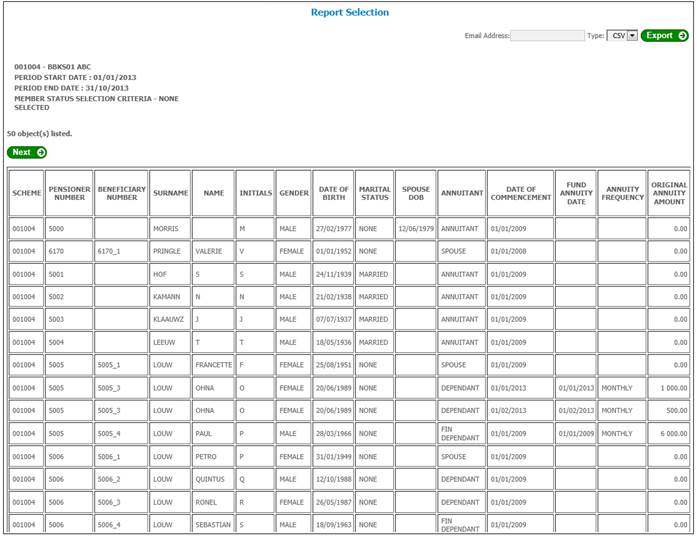

This report displays an extract of annuity data for pensioners for valuation purposes.

Note:

To be able to run this report, a benefit package with a purpose of VALUATION needs to be set up for the benefit event DEATH OF MEMBER AFTER RETIREMENT. Where the annuitant is the member, i.e. not the spouse or a dependant, the spouses percentage is displayed on the report, and this is read from the benefit product linked to the benefit package. The package needs to be exactly the same as the one for the payable benefit, but with a purpose of VALUATION. It will use the same benefit product as the payable benefit, which will have spouses and children’s portions.

Refer to Define the benefit packages linked to each event under

Product Launch Requirements

Product Update

Product Update Type: Maintain Scheme Benefit Rules

The report is generated by a batch run, and is produced in two stages:

- submit the batch job

Note:

The reports are not displayed automatically.

- view the completed reports

From the Reports menu, click ![]() alongside Annuity Valuation on the sub-menu on the left. Additional options will be displayed.

alongside Annuity Valuation on the sub-menu on the left. Additional options will be displayed.

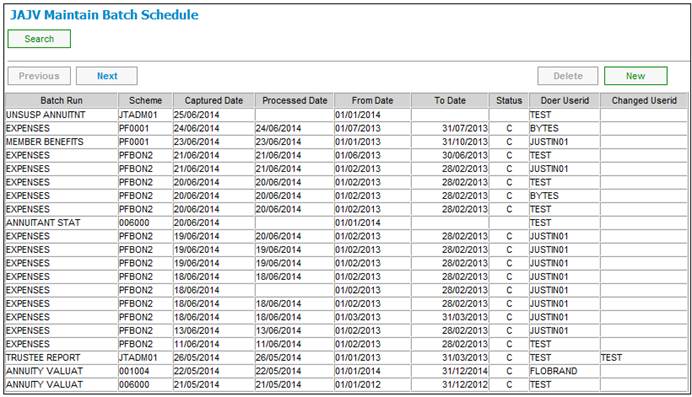

Click New below Annuity Valuation. The JAJV Maintain Batch Schedule screen will be displayed.

This screen displays details of all batch runs that are ready to be processed. If a date appears in the PROCESSED DATE column, the batch has been processed.

A sub-menu will be displayed on the left.

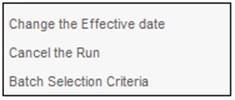

To change the effective date of the run for batch runs that are ready to be processed, highlight the required batch run and select Change the Effective Date from the sub-menu on the left. .

To cancel a batch run that has not yet been processed, highlight the required batch run and select Cancel the Run from the sub-menu on the left. .

To view the various selection criteria defined for a batch run, highlight the required batch run select Batch Selection Criteria .from the sub-menu on the left.

To schedule a new batch run, click NEW.

Refer to Report Criteria under

Infrastructure

Batch

Batch

Maintain Batch Schedule

Click Submit below Annuity Valuation. A message will confirm that the batch job has started successfully.

Batch job (JU2A)_ANNVAL\BJU2A00o.BAT) started successfully.

Note:

JU2AO_ANNVAL\BJU2AOO0.BAT is the BJU2AO Annuity Valuation batch job.

Processing

When the JU2AO Annuity Valuation batch job runs, the system will read the values for Report Criteria and if one of the criteria selected on the JAJV Report Criteria screen is ADDITIONAL INC, the system will extract the information for the Membership Payment records with the Payment Types selected and for which Frequency is not ONCE OFF for each annuitant for all Benefit Types in addition to the Payment Types of ANNUITY.

Where there are multiple records for an annuitant, the information for each record will be included in a new line on the report.

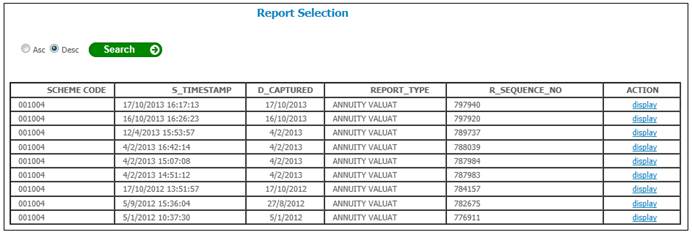

Click View below Annuity Valuation. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Sequence number

- Action

To select a report, click on the hyperlinked display in the Action column alongside the appropriate report.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme

- Pensioner number

- Beneficiary number

- Surname

- Name

- Initials

- Gender

- Date of birth

- Marital status

- Spouse date of birth

- Annuitant

- Date of commencement

- Fund annuity date

- Annuity frequency

- Original annuity amount

- Commutation percentage

- Status

- Annual Annuity at last valuation

- Annual annuity at period start

- Annual annuity at period end

- Spouse percentage

- Annuity paid

- Payments outstanding

- Suspended annuity accrual

- Ceased date

- Dependant Maximum Age Date

- Cessation indicator

- Type of Annuity

- Tax Territory

- Product

- Increase Percentage

- Increase Date

- Guarantee Period

- Investment Type

- Joint Life Surname

- Name and Initial

- Gender

- Age Next Birthday

- Type of Beneficiary

- Guarantee Period

- Annuity Before Guarantee Date

- Annuity After Guarantee Date

- Pro rata increase

- Death Benefit

- Consideration

- Annuitant Age as at start date

- J&S Spouse Age at Start Date

- Annuity Membership Group

- Suspended Date

- Suspension Reason

- Admin Fee

Certain values will be added to the report as per the table below:

|

Field |

Column |

Source |

|

Scheme Code |

1 |

Scheme Code of Sub Umbrella Scheme |

|

Gender |

7 |

Gender on Beneficiary record linked to Membership |

|

Original Annuity Amount |

15 |

The system will read the Regular Payment Amount on the first Membership Payment Detail record for the Annuitant.

Note: The Regular Payment Amount field on the JU4DD Membership Payment Details screen must be updated with the consideration (single premium) amount in order for this to be included in the valuation report for existing annuitants. |

|

Principal member’s % after death of spouse/child |

21 |

The system will read the value for % per Type of Dependant on the Scale of Benefits with a Type of Dependant of MEMBER linked to the Benefit Product linked to the Benefit Package with a Benefit Event of DEATH OF A SPOUSE.

If the Annuitant is a SPOUSE default the value will default to 100% |

|

Suspended Annuity Accrual |

24 |

If the Amendment Reason for an Annuitant is SUSPENDED, the balance on the Annuitant’s SUSPPENPAYBL account as at the To Effective Date of the report is displayed in the Suspended Annuity Accrual field. |

|

Ceased Date |

25 |

The system will read the End Date on the Membership Payment (JUD12) record or the Membership Payment History (JUD19) record and if a value is found that is less than or equal to the To Effective Date of the report then this date will be extracted and extract the value for Cessation Reason on the Membership Payment record for the Cessation Indicator field. If no End Date less than or equal to the To Effective Date of the report is found on the Membership Payment record check for an active Membership Payment Detail (JUD14) record or the Membership Payment Detail History (JUD20) record with a Status of ENDED as at the To Effective Date of the report i.e. with a Timestamp Date less than or equal to the To Effective Date of the report. If no such Membership Payment Detail record or Membership Payment Detail History record is found, the Cessation Date will be set to the To Effective Date of the report and the Cessation Indicator will be set to 999. Note: For Dependant Children the Ceased Date will still be extracted as per current functionality i.e. the End Date on the Membership Payment record will still be displayed even if this date is a date in the future. If there is no end date on the Membership Payment record the Scheme Parameter Dependant Age Limit 2 or the Global Parameter Dependant Age Limit 2 will be read and added to the Dependant’s Date of Birth and the Cessation Indicator displayed with a value of EDUCATION ENDED. |

|

Dep Max Age Date |

26 |

|

|

Cessation Indicator |

27 |

If the value for Cessation Reason on the Membership Payment Detail record is null, a value of 999 will be displayed.

Also refer to Ceased Date above. |

|

Type of Annuity |

28 |

Type of Annuity on Membership Payment record (JOINT LIFE, SINGLE LIFE, etc.) |

|

Territory |

29 |

Tax Territory on Membership Payment Detail record |

|

Product |

30 |

Benefit Type on Membership Payment record |

|

Increase Percentage |

31 |

If the value for Increase Participation on the Membership Payment Details record is not NETOFPURCHRATE or NO INCREASE or the Increase % on JU4DC is not zero, the system will: - Find the latest Membership Payment Detail record with an Amendment Reason of INCREASE with a Start Date less than or equal to the Statement Period End Date. - Find the Membership Payment Detail effective immediately prior to the Membership Payment Detail record in 1 for which the Amendment reason is null or INCREASE. - Calculate the percentage increase in the Regular Payment Amount on the Membership Payment Detail record in 1 from the Regular Payment Amount on the Membership Payment Detail record in 2.

The system will display the percentage increase calculated in the Increase Percentage column.

If the value for Increase Participation on the Membership Payment Details record is NETOFPURCHRATE then the Purchase rate on JU4DC will be displayed in the Increase Percentage Column.

If the Increase % on JU4DC is not zero, the Increase % on JU4DC will be displayed in the Increase Percentage Column.

If the Increase Participation on the Membership Payment Details record is NO INCREASE, then zero will be displayed in the Increase Percentage Column. |

|

Increase Date |

32 |

If the value for Growth Percentage is zero then a value of 01 will be displayed |

|

Guarantee Period |

33 |

Number of months from Date of Commencement to Guarantee Date.

If there is Beneficiary record with a Relationship of SPOUSE then this is the value in column 32

If there is no Beneficiary record with a Relationship of SPOUSE and there is a Beneficiary record with a Relationship of DEPENDANT then this value will be determined from the Minimum Age and the Beneficiaries Date of Birth. The Beneficiaries age will be derived from the Date of Birth.

The system will read the value for Global Parameter DEP AGE LIMIT and Parameter Sub Type of DEP AGE LIMIT 1, and calculate the number of years from the Date of Commencement (column 14) to the date on which the Beneficiary will attain the Minimum Age.

This value is the number of months calculated.

If this value is greater than the value in column 32, then the value for column 32 will be displayed. If it is less, the value calculated will be displayed. |

|

Investment Type |

34 |

If the value for Benefit Type is PSEC then this will be the value for Increase Participation on the Membership Payment Detail record e.g. PROVIDER SMM11. |

|

Joint Life Surname |

35 |

Surname on Beneficiary record linked to Membership |

|

Name |

36 |

First name on Beneficiary record linked to Membership |

|

Initials |

37 |

Initials on Beneficiary record linked to Membership |

|

Age Next Birthday |

38 |

Current Year (CCYY) + 1 – (birth year CCYY of Joint Life Date of Birth).

The system will read the Date of Birth on the Beneficiary record linked to the Membership to derive birth year of Joint Life. |

|

Type of Beneficiary |

39 |

Value for the Relationship on the Beneficiary record: - SPOUSE - DEPENDANT |

|

Annuity Before Guarantee Date |

40 |

Pension the Spouse will receive if the Member dies before the Guarantee Date. Same as Annual Annuity at Period End for main member (column 21) |

|

Annuity After Guarantee Date |

41 |

If there is Beneficiary record with a Relationship of SPOUSE, the system will read the value for Spouse/Dependnt% on the Member’s Membership Payment record.

If the value is null, the system will read the % per Type of Dependant where Type of Dependant is SPOUSE on the Scale linked to the Benefit Product associated to the Benefit Event of DEATH OF MEMBER AFTER RETIREMENT and the Benefit Package with a Purpose of VALUATION.

The system will calculate the annual annuity to be paid to the spouse if the member dies after the guarantee date as follows, by multiplying the annual annuity by the value found.

If there is no Beneficiary record with a Relationship of SPOUSE and there is a Beneficiary record with a Relationship of DEPENDANT, the system will read the value for Spouse/Dependnt% on the Member’s Membership Payment record.

If the value is null, the system will read the value for % per Dependant where Type of Dependant is DEPENDANT on the Scale linked to the Benefit Product associated to the Benefit Event of DEATH OF MEMBER AFTER RETIREMENT and the Benefit Package with a Purpose of VALUATION. |

|

Pro Rata Increase |

42 |

Value for Pro Rata Increase Type on the Membership Payment record |

|

Death Benefit |

43 |

The Description for the Benefit Membership Group to which the Member is linked will be displayed. |

|

Consideration |

44 |

The value for the Original Amount on the Membership Payment record. |

|

Annuitant Age as at Start Date |

45 |

The system will calculate the Annuitant’s age as at the Start Date, based on the Annuitant’s Date of Birth and the Start Date of the Membership Payment record. |

|

J&S Spouse Age at Start Date |

46 |

|

|

Suspended Date |

47 |

The system will check for an active Membership Payment Detail (JUD14) record or the Membership Payment Detail History (JUD20) record with a Status of SUSPENDED as at the To Effective Date of the report i.e. with a Timestamp Date less than or equal to the To Effective Date of the report and where there is no record with a Status of ACTIVE with a Timestamp Date less than or equal to the To Effective Date of the report. If found, the system will extract this date. |

|

Suspension Reason |

48 |

The system will check for an active Membership Payment Detail (JUD14) record or the Membership Payment Detail History (JUD20) record with a Status of SUSPENDED as at the To Effective Date of the report i.e. with a Timestamp Date less than or equal to the To Effective Date of the report and where there is no record with a Status of ACTIVE with a Timestamp Date less than or equal to the To Effective Date of the report. If found, the system will extract the value for Amendment Reason on the Membership Payment Detail record or the Membership Payment Details History record for the Suspension Reason column. |

Admin Fee

When the Annuity Valuation report is extracted, the system will read the Expense Rules for the Scheme and if found will read the Expense Billing control record for the Scheme with an Effective Date equal to the Valuation Report To Date and find the fee amount for each annuitant.

Note:

The administration fees are calculated per annuitant, but accounting transactions will not be created per member and therefore the monthly administration fee per member cannot be retrieved from accounting.