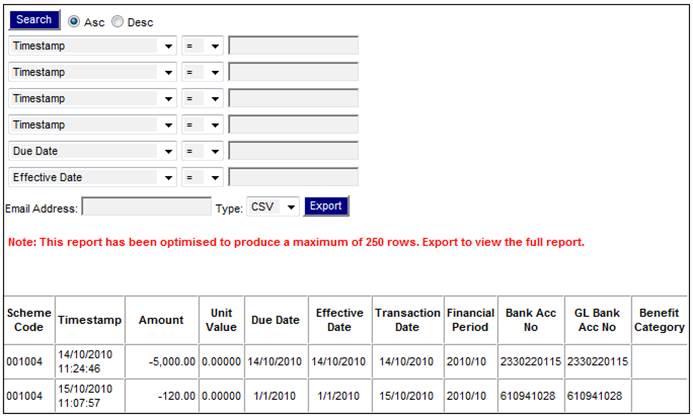

The following screen will be displayed.

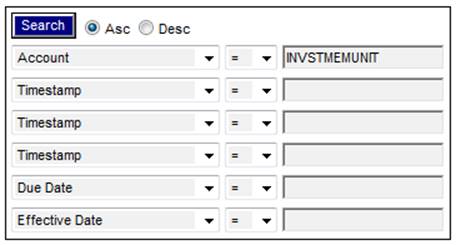

Select ACCOUNT from the drop down list on the left and capture INVSTMEMUNIT in the field on the right.

Click SEARCH.

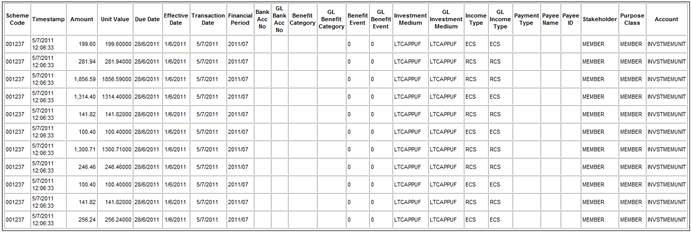

A list of transactions will be displayed which can be extracted to an email address.

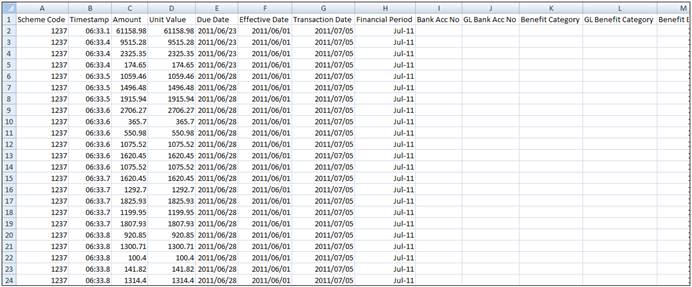

This information can be displayed in excel format.

You can sort the information by Effective Date (column F) or Process (Column AA).

Sorting the information by Effective Date will assist in establishing which transactions will tie up to that on the Asset Statement.

Sorting the information by Process will assist you in the following:

- Total of process = UNITISATION

The total of these transactions should tie up with the total of contributions on your asset statement.

- Total of process = DISTRIBUTION

The total of this column should tie up with the totals of fees and investment income distributed.

For more information, refer to

Reports

Financial

Business Transactions

Report

Should there be any exits or new entrants in the period of reconciliation, it is important to establish whether the investment balances for the exited members are still in the assets of the Fund or whether it has already been disinvested.

Note:

If a member has an exit status on the system, that member’s investment balance could still be in the assets of the Fund. This member will still show on the business transaction report.

By understanding which dates the system uses for different processes, the user can ensure that the correct results are generated. This is especially important because different processes may apply the same date differently. Accounting transactions are created with four dates:

|

Date |

Definition |

|

Transaction Date |

The actual date on which the transaction occurred.

Note: Certain processes will set the transaction date of Debtor (receivable) and Creditor (payable) entries to the due date. |

|

Effective Date |

The date on which the financial implication of the transaction was expected or required to take effect. In most cases this will be equal to the transaction date. |

|

Due Date |

Used to indicate the date contributions, premiums, fees, etc. were due.

For monthly recurring income this will be the last day of the month for the cycle month.

For transfer values this will be the date of transfer. |

|

Date Timestamp |

Used to indicate the date contributions, premiums, fees, etc. were due.

For monthly recurring income this will be the last day of the month for the cycle month.

For transfer values this will be the date of transfer. |

For more information, refer to

Accounting

Structure

Dates and Times