The first layout is used to load members’ National Insurance Contribution Office (NICO) earnings and the rebate rates.

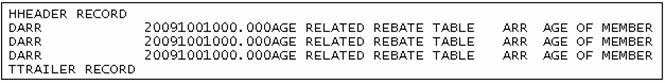

The second layout is used to load the data on the global percentage table.

Note:

For members of a money purchase scheme that is contracted out i.e. does not participate in the additional state pension, the equivalent portion of the contribution that would have been paid to the NICO is paid into the pension fund each month.

For those members that have not reached State Pension Age, an Age Related Rebate is received annually from NICO based on their earnings on which their National Insurance contributions are based.

- The date format must be correct (e.g. a date of 19521560 will reject because the month and day are invalid).

- The member must exist on the system and the membership record must have the same NI Number as on the file.

- The date of birth for the member with an NI Number equal to the NI Number on the file must be the same as the date of birth used in the calculation.

- The membership Status must be LIVE, DEF ANNUITANT, ANNUITANT or LIVING ANNUITY. If it is not, then validation will be performed to check that the Effective Date of the membership Status changed from LIVE, DEF ANNUITANT, ANNUITANT or LIVING ANNUITY was greater than the start of the Tax Year for which the payment relates.

The file received from NICO contains the following set of records that are identified by a single alphabetical character:

|

Record |

Record Identifier |

|

Provider Header |

A |

|

Scheme Header |

B |

|

Payment Records |

C |

|

Recovery Records |

D |

|

Acknowledgement Records |

E |

|

Scheme Control Record |

F |

|

File Balancing Record |

G |

Each file will contain at least records A, B, F and G, but may also contain records C, D or E.

The following relates to record C, Payment Records. The details of the fields for each of the records are contained in the tables below.

Where fields require specific values, these values have been indicated in the Description / Value column of the detail record below.

Provider Header (A)

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Record Identifier |

1 |

|

1 |

1 |

A |

|

A |

|

2 |

Provider Number |

5 |

|

2 |

6 |

N |

|

Unique number of provider. 5 digit number |

|

3 |

Date of issue |

8 |

|

7 |

14 |

D |

|

Date the schedule was produced. CCYYMMDD |

|

4 |

Date of payment |

8 |

|

15 |

22 |

D |

|

Date of payment (BACS entry date) |

|

5 |

Filler |

98 |

|

23 |

120 |

|

|

Spaces |

Scheme Header (B)

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Record Identifier |

1 |

|

1 |

1 |

A |

|

B |

|

2 |

ASCN/SCON |

9 |

|

2 |

10 |

A/N |

|

Scheme number or scheme contracted-out number. 1 alphanumeric character followed by 7 numeric and 1 aphanumeric letter. |

|

3 |

Bank account |

8 |

|

11 |

18 |

N |

|

Bank account number of the receiving scheme. |

|

4 |

Bank sort code |

6 |

|

19 |

24 |

N |

|

Bank sort code of the receiving scheme’s bank |

|

5 |

Bank account |

50 |

|

25 |

74 |

A |

|

Bank account name of the receiving scheme’s account |

|

6 |

Filler |

46 |

|

75 |

120 |

|

|

Spaces |

Payment Record (C)

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Record Identifier |

1 |

|

1 |

1 |

A |

|

C |

|

2 |

Earner’s surname |

18 |

|

2 |

19 |

A |

|

Surname of person – truncated to 18 characters, if necessary |

|

3 |

Earner’s initials |

2 |

|

20 |

21 |

A |

|

First 2 initials of person. If only 1 initial, second character is space. |

|

4 |

NI number |

9 |

|

22 |

30 |

A/N |

|

Person’s NI number. 2 alphabetic, 6 numeric and 1 alphabetic. |

|

5 |

Membership number |

18 |

|

31 |

48 |

A/N |

|

Scheme membership number of person – 18 alphanumeric characters. Can be blank if payment is in respect of a contracted out money purchase (COMP) scheme. |

|

6 |

Tax year |

4 |

|

49 |

52 |

N |

|

Tax year to which the payment relates e.g. 1988/89 = 1988. |

|

7 |

Rebate |

8 |

|

53 |

60 |

N |

|

Amount of contracted-out rebate. 8 numeric characters giving sum in pence |

|

8 |

Additional rebate |

8 |

|

61 |

68 |

N |

|

Amount of 1% additional rebate. 8 numeric characters giving sum in pence. |

|

9 |

Tax relief |

8 |

|

69 |

76 |

N |

|

Amount of tax relief. 8 numeric characters giving sum in pence. |

|

10 |

Incentive addition |

8 |

|

77 |

84 |

N |

|

Amount of incentive addition. 8 numeric characters giving sum in pence. |

|

11 |

Total payment |

8 |

|

85 |

92 |

N |

|

Total payment. 8 numeric characters giving sum in pence. |

|

12 |

Date of birth used in the calculation |

8 |

|

93 |

100 |

N |

|

8 numeric characters giving the date of birth used in the calculation of the rebate. |

|

13 |

Identity/address change |

1 |

|

101 |

101 |

N |

|

‘1’ if there has been a change to the person’s identity or address. |

|

14 |

‘Known as’ indicator |

1 |

|

102 |

102 |

N |

|

‘1’ if the person’s identity details are in ‘known as’ format |

|

15 |

Filler |

18 |

|

103 |

120 |

|

|

Spaces |

Scheme Control Record (F)

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Record identifier |

1 |

|

1 |

1 |

A |

|

F |

|

2 |

Number of payments |

7 |

|

2 |

8 |

N |

|

Number of payments recorded for this scheme on this file. |

|

3 |

Number of recoveries |

7 |

|

9 |

15 |

N |

|

Number of recovery payments for this scheme on this file. |

|

4 |

Number of acknowledgements |

7 |

|

16 |

22 |

N |

|

Number of acknowledgements for this scheme on this file. |

|

5 |

Cash paid to scheme |

11 |

|

23 |

33 |

N |

|

Total cash amount paid to this scheme on this file. 9 numeric characters giving sum in pence. |

|

6 |

Cash recovered from scheme |

11 |

|

34 |

44 |

N |

|

Total cash recovered from scheme on this file. 9 numeric characters giving sum in pence. |

|

7 |

Filler |

76 |

|

45 |

120 |

|

|

Spaces |

File Balancing Record (G)

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Record Identifier |

1 |

|

1 |

1 |

A |

|

G |

|

2 |

Number of payments |

7 |

|

2 |

8 |

N |

|

Number of payment records on this file. |

|

3 |

Number of recoveries |

7 |

|

9 |

15 |

N |

|

Number of recovery records on this file. |

|

4 |

Number of acknowledgements |

7 |

|

16 |

22 |

N |

|

Number of acknowledgements on this file. |

|

5 |

Cash paid to schemes |

11 |

|

23 |

33 |

N |

|

Total cash amount paid on this file. Sum in pence. |

|

6 |

Cash recovered from schemes |

11 |

|

34 |

44 |

N |

|

Total cash recovered in this file. Sum in pence |

|

7 |

Filler |

76 |

|

45 |

120 |

|

|

Spaces |

Note:

All optional text fields must be padded with trailing spaces.

All numeric fields must be padded with leading zeroes.

Global percentage table

Where fields require specific values, these values have been indicated in the Description / Value column of the detail record below.

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Header / Detail / Trailer |

1 |

|

1 |

1 |

A |

|

H for Header and T for Trailer |

|

2 |

Percentage Type |

15 |

|

2 |

16 |

A |

|

|

|

3 |

Effective Date |

8 |

|

17 |

24 |

D |

|

CCYYMMDD |

|

4 |

FILLER |

7 |

|

25 |

31 |

|

|

000.000 |

|

5 |

Description |

50 |

|

32 |

81 |

A |

|

|

|

6 |

Sub Type |

15 |

|

82 |

96 |

A |

|

|

|

7 |

Description 2 |

50 |

|

97 |

146 |

A |

|

|

|

8 |

FILLER |

15 |

|

147 |

161 |

|

|

000000000000.00 |

|

9 |

FILLER |

8 |

|

162 |

169 |

|

|

00000000 |

|

10 |

FILLER |

8 |

|

170 |

177 |

|

|

00000000 |

|

11 |

FILLER |

15 |

|

178 |

192 |

A |

|

|

|

12 |

FILLER |

50 |

|

193 |

242 |

A |

|

|

|

13 |

FILLER |

7 |

|

243 |

249 |

|

|

000.000 |

|

14 |

FILLER |

15 |

|

250 |

264 |

|

|

000000000000.00 |

|

15 |

Percentage |

15 |

|

265 |

279 |

|

|

0000000.0000000 |

|

16 |

FILLER |

15 |

|

280 |

294 |

|

|

0000000.0000000 |

|

17 |

Age |

7 |

|

295 |

301 |

|

|

0000000 |

|

18 |

FILLER |

7 |

|

302 |

308 |

|

|

0000000 |

|

19 |

FILLER |

15 |

|

309 |

323 |

A |

|

|