This option will be enabled when the Status of the membership selected is DECEASED.

Select Amend Beneficiary Allocations from the sub-menu on the left.

Note:

If the status of the selected member is BENEFICIARY, then the JU3EO Regular Payment Amount screen can be accessed by selecting the Regular Payment menu option.

For more information, refer to

Members

Products

Beneficiary Fund

Regular Payment

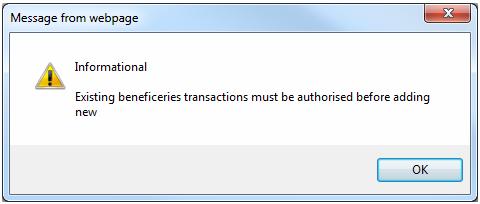

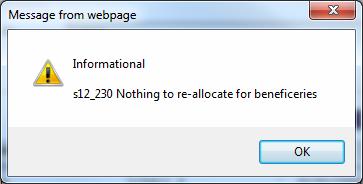

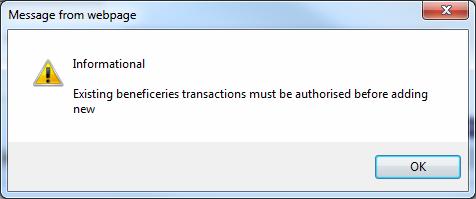

If there are existing beneficiaries linked to the deceased member that have not yet been authorised, then the following message will be displayed:

Existing beneficiaries transactions must be authorised before adding new.

Click

![]() to remove the message.

to remove the message.

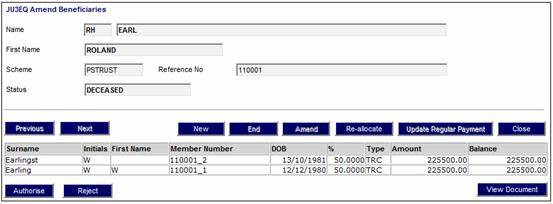

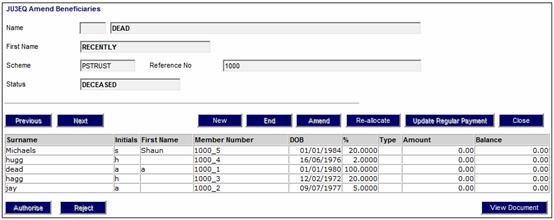

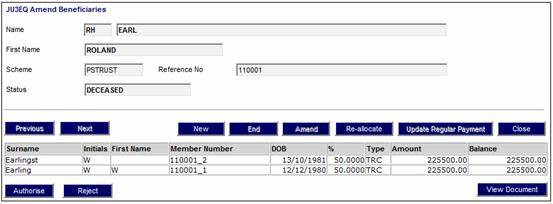

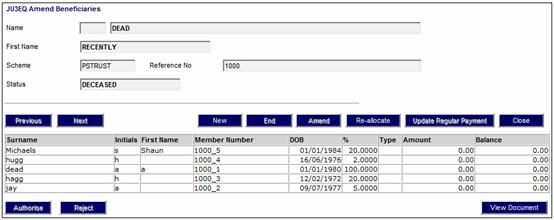

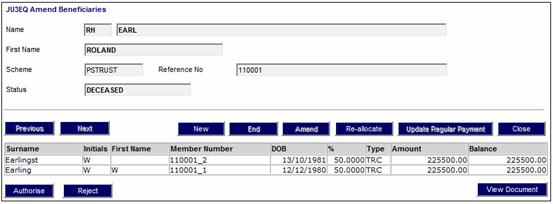

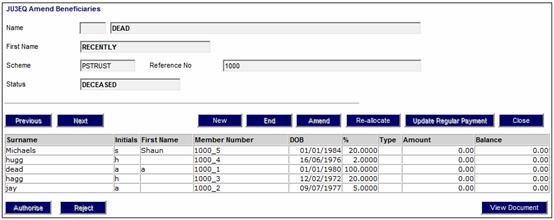

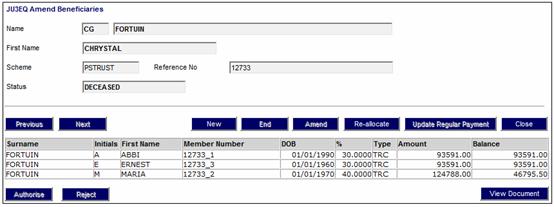

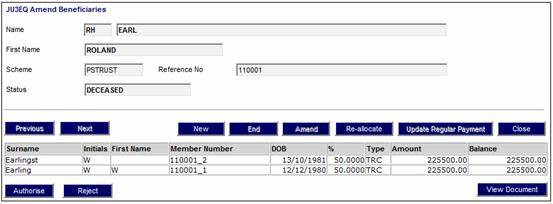

The JU3EQ Amend Beneficiaries screen is displayed.

This screen displays a list of the existing beneficiaries linked to the deceased member selected.

- The following columns are displayed:

- Surname

- Initials

- First Name

- Membership Number

- Date of Birth

- Percentage

- Amount (Sum of MEM CONTRIB, MEMINVADJPOS and MEMINVADJNEG BT’s)

- Balance (Latest balance on Beneficiary’s INVESTMEMB account)

To

add a new beneficiary click ![]() .

.

Note:

This can also be accessed by selecting the New Investor Details menu option.

For more information, refer to

Members

Products

Beneficiary Fund

New Investor Details

My Work for Linked Beneficiary Funds

The user can also create a Service Request in My Work with a Process of BENEFICIARY INV, Activity Name of ADD BENEFICIARY and with the Scheme Code and Membership Number of the Beneficiary Fund Membership with a Status of DECEASED and a Status of OPEN.

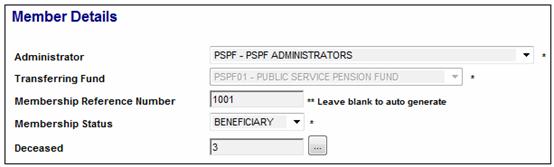

When the Service Request is selected and the Process Service Request menu option is selected, the Member Details screen will be displayed with the details of the Membership captured.

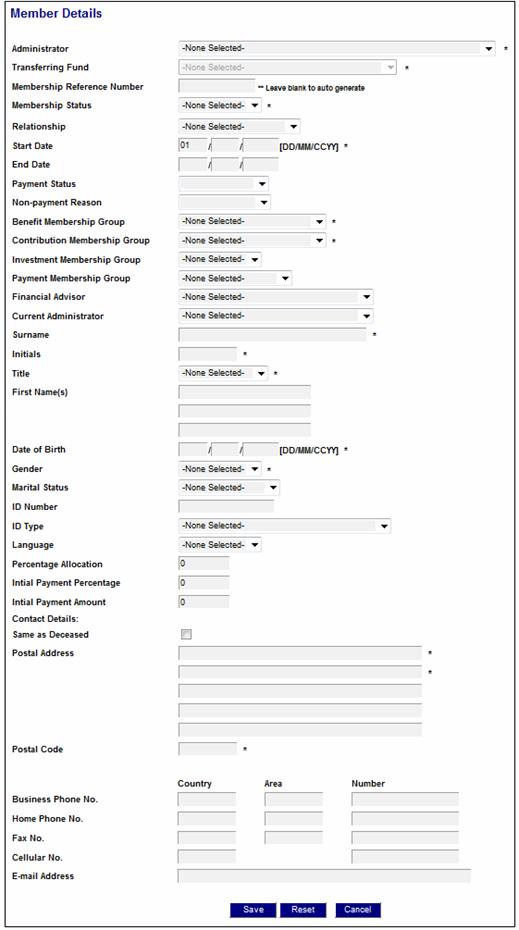

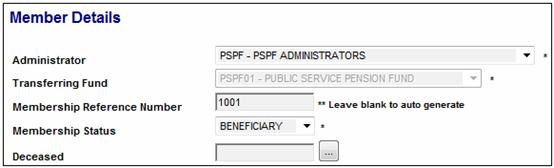

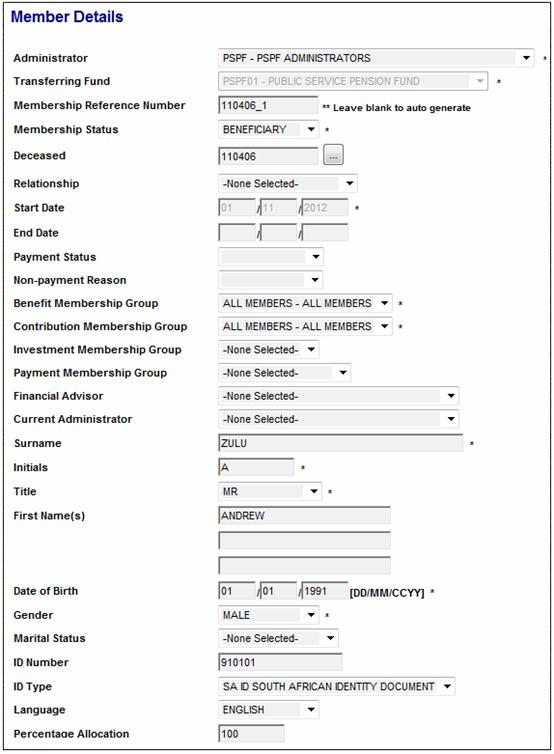

Capture data as follows:

Note:

The following fields make use of the - Enter search - facility:

- Transferring Fund

- Deceased

- Financial Advisor

- Current Administrator

For more details refer to Enter search under Person List (Beneficiary) above.

|

Administrator |

Select a value from the drop-down list.

The system will default the value for Administrator to the user capturing the Member Details if nothing is selected.

The completion of this field is Mandatory. |

||||||||||||

|

Transferring Fund |

The schemes from which money will be transferred to the beneficiary fund. Select the required scheme from the drop-down list, or select - Enter search - .

The completion of this field is Mandatory. |

||||||||||||

|

Membership Reference Number |

The member's reference number. If this field is left blank, a number will be generated by the system.

Note: When beneficiary records are created on the beneficiary fund the system will automatically create the beneficiary record with a membership reference number of the deceased member’s reference number followed by an underscore and a number starting at 1 for each beneficiary. |

||||||||||||

|

Membership Status |

Select BENEFICIARY from the drop-down list.

The completion of this field is Mandatory. |

||||||||||||

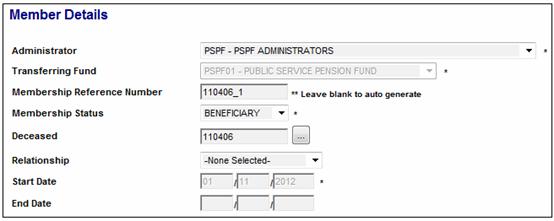

|

Deceased |

Click

For more information on the Deceased Member Search screen, refer to Deceased Member Search below.

This field will only be displayed when the Membership Status field is BENEFICIARY.

The completion of this field is Mandatory. |

||||||||||||

|

Relationship |

Select a value from the drop-down list.

Examples: MOTHER BROTHER |

||||||||||||

|

Start Date |

The start date of this membership. The completion of this field is Mandatory. |

||||||||||||

|

End Date |

The end date of this membership. |

||||||||||||

|

Payment Status |

Click the drop-down list to display a list of Payment Statuses from which to select a status.

Current values are:

|

||||||||||||

|

Non-payment Reason |

If the Beneficiary is still due payment(s), click the drop-down list to display a list of Non Payment Reasons from which to select.

Current values are: NO DOCUMENTS FAMILY DISPUTE |

||||||||||||

|

Benefit Membership Group |

Select the applicable benefit membership group from the drop-down list. The completion of this field is Mandatory. |

||||||||||||

|

Contribution Membership Group |

Select the applicable contribution membership group from the drop-down list. The completion of this field is Mandatory. |

||||||||||||

|

Investment Membership Group |

Select the applicable investment membership group from the drop-down list. The completion of this field is Optional. |

||||||||||||

|

Payment Membership Group |

Select the applicable payment membership group from the drop-down list. The completion of this field is Optional. |

||||||||||||

|

Financial Advisor |

Select the financial advisor from the drop-down list, or select - Enter search - .

The completion of this field is Optional. |

||||||||||||

|

Current Administrator |

Select the financial advisor from the drop-down list, or select - Enter search - .

The completion of this field is Optional. |

||||||||||||

|

Surname |

The member's surname.

The completion of this field is Mandatory. |

||||||||||||

|

Initials |

The member's initials.

The completion of this field is Mandatory. |

||||||||||||

|

Title |

Select the member's title from the drop-down box.

The completion of this field is Mandatory. |

||||||||||||

|

First Name(s) |

The member's first names. |

||||||||||||

|

Date of Birth |

The member's date of birth.

The completion of this field is Mandatory. |

||||||||||||

|

Gender |

Select the member's gender from the drop-down box.

The completion of this field is Mandatory. |

||||||||||||

|

Marital Status |

Select the member's marital status from the drop-down box.

The completion of this field is Mandatory. |

||||||||||||

|

ID Number |

The member's identity number. |

||||||||||||

|

ID Type |

Select the applicable value from the drop-down box. |

||||||||||||

|

Language |

Select the member's language from the drop-down box. |

||||||||||||

|

Percentage Allocation |

The percentage of the death benefit that each Beneficiary must receive.

This field will only be enabled if the Membership Status is BENEFICIARY. |

||||||||||||

|

Initial Payment Percentage |

If a portion of the Beneficiary’s allocation must be paid to the Beneficiary at the time that the investment amount is processed then a value must be captured in this field.

If the full amount of the Beneficiary’s allocation must be paid to the Beneficiary at the time that the investment amount is processed then a value of 100 must be captured in this field.

This field will only be enabled if the Membership Status is BENEFICIARY.

Note: Either a percentage or an amount must be captured. If both are captured, then the following Error Message will be displayed:

Click

|

||||||||||||

|

Initial Payment Amount |

If a portion of the Beneficiary’s allocation must be paid to the Beneficiary at the time that the investment amount is processed then a value must be captured in this field.

This field will only be enabled if the Membership Status is BENEFICIARY.

Note: Either a percentage or an amount must be captured. If both are captured, then the following Error Message will be displayed:

Click

|

||||||||||||

|

Contact Details: |

|

||||||||||||

|

Same as Deceased |

If the contact details of the beneficiary are the same as that of the deceased, then place a tick (yes) in the Tick box.

This field will only be displayed if the Membership Status is BENEFICIARY. |

||||||||||||

|

Postal Address |

The member's postal address.

The completion of the first 2 address lines is mandatory. |

||||||||||||

|

Postal Code |

The postal code of the member's postal address. The completion of this field is Mandatory. |

||||||||||||

|

Business Phone Number |

The member's business phone number. |

||||||||||||

|

Home Phone Number |

The member's home phone number. |

||||||||||||

|

Fax Number |

The member's fax number. |

||||||||||||

|

Cellular No |

The member's cellular number. |

||||||||||||

|

E-mail Address |

The member's e-mail address. |

||||||||||||

Click

![]() . To clear the fields of any

data captured, click

. To clear the fields of any

data captured, click ![]() . This must be done before

the record is saved.

. This must be done before

the record is saved.

When

![]() is selected, the system will not validate that

the sum of the percentages for all of the Beneficiaries is equal to 100. If there are no validation issues, the

Beneficiary record will be created and the

JU3EQ Amend Beneficiaries screen

will be displayed with the newly created Beneficiary in the list.

is selected, the system will not validate that

the sum of the percentages for all of the Beneficiaries is equal to 100. If there are no validation issues, the

Beneficiary record will be created and the

JU3EQ Amend Beneficiaries screen

will be displayed with the newly created Beneficiary in the list.

The system will flow to different screens depending on whether Initial Payment Percentage or Initial Payment Amount was captured on the Member Details screen.

If an Initial Payment Percentage or Initial Payment Amount was captured on the Member Details screen, the system will display the Member Details screen to enable the capture of the Initial Payment Details.

Once the Initial Payment Details have been captured or if no Initial Payment is required, the Amend Beneficiary Allocations menu option must be selected again to display the JU3EQ Amend Beneficiaries screen.

Note:

The existing Beneficiaries’ percentages must all be adjusted before the additional Beneficiary records can be captured so that when the last additional Beneficiary record is submitted the validation can be done to ensure that the total allocation does not exceed 100%.

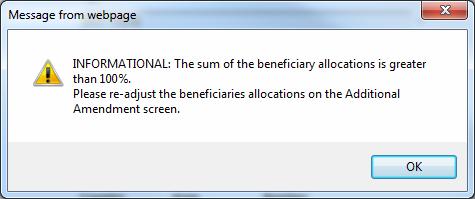

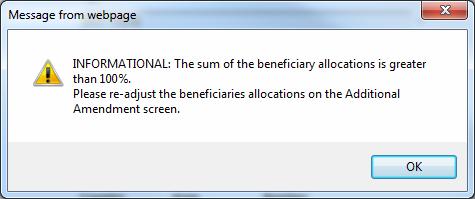

If the sum of the Percentage Allocation for all of the beneficiaries linked to the deceased is now not 100 %, the following message will be displayed:

The sum of the beneficiary allocations is greater than 100%. Please re-adjust the beneficiaries allocations on the Amend Beneficiaries screen.

Click

![]() to remove the message. Adjust the allocations for the beneficiaries

linked to the deceased.

to remove the message. Adjust the allocations for the beneficiaries

linked to the deceased.

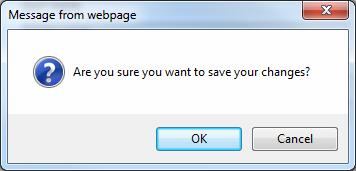

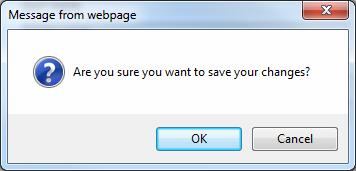

The following message will now be displayed:

Are you sure you want to save your changes?

Click

![]() to confirm.

to confirm.

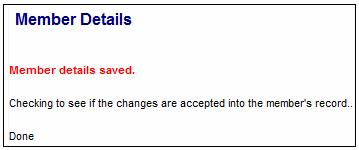

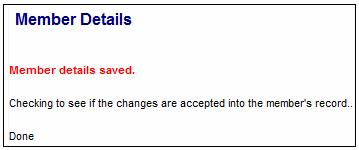

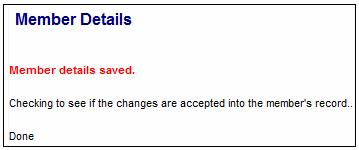

The screen will display the message Member details saved.

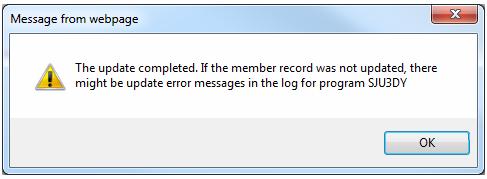

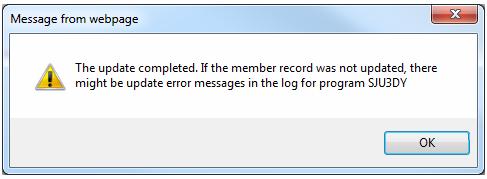

Once the changes have been completed, the following message will displayed:

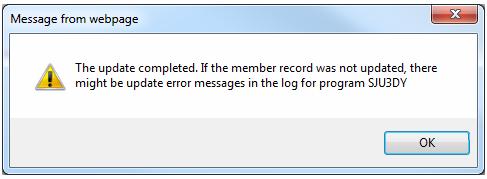

The update completed. If the member record was not updated, there might be update error messages in the log for program SJU3DY

Check

to see that the beneficiary has been added.

If the beneficiary was not created, refer to the Log to view any error

messages. Click ![]() to remove the message.

to remove the message.

If the beneficiary has been added, the system will display the JU3EQ Amend Beneficiaries screen and with the new beneficiary.

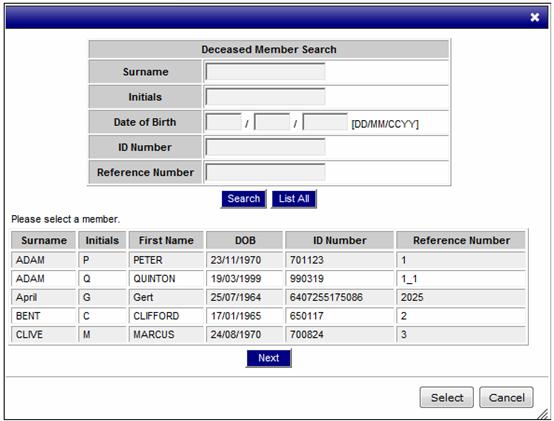

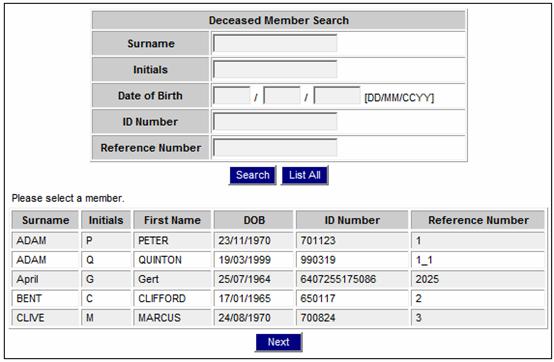

Deceased Member Search

On the Member Details screen, when the Membership Status is BENEFICIARY, the Deceased field will be displayed.

Click

![]() alongside the Deceased field.

alongside the Deceased field.

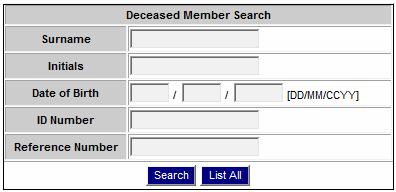

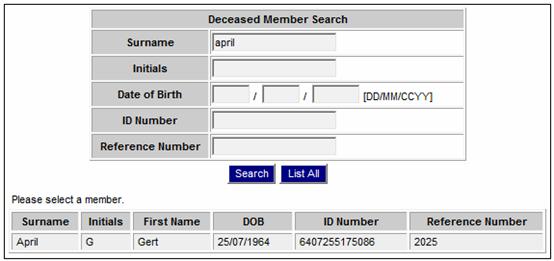

The Deceased Member Search screen will be displayed.

This screen displays a list of members with a Membership Status of DECEASED.

To search for a deceased member, capture one or more of the following search criteria in the appropriate fields:

- Surname

- Initials

- Date of Birth

- ID Number

- Reference Number

Click

![]() .

.

The deceased members matching the search criteria will be displayed in the lower half of the screen.

To

display a list of all Memberships for which the Membership Status is DECEASED,

click ![]() .

.

A list of all deceased member(s) will be displayed in the lower half of the screen.

To

select a deceased member, click on the member and click ![]() .

.

The Reference Number of the deceased member selected will be displayed in the Deceased field on the Member Details screen.

This allows for a beneficiaries membership to be ended.

On

the JU3EQ Amend Beneficiaries

screen, highlight a beneficiary and click ![]() .

.

The Member Details screen will be displayed.

The

End Date field will be enabled for

update. Update the End Date and click ![]() .

.

The following message will now be displayed:

Are you sure you want to save your changes?

Click

![]() to confirm.

to confirm.

The screen will display the message Member details saved.

Once the changes have been completed, the following message will displayed:

The update completed. If the member record was not updated, there might be update error messages in the log for program SJU3DY

Check

to see that the beneficiary has been end dated.

If the beneficiary has not been end dated, refer to the Log to view any

error messages. Click ![]() to remove the message.

to remove the message.

If the beneficiary has been end dated, the system will display the JU3EQ Amend Beneficiaries screen.

If an End Date has been captured, the system will retrieve the balance on the Beneficiary’s INVESTMEMB account and if it is not zero, the following message will be displayed:

The beneficiary has an unpaid balance.

If the balance is zero, the system will check that the Payment Status has been updated. The latest BT in the beneficiary’s INVESTMEMB account will be retrieved and if no BT is found the system will check that the Payment Status is NOT APPROVED. If a BT is found, the system will check that the Payment Status is DECEASED or FULLY PAID.

If these validation criteria have been met, the CAR End Date will be updated on the Membership record for the beneficiary with the End Date captured and the Beneficiary Payment Status record will be updated with the value for Payment Status and Non-payment Reason.

This allows for the Percentage Allocation to be updated for a beneficiary.

On

the JU3EQ Amend Beneficiaries

screen, highlight a beneficiary and click ![]() .

.

The Member Details screen will be displayed.

The

Percentage Allocation field will be

enabled for update. Update the Percentage Allocation and click ![]() .

.

If the sum of the Percentage Allocation for all of the beneficiaries linked to the deceased is now not 100 %, the following message will be displayed:

The sum of the beneficiary allocations is greater than 100%. Please re-adjust the beneficiaries allocations on the Amend Beneficiaries screen.

Click

![]() to remove the message. Adjust the allocations for the beneficiaries

linked to the deceased.

to remove the message. Adjust the allocations for the beneficiaries

linked to the deceased.

The following message will now be displayed:

Are you sure you want to save your changes?

Click

![]() to confirm.

to confirm.

The screen will display the message Member details saved.

Once the changes have been completed, the following message will displayed:

The update completed. If the member record was not updated, there might be update error messages in the log for program SJU3DY

Check

to see that the update has been done. If

the update was not done, refer to the Log to view any error messages. Click ![]() to remove the message.

to remove the message.

If the update has been done, the system will display the JU3EQ Amend Beneficiaries screen and with the beneficiary updated.

This allows for the re-allocation of beneficiary percentages.

If the sum of all of the beneficiaries’ Percentage Allocations is equal to 100%, the system will calculate each beneficiary’s allocation amount based on the updated Percentage Allocations.

For each Beneficiary, the system will calculate the difference between the beneficiary’s original allocation amount and the new allocation amount. Pre-authorised BT’s will be created to adjust the beneficiaries’ investment balances depending on whether the difference is negative or positive.

For more information, refer to Processing below.

Click

![]() on the JU3EQ

Amend Beneficiaries screen.

on the JU3EQ

Amend Beneficiaries screen.

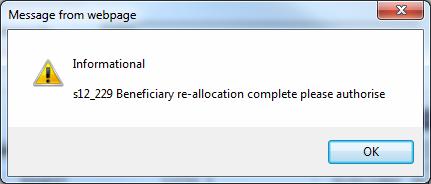

Once the system has finished re-calculating each beneficiary’s allocation amount. the following message will be displayed:

Beneficiary re-allocation complete please authorise

Click

![]() to remove the message.

to remove the message.

These re-allocations must now be authorised.

Messages

The

following messages may be displayed when ![]() is selected on the JU3EQ Amend Beneficiaries screen:

is selected on the JU3EQ Amend Beneficiaries screen:

If there is nothing to be re-allocated, the following message will be displayed:

Nothing to re-allocate for beneficiaries

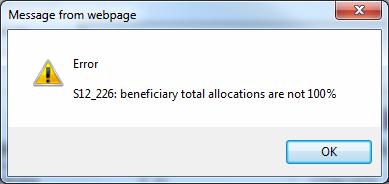

If the beneficiary total allocations are not 100%, the following message will be displayed:

Beneficiary total allocations are not 100%

If the existing beneficiary transactions have not been authorised yet, the following message will be displayed:

Existing beneficiaries transactions must be authorised before adding new

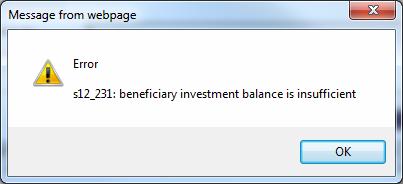

If the beneficiary investment balance is insufficient, the following message will be displayed:

beneficiary investment balance is insufficient

In

each case, click ![]() to remove the message.

to remove the message.

Processing

When

![]() is selected on the JU3EQ Amend Beneficiaries screen, the system will perform the

following:

is selected on the JU3EQ Amend Beneficiaries screen, the system will perform the

following:

Check that the sum of all of the Beneficiaries’ percentages is equal to 100%.

If it is 100%, retrieve the MAINMEMINV BT’s and the MEMBERBONUS BT’s from the INVESTMEMB account for the deceased member to which the Beneficiaries are linked and sum the amounts.

Calculate each Beneficiary’s allocation amount based on the updated Percentages and the sum of the MAINMEMINV and BT’s.

Calculate the difference between the Beneficiaries original allocation amount and the new allocation amount.

Retrieve the BT’s on each Beneficiary’s CONTRIBUTION account and sum the amounts per Beneficiary (this represents the Beneficiary’s original allocation amount).

- For each Beneficiary, calculate the difference between the Beneficiary’s original allocation amount and the new allocation amount

- Retrieve the balances for each of the Beneficiaries’ INVESTMEMB accounts. For each of the Beneficiaries for which BT’s are retrieved from the CONTRIBUTION account, check that the new allocation amount calculated above is greater than or equal to the difference calculated above.

- If the new allocation amount is less than the original allocation and the difference between the original allocation amount and the new allocation amount is less than the INVESTMEMB balance for any of the Beneficiaries, the following error message will be displayed:

The adjustment for one or more of the beneficiaries’ allocation amount is less than the beneficiary’s investment balance and therefore the allocation cannot be reduced. Please adjust the allocation percentages.

Note:

If no BT’s are retrieved from a Beneficiary’s CONTRIBUTION account then the Beneficiary is one of the new Beneficiaries captured. This can’t be derived based on the balance on the INVESTMEMB account as a Beneficiary could have been paid out in full and therefore has a zero balance at the time that the re-allocation is done.

If there are no Beneficiaries for which the adjustment is greater than the Beneficiary’s INVESTMEMB account, the system will create the Pre-authorised BT’s to adjust the Beneficiaries’ investment balances depending on whether the difference is negative or positive.

Negative

If the difference is negative, i.e. the Beneficiary’s new allocation amount is less than the original allocation amount, the following BT will be created with the Due Date, Transaction Date and Effective Date equal to the current date:

BENEFICIARY INV MEMINVADJNEG MEMBER DR INVESTMEMB

BENEFICIARY INV MEMINVADJNEG MEMBER CR CONTRIBUTION

Positive

If the difference is positive, i.e. the Beneficiary’s new allocation amount is greater than the original allocation amount, the following BT will be created with the Due Date, Transaction Date and Effective Date equal to the current date:

BENEFICIARY INV MEMINVADJPOS MEMBER DR CONTRIBUTION

BENEFICIARY INV MEMINVADJPOS MEMBER CR INVESTMEMB

Note:

In most cases the positive adjustments will be for the additional Beneficiaries. It is unlikely that there will ever be a positive adjustment for an existing Beneficiary as effectively a portion of their investment will be re-allocated to the additional Beneficiaries.

If an Initial Payment Percentage or Initial Payment Amount was captured on the Member Details screen for a new Beneficiary, a BT will be created with the following Accounting Activity:

BENEFICIARY PMT INITIALPAYMT MEMBER DR BENEFITS

BENEFICIARY PMT INITIALPAYMT MEMBER CR INVESTMEMB

BENEFICIARY PMT INITIALPAYMT FUND DR BENEFITS

BENEFICIARY PMT INITIALPAYMT FUND CR BANK

My Work

When the Pre-authorised BT’s have been created successfully, the Activity Name will be updated on the applicable My Work Service Request to AUTH ADD ALLOCS.

The Remaining Balance Amount will be apportioned by the system between the other Beneficiaries for which the Balance is not zero, based on their balance and the calculated amount will be displayed in the Amount column for each Beneficiary.

The apportionment per beneficiary is calculated as follows:

Remaining Balance / Sum of Beneficiaries’ Balances x Beneficiary’s Balance

The following pre-authorised BT’s will be created for each Beneficiary for the amount calculated above:

|

BENEFICIARY INV |

MEMINVADJPOS |

MEMBER |

DR |

INVESTMEMB |

|

BENEFICIARY INV |

MEMINVADJPOS |

MEMBER |

CR |

CONTRIBUTION |

Note:

The

![]() and

and ![]() buttons on the JU3EQ Amend Beneficiaries screen will

only be enabled if the Status of the BT’s in the list is not AUTHORISED BT.

buttons on the JU3EQ Amend Beneficiaries screen will

only be enabled if the Status of the BT’s in the list is not AUTHORISED BT.

My Work

When the Pre-authorised BT’s have been created successfully, the Activity Name on the My Work Service Request will be updated to AUTH ALLOC ADJS.

Once the re-allocation of beneficiary percentages has been calculated, they must be authorised.

Note:

Once the re-allocation of beneficiary percentages has been calculated, the Authorise and Reject buttons will be enabled on the JU3EQ Amend Beneficiaries screen.

My Work

- When a Service Request is selected on the My Work screen with a Process of END BENEFICIARY and an Activity Name of AUTH ALLOC ADJS and the Process Service Request menu option is selected, the JU3EQ Authorise Re-allocations screen will be displayed.

- When a Service Request is selected on the My Work screen with a Process of BENEFICIARY INV and an Activity Name of AUTH ADD ALLOCS and the Process Service Request option is selected, the JU3EQ Amend Beneficiaries screen will be displayed.

Click

![]() to

authorise re-allocations.

to

authorise re-allocations.

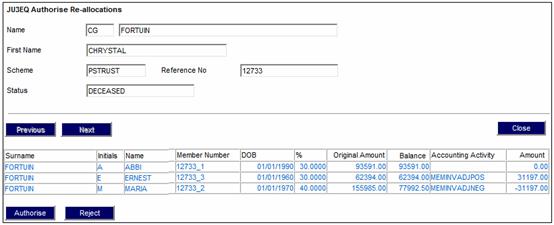

The JU3EQ Authorise Re-allocations screen will be displayed.

This screen displays a list of the pre-authorised BT’s created when re-allocation was calculated.

The following columns are displayed for each Beneficiary linked to the deceased member:

- Surname

- Initials

- Name

- Membership Number

- Date of Birth

- Percentage

- Original Amount (Sum of MEM CONTRIB, MEMINVADJPOS and MEMINVADJNEG BT’s)

- Balance (Latest balance on Beneficiary’s INVESTMEMB account)

- Accounting Activity

- Amount (BT amount)

To

authorise the pre-authorised BT’s, click ![]() on the JU3EQ

Authorise Re-allocations screen.

on the JU3EQ

Authorise Re-allocations screen.

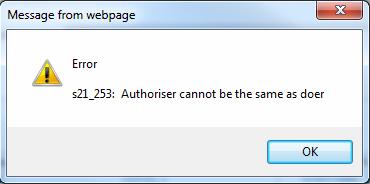

If the User ID of the Authoriser is the same as the User ID of the Doer, the following message will be displayed:

Authoriser cannot be the same as doer

Click

![]() to remove the message. The Authoriser must have a different User ID

to the Doer.

to remove the message. The Authoriser must have a different User ID

to the Doer.

The JU3EQ Amend Beneficiaries screen will be displayed once authorisation has been completed.

Reject

To

reject the authorisation, click ![]() . The system will delete the pre-authorised

BT’s. The authorisation will be

cancelled and the JU3EQ Amend

Beneficiaries screen will be displayed again.

. The system will delete the pre-authorised

BT’s. The authorisation will be

cancelled and the JU3EQ Amend

Beneficiaries screen will be displayed again.

Validations

When

![]() is selected, the system will check that the

User ID of the user selecting

is selected, the system will check that the

User ID of the user selecting ![]() is not the same as the Doer User ID on the

pre-authorised BT’s. The system will

apply the authorisation limit checks as per manual journals and apply the

limits to the individual BT’s.

is not the same as the Doer User ID on the

pre-authorised BT’s. The system will

apply the authorisation limit checks as per manual journals and apply the

limits to the individual BT’s.

When

![]() is selected, the BT’s with a

Due Date, Transaction Date and Effective Date equal to current date will be

created.

is selected, the BT’s with a

Due Date, Transaction Date and Effective Date equal to current date will be

created.

My Work

When the BT’s are successfully authorised, the Status on the My Work Service Request will be updated to COMPLETED.

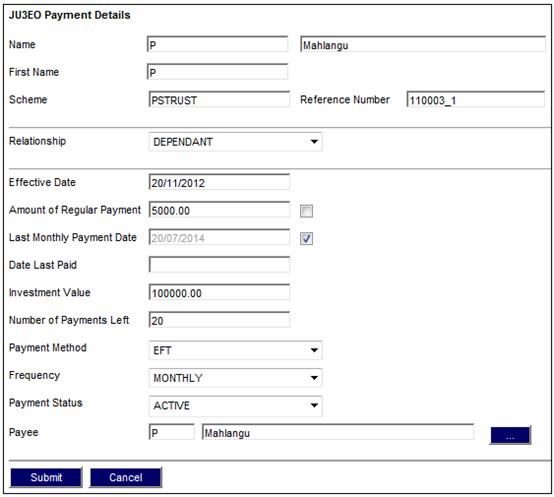

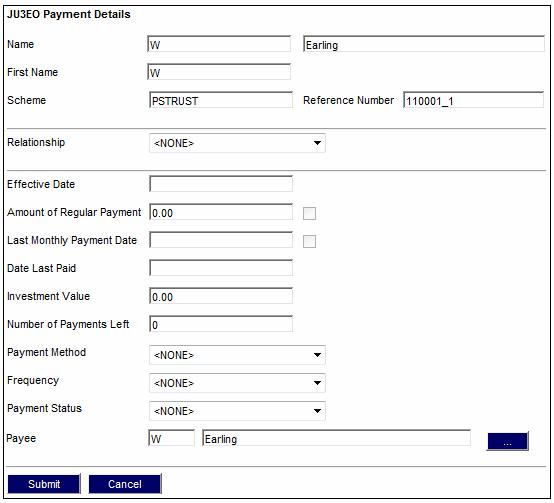

To

update and re-calculate a regular payment amount, select a beneficiary on the JU3EQ Amend Beneficiaries screen and

click ![]() .

.

The JU3EO Regular Payment Amount screen will be displayed.

Highlight

the beneficiary and click ![]() .

.

The JU3EO Payment Details screen will be displayed.

Make

the necessary updates on the screen and click ![]() .

.

The JU3EO Regular Payment Amount screen will be displayed with the updated details.

New

To

create a new set of payment details, click ![]() on the JU3EO

Regular Payment Amount screen.

on the JU3EO

Regular Payment Amount screen.

The JU3EO Payment Details screen will be displayed.

Capture

the required data and click ![]() .

.

The JU3EO Regular Payment Amount screen will be displayed with the updated details.

Processing

If the tick box next to the Amount of Regular Payment field on the JU3EO Payment Details screen is selected, the system will calculate the regular payment amount based on the Last Monthly Payment Date and the Investment Value. The system will calculate the number of months from the current date to the Last Monthly Payment Date and divide the Investment Value by the number of months.

When

![]() is selected, the following message will be

displayed:

is selected, the following message will be

displayed:

The regular payment amount will be changed to the value calculated. Do you wish to continue?

If the YES is selected, the Membership Payment Detail record for the Beneficiary will be updated with the Amount of Regular Payment value and the JU3EQ Amend Beneficiaries screen will be displayed.

If the NO button is selected, the Amount of Regular Payment will be reset to the previous value and the following message will be displayed:

If the date of the regular payment amount must not change then please tick the box next to the Last Monthly Payment Date.

If the tick box next to the Last Monthly Payment Date field is select, the system will calculate the Last Monthly Payment Date based on the Amount of Regular Payment value and the Investment Value. The system will calculate the number of months for which the regular amount will be paid by dividing the Investment Value by the Amount of Regular Payment value and dividing by 12. The Last Monthly Payment Date will be determined by adding the number of months to the current date.

When

![]() is selected, the following message will be

displayed:

is selected, the following message will be

displayed:

The date of the last monthly payment will be changed to the date calculated. Do you wish to continue?

If the YES is selected, the system will not update the End Date on the Membership Payment Detail record for the Beneficiary. The JU3EQ Amend Beneficiaries screen will be displayed

If NO button is selected, the value for the Last Monthly Payment Date will be reset to the previous value and the following message will be displayed:

If the date of the last monthly payment must not change then please tick the box next to the Amount of Regular Payment.

Note:

The calculation of the Amount of Regular Payment or the Date of Last Monthly Payment does not take into account interest added to the Beneficiary’s investment account and therefore are approximate values. In the monthly payment run, if it is the month of the End Date then the balance on the Beneficiary’s investment account must be paid.

The calculation of the Amount of Regular Payment or the Date of Last Monthly Payment also doesn’t take into account any ad hoc payments as these are unpredictable events. However, the regular payment amount will always be limited to the value in the beneficiary’s investment account and therefore there is no risk of overpayment as the ad hoc payments will reduce the balance in the Beneficiary’s investment account.

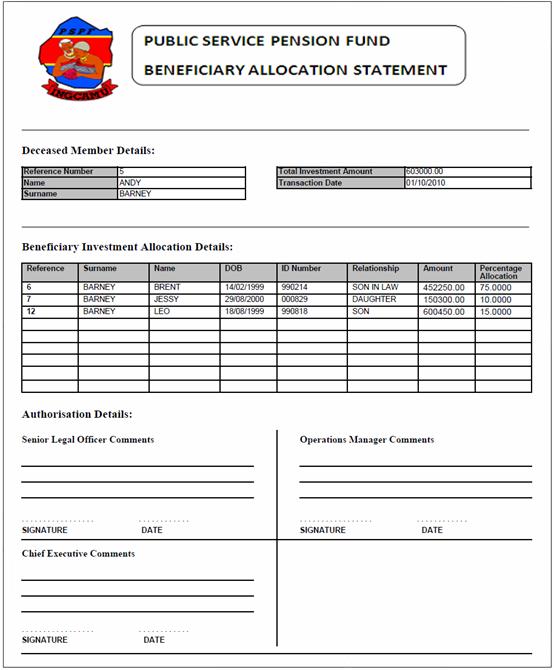

To

view the Beneficiary Allocation

Statement, click ![]() .

.

The system will read the document template with the Process Type of BENEFICIARY and a Template Type of BENEFICIARY INV.

The Beneficiary Allocation Statement will be displayed in PDF format.

This document displays the following data:

- Deceased Member Reference Number

- Deceased Member First Name

- Deceased Member Surname

- Total Investment Amount

- Transaction Date

- For Each Beneficiary:

- Membership Reference Number

- Surname and Name

- Date of Birth

- ID Number

- Relationship

- Amount

- Percentage Allocation