This facility provides for the splitting of a single deposit or payment amount into multiple debit or credit allocations.

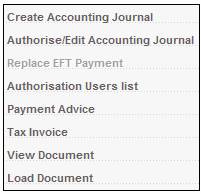

The following menu options are available:

- Bank Account Allocations

- Income Allocations

- Expense Allocations

The bank account allocations show the accounting activities that debit or credit the allocations.

For income and expense allocations, the purpose class of ALLOCATION on the business transaction linked to the accounting activity will be used to identify the accounting activities to be displayed for selection on a journal allocation screen, and to identify the corresponding accounting activities.

The functionality of each of these options is the same, but depending on the option being used, different accounting activities will be used to create the journal transactions.

From the main menu on top, select Transaction Capture. A sub-menu will be displayed on the left.

Select Bank Account Allocations.

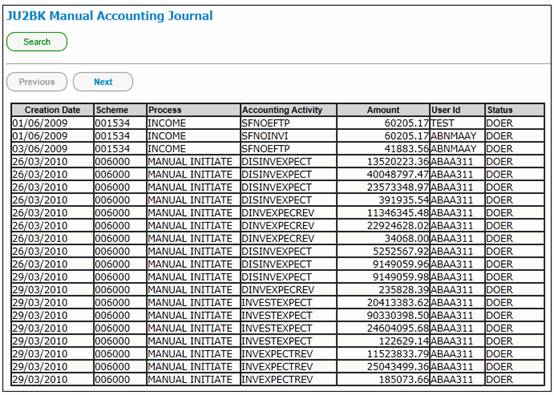

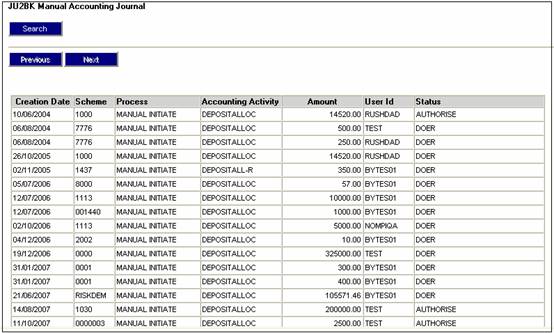

The JU2BK Manual Accounting Journal screen will be displayed.

To create a new allocation, highlight the required accounting journal on the JU2BK Manual Accounting Journal screen and select Create Accounting Journal from the sub-menu on the left.

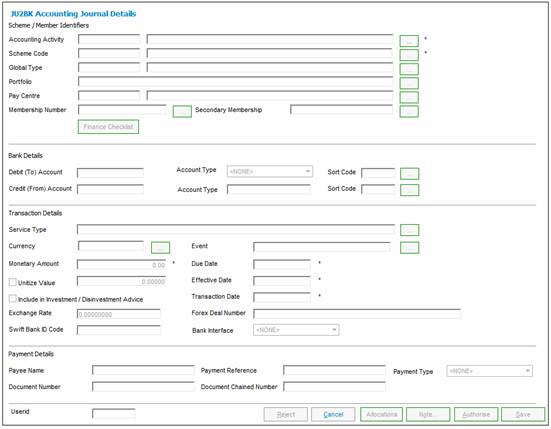

The JU2BK Accounting Journal Details screen will be displayed.

For an explanation of this screen and information on how to code the accounting activity details, refer to Manual Accounting Transactions.

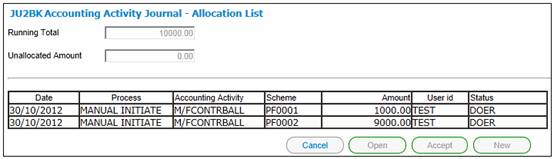

Once all the required data has been captured, click ALLOCATIONS. The JU2BK Accounting Activity Journal - Allocation List screen will be displayed.

This screen displays the following details:

|

Running Total |

A cumulative total of the amounts that have already been allocated. |

|

Unallocated Amount |

The amount that still has to be allocated. |

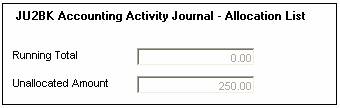

The initial screen does not display any entries as no allocations have been made yet. The UNALLOCATED AMOUNT field will show the total amount to be allocated and the RUNNING TOTAL field will be 0.00, as no allocations have yet been made.

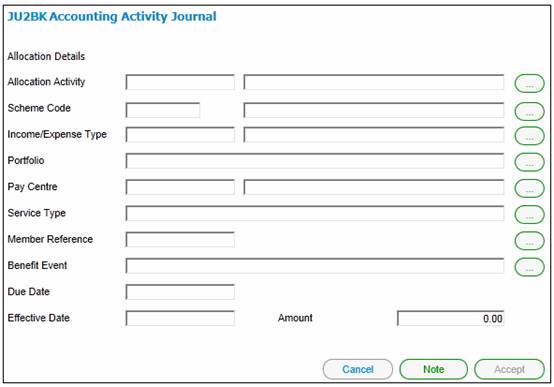

To add an allocation split, click NEW. The JU2BK Accounting Activity Journal screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Allocation Activity Process |

The code and process associated to the selected allocation activity. Click the LIST button at the end of the line. This links to the JU2AF Accounting Activity List screen and displays a list of accounting activities to select from. Once a selection has been made, click SELECT. Note: The accounting activity selected must either debit or credit the account code selected on the Accounting Activity Journal List - Bank Account Allocations screen, i.e. either DEPOSITALLOC or PAYMENTALLOC. If the two accounting activities both credit or both debit the account code, then the amount will be reflected as a negative amount in the allocation list. Note: Refer to Income allocations and Expense allocations below. For income and expense allocations, the purpose class of ALLOCATION on the business transaction linked to the accounting activity will be used to identify the accounting activities to be displayed for selection on a journal allocation screen, and to identify the corresponding accounting activities. |

|

Income / Expense Type |

The code and description of the selected income type. Click the LIST button at the end of the line. This links to the Scheme Global Type List screen and displays a list of income types to select from. Once a selection has been made, click SELECT. If the selected income / expense type is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the income type is mandatory or optional. |

|

Portfolio Description |

The description of the selected portfolio. Click the LIST button at the end of the line. This links to the JU1BV Scheme Portfolio List screen and displays a list of investment mediums to select from. Once a selection has been made, click SELECT. If the selected portfolio is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the portfolio is mandatory or optional. |

|

Pay Centre |

The code and description of the selected pay centre. A pay centre is the entity from which income is received for a group of members. The code will have been defined by the user at the time of setting up the pay centre. Click the LIST button at the end of the line. This links to the JU1DL Scheme Pay Centre List screen and displays a list of pay centres to select from. Once a selection has been made, click SELECT. Note: The system determines via the accounting rule for the accounting activity selected whether the pay centre is mandatory or optional. |

|

Service Type |

The description of the service for which a transaction fee is charged. Click the LIST button at the end of the line. This links to the JU1CX Scheme Services List screen and displays a list of services to select from. Once a selection has been made, click SELECT. If the selected service type is not active, a warning message will be displayed. |

|

Member Reference Number |

The number identifies a person's membership of the product. Membership numbers are unique per product. Required if the transaction is for a specific member. Click the LIST button at the end of the line. This links to the JU3AO List of Members for a Scheme/Pay Centre screen and displays a list of members to select from. Once a selection has been made, click SELECT. |

|

Benefit Event |

The benefit event linked to the benefit package (e.g. late retirement). Click the LIST button at the end of the line. This links to the BIAB Benefit Event List screen and displays a list of events to select from. Once a selection has been made, click SELECT. |

|

Due Date |

The date on which the transaction should have occurred. Note: This date defaults to the due date captured on the JU2BK Accounting Activity Journal screen, but it can be changed here if necessary. |

|

Effective Date |

The date on which the financial implication of the transaction was expected or required to take effect. Note: This date defaults to the effective date captured on the JU2BK Accounting Activity Journal screen, but it can be changed here if necessary. |

|

Amount |

The amount to be allocated in terms of the details provided on this screen. |

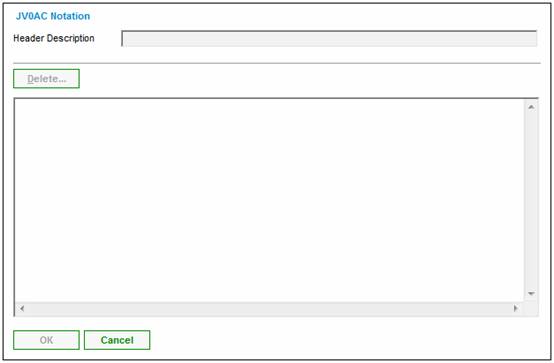

You can attach comments to the allocation details. Click NOTE. The JV0AC Notation screen will be displayed.

Enter the relevant text details, then click OK.

For further information regarding the notes facility, refer to Notes under

Product Launch Requirements

Additional Menu Options

Once all the required information has been completed, click ACCEPT.

The JU2BK Accounting Activity Journal - Allocation List screen will be displayed.

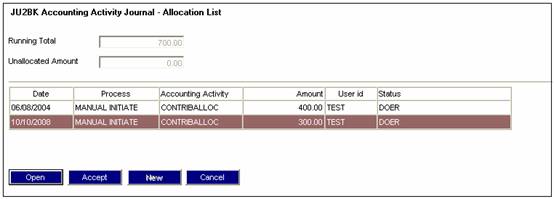

Details of each amount allocated will be displayed on the screen. This information is updated as each allocation is made. Continue the process until all allocations have been completed (i.e. the UNALLOCATED AMOUNT field will be 0.00 and the RUNNING TOTAL field will show the total amount to be allocated.

To change an allocation split, click OPEN. The JU2BK Accounting Activity Journal screen will be displayed. Allocation details can only be changed if they haven't yet been accepted.

An allocation will automatically be deleted if the amount of the allocation is zero. Capture a positive or negative figure in order to generate an amount of zero. Refer to Change an allocation above.

For information on reversing a deposit allocation, refer to

Supplements

Processes

Reversing a deposit allocation

Once all allocations have been made, click ACCEPT. The JU2BK Accounting Activity Journal Details screen will be displayed. Click SAVE.

The following CONFIRMATION box will be displayed:

Click YES to confirm that an accounting activity journal must be created. The JU2BK Manual Accounting Journal screen will be displayed.

This total amount of the entry created will be added to the list.

This transaction must be authorised in the same manner as the manual accounting transaction. Refer to Manual Accounting Transactions.

An amount of R2000.00 must be allocated as follows:

- R700.00

- R400.00

- R900.00

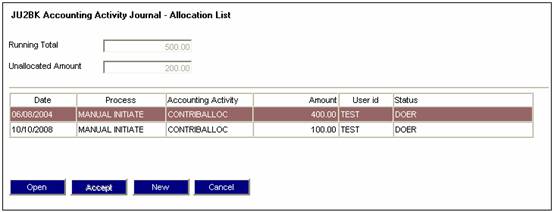

This illustrates the content of each JU2BK Accounting Activity Journal - Allocation List screen as the allocations are made.

JU2BK Accounting Activity Journal - Allocation List screen (no allocations done yet):

JU2BK Accounting Activity Journal - Allocation List screen (after allocation of R400.00):

JU2BK Accounting Activity Journal - Allocation List screen (after allocation of R900.00):

ACCEPT remains disabled until all allocations have been made and the unallocated amount is 0.00.

Refer to the functionality explained under Manual Accounting Transactions above.

Refer to the functionality explained under Manual Accounting Transactions above.

Refer to the functionality explained under Manual Accounting Transactions above.

Refer to the functionality explained under Manual Accounting Transactions above.

Refer to the functionality explained under Manual Accounting Transactions above.

Refer to the functionality explained under Bank account allocations above.

Refer to the functionality explained under Bank account allocations above.

For examples of accounting transactions (T-accounts), refer to

Supplements

Accounting Transaction Examples