This file is for loading annuity payment details / ad-hoc pension payments / ad-hoc pension increases.

Note:

A record is required for each payment, i.e. the principal member OR each dependant, AND for each deduction to be paid to a third party.

This file upload is used to load the Beneficiary membership record as well as the regular payment details for the beneficiary.

- The date format must be correct (e.g. a date of 19521560 will reject because the month and day are invalid).

- The member number must exist on the system.

- Where fields require specific values, these values have been indicated in the Description / Value column of the detail record below.

To view data loaded for a beneficiary member for an Annuity:

Log in to the system from the Logon page.

Click ![]() .

.

The Welcome screen will be displayed.

To view data loaded for annuitants or beneficiaries of annuitants:

From the main menu on top, click Members. The JU3AO List of Members for a Scheme/Pay Centre screen will be displayed.

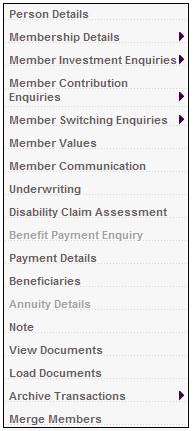

Once the required member has been selected, the JU3AO List of Members for a Scheme/Pay Centre screen will be displayed. Highlight the required member and select Annuity Details from the sub-menu on the left.

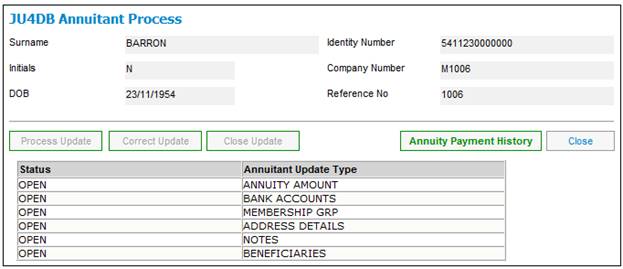

The JU4DB Annuitant Process screen will be displayed.

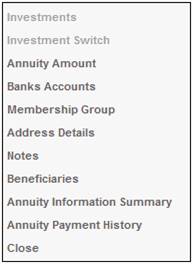

Select Annuity Amount from the sub-menu on the left.

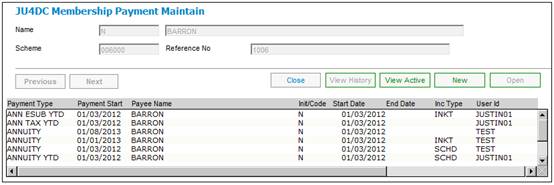

The JU4DC Membership Payment Maintain screen will be displayed.

The annuity details that were loaded via the conversion tool will be shown.

The data has now been successfully loaded and is ready for further processing. Refer to

Processes

Annuities

Annuitant Update Types

Annuitant Update Type: Annuity Amount

Maintaining Annuity Amount

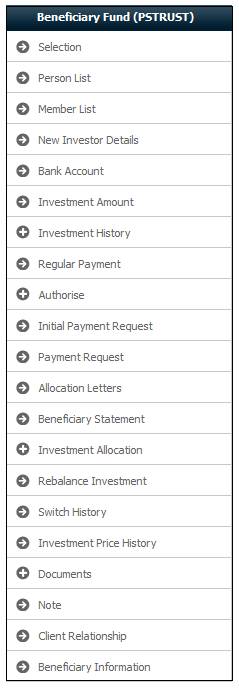

To view data loaded for a beneficiary member of a Beneficiary Fund:

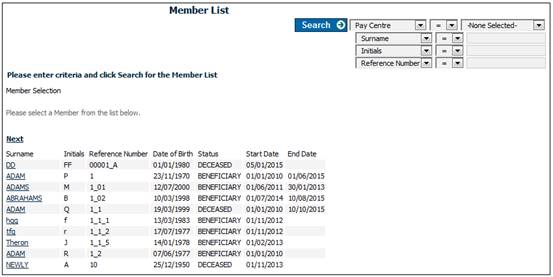

Select the Scheme Code for the Beneficiary Fund of the member and select Member List from the menu on the left.

Click on a Member with a Status of one of the following:

SPOUSE

DEPENDANT

DISABLED DEPDNT

ANNUITANT

LIVING ANNUITNT

BENEFICIARY

Click on the beneficiary.

Select Payment Request from the sub-menu on the left.

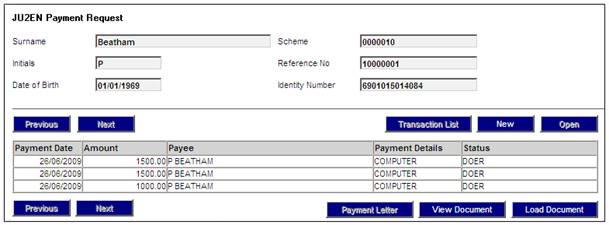

The JU2EN Payment Request screen will be displayed.

To view payment details highlight a payment and click OPEN.

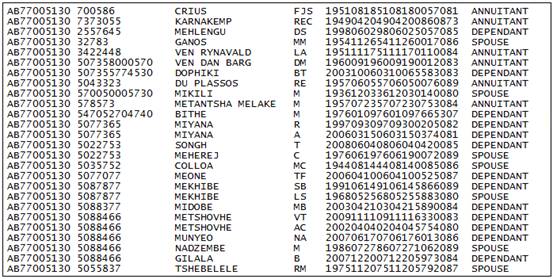

Detail record

|

|

Field Name |

Field Size |

DEC |

ATTR |

O/M |

Start |

End |

Description / Value |

|

1 |

File indicator |

4 |

|

Char |

M |

1 |

4 |

AB77 |

|

2 |

FundNumber |

7 |

|

Char |

M |

5 |

11 |

Scheme code |

|

3 |

MemberNumber |

20 |

|

Char |

M |

12 |

31 |

Member reference number. The deceased member number if you are loading a Beneficiary member of a Beneficiary Fund. All other information must be the Beneficiaries information. |

|

4 |

Surname |

30 |

|

Char |

M |

32 |

61 |

Surname |

|

5 |

Initials |

5 |

|

Char |

M |

62 |

66 |

Initials |

|

6 |

DOB |

8 |

|

Num |

M |

67 |

74 |

CCYYMMDD - Date of Birth |

|

7 |

IDnumber |

15 |

|

Char |

M |

75 |

89 |

ID number |

|

8 |

Status |

15 |

|

Char |

O |

90 |

104 |

ANNUITANT BENEFICIARY LIVING ANNUITNT SPOUSE DEPENDANT DISABLED DEPDNT BENEFICIARY |

|

9 |

Purchase Amount |

11 |

2 |

Num |

M |

105 |

115 |

The CAPITAL amount of the pension (or loan, etc. for deduction). |

|

10 |

Payment Type |

15 |

|

Char |

O |

116 |

130 |

Type of payment. ALLOWANCE ANNUITY EX GRATIA LOAN SUBSIDY HOUSING SUBSIDY MED AID SUBSIDY MED AID ER CONT ANNUITY YTD ANN ESUB YTD ANN LSUB YTD ANN HSUB YTD ANN MSUB YTD ANN TAX YTD ANN GRD YTD ANN LOAN DEDUCTIONS MED SHORTFALL MEDICAL AID RA CONTRIBUTION ANN DED YTD ALLOWANCE

For a beneficiary’s payment record use “ALLOWANCE”. |

|

11 |

Payment Start Date |

8 |

|

Num |

M |

131 |

138 |

CCYYMMDD - the date of the first payment. This is the Start Date field on the JU4DC Payment Details screen, which is the original start date of the annuity. |

|

12 |

EFFECTIVE_DATE |

8 |

|

Num |

M |

139 |

146 |

CCYYMMDD - the effective date from which the payments must start. This is the Effective Date field on the JU4DD Membership Payment Details screen.

This is the effective date from which the current amount is payable. For example, if the person’s pension increased in April, then you should use 1st April of the year that you are migrating (i.e. 20120401). For YTD records you must use the start of the current Tax Year unless the Annuity started after the Tax year commenced. |

|

13 |

DATE_OF_LAST_ PAYMENT |

8 |

|

Num |

M |

147 |

154 |

CCYYMMDD - the date on which the annuitant was last paid. |

|

14 |

AMOUNT_OF_ REGULAR_ PAYMENT |

11 |

2 |

Num |

M |

155 |

165 |

The amount of the payment to be made regularly. |

|

15 |

C_UDPV_ FREQUENCY |

15 |

|

Char |

O |

166 |

180 |

The frequency of the payment. ANNUAL BI-ANNUAL MONTHLY QUARTERLY ONCE OFF |

|

16 |

C_UDPV_ ANNUITANT_ STATUS |

15 |

|

Char |

O |

181 |

195 |

ACTIVE ADJUSTMENT SUSPENDED |

|

17 |

PAYMENT_ REVIEW_DATE |

8 |

|

Num |

O |

196 |

203 |

CCYYMMDD - the date on which the payment will be reviewed for increase purposes.

This applies to Living Annuitants. |

|

18 |

PERCENTAGE |

7 |

4 |

Num |

O |

204 |

210 |

The percentage of the annuity allocated to a beneficiary. The total percentage allocated to all beneficiaries cannot exceed 100%. Note: On each beneficiary record only.

Note: Not applicable for a Beneficiary Fund. |

|

19 |

COE_DATE_SENT |

8 |

|

Num |

O |

211 |

218 |

CCYYMMDD - date a request for a certificate of existence was sent. |

|

20 |

COE_DATE_ RECEIVED |

8 |

|

Num |

O |

219 |

226 |

CCYYMMDD - date the certificate of existence was received. |

|

21 |

PRIORITY_OF_ DEDUCTION |

4 |

|

Num |

O |

227 |

230 |

A number to denote the priority that must be placed on a payment. The lowest number indicates the highest priority.

Note: Not applicable for a Beneficiary Fund. |

|

22 |

TAX_RELIEF |

1 |

|

Char |

O |

231 |

231 |

Indicates whether or not this member is eligible for tax relief. Y N

Note: Not applicable for a Beneficiary Fund. |

|

23 |

END_DATE |

8 |

|

Num |

O |

232 |

239 |

CCYYMMDD - the date on which the annuity will end.

It is preferred that this date is only used if this is a TERM annuity or for deduction that will end at a known date.

The value in this field populates the End Date field on the JU4DC Payment Details record. |

|

24 |

C_UDPV_ PAYMENT_ METHOD |

15 |

|

Char |

O |

240 |

254 |

BANK TRANSFER CHEQUE EFT FOREIGN DRAFT |

|

25 |

TAX_RELIEF_ PERCENTAGE |

7 |

4 |

Num |

O |

255 |

261 |

The percentage allowed for tax relief by the tax authority.

Note: Not applicable for a Beneficiary Fund. |

|

26 |

GN18_ INDICATOR |

1 |

|

Char |

O |

262 |

262 |

Per General Note 18 issued by SARS. Y = annuity purchased by the member (member owned annuity) N = annuity not purchased by the member

Note: Not applicable for a Beneficiary Fund. |

|

27 |

DISINVEST_ LIVING_ ANNUITY_RATE |

7 |

4 |

Num |

O |

263 |

269 |

Currently not in use. |

|

28 |

TAX_DIRECTIVE_ PERCENTAGE |

7 |

4 |

Num |

O |

270 |

276 |

Tax rate percentage for a pension payment that a member or beneficiary has applied for, and for which a tax directive has been received.

Note: Not applicable for a Beneficiary Fund. |

|

29 |

TAX_DIRECTIVE_ START_DATE |

8 |

|

Num |

O |

277 |

284 |

CCYYMMDD - the start date of a tax rate percentage, for which a tax directive has been received.

Note: Not applicable for a Beneficiary Fund. |

|

30 |

TAX_DIRECTIVE_ END_DATE |

8 |

|

Num |

O |

285 |

292 |

CCYYMMDD - the end date of a tax rate percentage, for which a tax directive has been received.

Note: Not applicable for a Beneficiary Fund. |

|

31 |

INCREASE_ PARTICIPATION |

1 |

|

Char |

O |

293 |

293 |

Indicates whether or not a member is eligible for an increase to his annuity, when increases are allocated by the system. Y N |

|

32 |

CO_INCOME_ DATE_SENT |

8 |

|

Num |

O |

294 |

301 |

CCYYMMDD - the date on which a request for a statement of income from the member or beneficiary was sent. |

|

33 |

CO_INCOME_ DATE_RECEIVED |

8 |

|

Num |

O |

302 |

309 |

CCYYMMDD - the date on which a request for a statement of income from the member or beneficiary was received. |

|

34 |

CO_MEDICAL_ DATE_SENT |

8 |

|

Num |

O |

310 |

317 |

CCYYMMDD - the date on which a request for medical evidence of health for the member was sent. |

|

35 |

CO_MEDICAL_ DATE_RECEIVED |

8 |

|

Num |

O |

318 |

325 |

CCYYMMDD - the date on which a request for medical evidence of health for the member was received. |

|

36 |

CO_EDUCATION_ VALID_UNTIL |

8 |

|

Num |

O |

326 |

333 |

CCYYMMDD - the date until which the certificate of education is valid. |

|

37 |

CO_EDUCATION_DATE_SENT |

8 |

|

Num |

O |

334 |

341 |

CCYYMMDD - the date on which the certificate of education was sent. |

|

38 |

PAYMENT_TYPE

|

15 |

|

Char |

O |

342 |

356 |

Reason for suspending payment (for suspended annuities only – refer field 16). <NONE> BONUS FRAUD OUTSTANDING COE OVERPAYMENT SALARY INCREASE UNCASHED CHEQUE IMPRISONMENT |

|

39 |

ORGANIZATION CODE |

6 |

|

Char |

O |

357 |

362 |

The organization (e.g. Medical Aid Institution code).

Note: Not applicable for a Beneficiary Fund. |

|

40 |

FIRST_NAME |

20 |

|

Char |

O |

363 |

382 |

The member's first name. |

|

41 |

MINIMUM_PERCENTAGE |

7 |

4 |

Num |

O |

383 |

389 |

The member's pension as a percentage of the original amount.

Note: Not applicable for a Beneficiary Fund. |

|

42 |

YEAR_TO_DATE_ |

15 |

2 |

Num |

O |

390 |

404 |

Accumulated figures from the previous system.

This field should not be used. The YTD record must be loaded separately. |

|

43 |

UNIQUE_ID_FROM_ORIG_SYSTEM |

8 |

|

Char |

O |

405 |

412 |

The member's reference number from the previous system. |

|

44 |

CLIENT_ |

15 |

|

Num |

O |

413 |

427 |

Internal reference number. |

|

45 |

TOTAL_AMOUNT_REPAID |

15 |

2 |

Num |

O |

428 |

442 |

Amount Repaid. |

|

46 |

TOTAL_AMOUNT_OUTSTANDING |

15 |

2 |

Num |

O |

443 |

457 |

Amount Outstanding. |

|

47 |

TYPE_OF_ ANNUITY |

15 |

|

Char |

O |

458 |

472 |

Type of Annuity ABOLITON OFFICE BALOFGUARANTEE CHILD POST RET CHILD PRE RET DISABILITY EARLY RETIRAL FINDEP POST RET FINDEP PRE RET ILL-HEALTH JOINT LIFE LATE RETIRAL NORMAL RETIRAL PAID UP REM GUARANTEE SICK PRE RET SINGLE LIFE SPOUSE POST RET SPOUSE PRE RET TERM

Note: Not applicable for a Beneficiary Fund. |

|

48 |

DATE_OF_RETIREMENT |

8 |

|

Num |

O |

473 |

480 |

CCYYMMDD - the date on which the Member Retired.

Note: Not applicable for a Beneficiary Fund. |

|

49 |

GUARANTEED_ DATE |

8 |

|

Num |

O |

481 |

488 |

CCYYMMDD - the guaranteed date.

Note: Not applicable for a Beneficiary Fund. |

|

50 |

SALARY_AT_RETIREMENT |

15 |

2 |

Num |

O |

489 |

503 |

Salary at Retirement.

Note: Not applicable for a Beneficiary Fund. |

|

51 |

APPLY_RULE_IND |

1 |

|

Char |

O |

504 |

504 |

Apply Rule indicator.

This is used for cases where “Medical Aid” or “Med Aid ER Cont” is calculated automatically by the Application.

Note: Not applicable for a Beneficiary Fund. |

|

52 |

COMMUTATION_AMOUNT |

15 |

2 |

Num |

O |

505 |

519 |

Commutation Amount

Note: Not applicable for a Beneficiary Fund. |

|

53 |

BONUS_PARTICIPATION |

1 |

|

Char |

O |

520 |

520 |

Bonus participation indicator

Note: Not applicable for a Beneficiary Fund. |

|

54 |

CONFIRMATION_ TYPE |

15 |

|

Char |

O |

521 |

535 |

The method by which proof of existence is to be confirmed. |

|

55 |

YEARLY_REVIEW_DATE |

8 |

|

Num |

O |

536 |

543 |

CCYYMMDD – the yearly review date. |

|

56 |

CESSATION_REASON |

15 |

|

Char |

O |

544 |

558 |

Reason why pension has ceased. CONVERSION DEATH DISABILITY END EDUCATION ENDED SURRENDER |

|

57 |

BENEFIT_TYPE |

4 |

|

Char |

O |

559 |

562 |

This is the Income Type linked to the Annuity Product or Deduction Type i.e. SCHD, BONP, DRET, DMED, etc. |

|

58 |

CURRENCY |

15 |

|

Char |

O |

563 |

577 |

The currency where payment is made |

|

59 |

TOTAL_PENSION |

11 |

2 |

Num |

O |

578 |

588 |

Total pension value

Note: Not applicable for a Beneficiary Fund. |

|

60 |

COMMUTED_PENSION |

15 |

2 |

Num |

O |

589 |

603 |

Commuted pension amount

Note: Not applicable for a Beneficiary Fund. |

|

61 |

TAX_TYPE |

11 |

|

Char |

O |

604 |

614 |

Identifier for type of tax Note:

Not applicable for a Beneficiary Fund. |

|

62 |

BASE_CURRENCY |

15 |

|

Char |

O |

615 |

629 |

Identifies the currency that the pension was originally converted to |

|

63 |

INCREASE_TYPE |

15 |

|

Char |

O |

630 |

644 |

|

|

64 |

INCREASE_MONTH |

2 |

|

Num |

O |

645 |

646 |

|

|

65 |

INCREASE_PERC |

7 |

4 |

Num |

O |

647 |

653 |

|

|

66 |

PRO_RATA_INCREASE_TYPE |

15 |

|

Char |

O |

654 |

668 |

|

|

67 |

PURCHASE_PRICE_RATE |

7 |

4 |

Num |

O |

669 |

675 |

|

|

68 |

POLICY_NUMBER |

50 |

|

Char |

O |

676 |

725 |

|

|

69 |

TAX_DIRECTIVE_AMOUNT |

15 |

|

Num |

O |

726 |

740 |

|

|

70 |

TAX_DIRECTIVE_NUMBER |

15 |

|

Char |

O |

741 |

755 |

|

|

71 |

TAX_DIRECTIVE_ISSUE_DATE |

8 |

|

Num |

O |

756 |

763 |

CCYYMMDD |

|

72 |

BENEFICIARY_TITLE |

15 |

|

Char |

O |

764 |

778 |

Title for SPOUSE DEPENDANT DISABLED DEPDNT FIN DEPENDANT |

|

73 |

BENEFICIARY_GENDER |

15 |

|

Char |

O |

779 |

793 |

This is the gender of the person record that is being added for the beneficiary. SPOUSE DEPENDANT DISABLED DEPDNT FIN DEPENDANT

Note: Not applicable for a Beneficiary Fund. |

|

74 |

BENEFICIARY_TAX_NUMBER |

20 |

|

Char |

O |

794 |

813 |

This is the tax number of the beneficiary that is being added SPOUSE DEPENDANT DISABLED DEPDNT FIN DEPENDANT BENFICIARY

Note: Not applicable for a Beneficiary Fund. |

|

75 |

THIRD_PARTY_REFERENCE_NUMBER |

20 |

|

Char |

O |

814 |

833 |

This is the reference at the third party company – the one for which the organization code is being added for deductions

Note: Not applicable for a Beneficiary Fund. |

|

76 |

MIN INCREASE |

7 |

|

NUM |

O |

834 |

840 |

Minimum increase for inflation-linked |

|

77 |

C UDPV BONUS TYPE |

15 |

|

Char |

O |

841 |

855 |

Type of bonus: 13TH CHEQUE INDIVIDUAL SCHEDULED NO BONUS

Note: Not applicable for a Beneficiary Fund. |

|

78 |

BONUS MONTH |

2 |

|

Num |

O |

856 |

857 |

|

|

79 |

BONUS AMOUNT |

15 |

2 |

Num |

O |

858 |

872 |

|

|

80 |

BONUS PERCENTAGE |

7 |

4 |

Num |

O |

873 |

879 |

|

|

81 |

Statement Frequency |

15 |

|

Char |

O |

880 |

894 |

Values are: YES / NO |

O = Optional field

M = Mandatory

Note:

Positions 1-3 of the last row must contain EOF, followed by a return character.

Notes

Fields 4, 5, 6 and 7 are the personal details for the benefit recipient for which the payment details are being loaded.

Field 14 relates to field 10. If the payment type is a YTD payment type, e.g. ANNUITY YTD, then this field should contain the YTD amount.

Note:

All optional text fields must be padded with trailing spaces.

All numeric fields must be padded with leading zeroes.

Refer to

Supplements

Processes

Data Take On Process For Pensioners

For information on ad-hoc pension payments and ad-hoc pension increases, refer to

Processes

File Transfer

File Layouts

Annuity Payment Detail Upload

For information on the order of loading, refer to

Processes

Annuities

New Business

Loading Data for Annuitants