This section describes how to add a new Income Contribution rate to the product. The process consists of 3 steps:

- Step 1 Discontinue the existing rule (rate).

- Step 2 Adding the new rule (rate).

- Step 3 Authorise the update.

Discontinue the existing rule (rate).

Highlight the product, and click on the UPDATE button on the right.

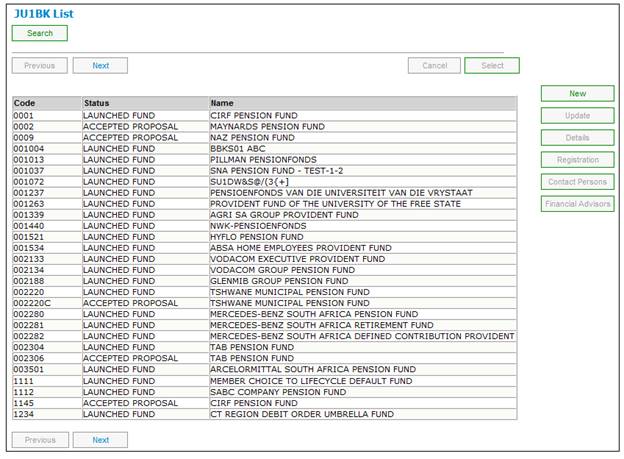

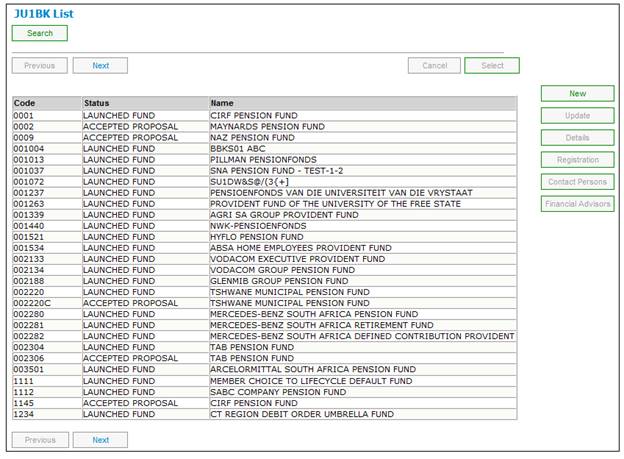

Click products then select LIST from the main menu on top. The JU1BK List screen will be displayed.

Highlight the fund, and click UPDATE on the right.

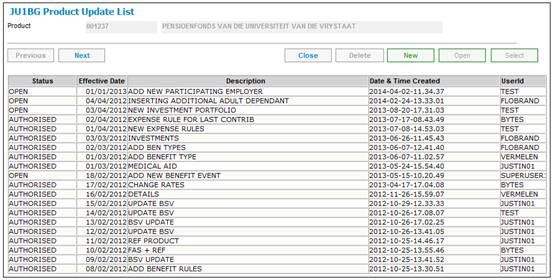

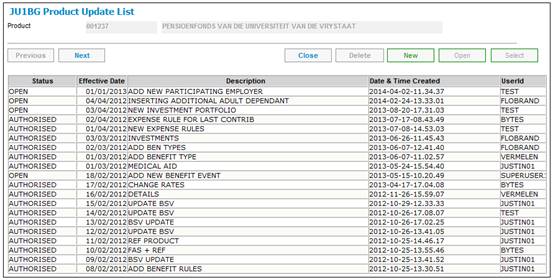

A list of all previous updates will be displayed.

Click NEW.

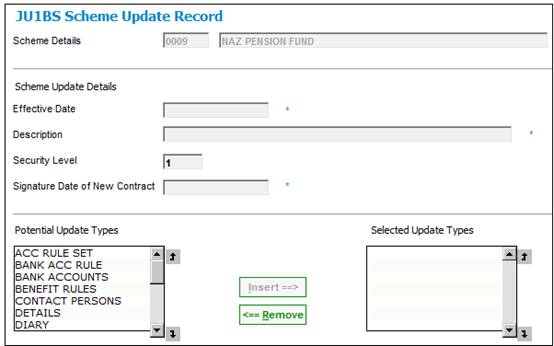

Complete the following fields:

|

Effective Date |

The date that the new rate is effective from |

|

Description |

Describe the nature of the change |

|

Security Level |

Defaults to 1 |

|

Signature Date |

Leave blank (Not Applicable) |

The JU1BS Scheme Update Record screen is displayed.

From the Potential Update Types list, insert the INCOME Update Type.

Use the CLOSE / CANCEL menu options to navigate back to the JU1BG Product Update List screen.

The update that you created is now listed with a status of OPEN.

Highlight this update and from the menu on the left click Scheme Update Type.

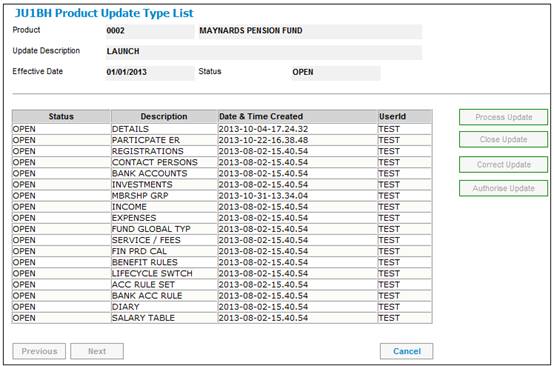

The JU1BH Product Update Type List screen is displayed.

Highlight the Update Type (INCOME) and click PROCESS UPDATE.

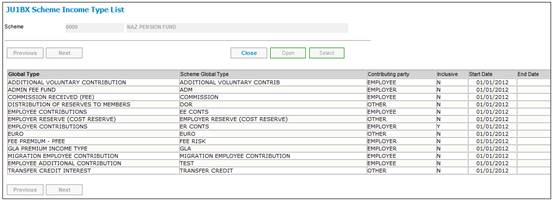

The JU1BX Scheme Update Type List screen is displayed.

Highlight the Income Type (Member Contributions) that you need to change.

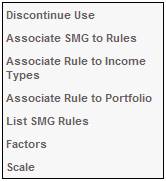

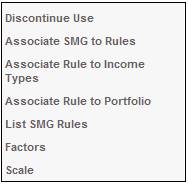

From the menu on the left, select Scheme Global Rules List.

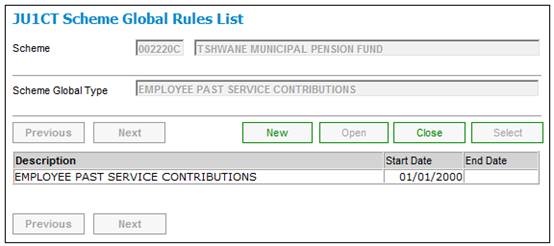

The JU1CT Scheme Global Rules List screen is displayed.

The current rule (rate) will be listed.

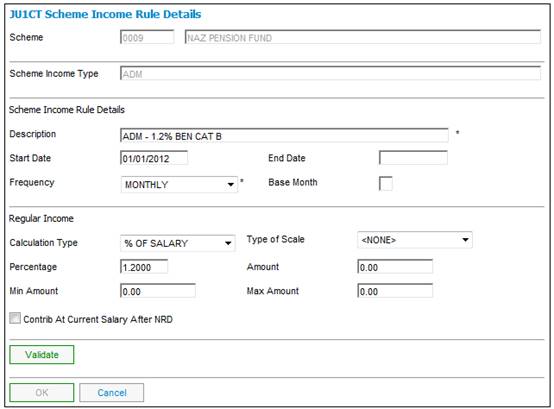

Highlight the rule and select Discontinue Use on the left.

The JU1CT Scheme Income Rule Details screen is displayed.

The rule will be displayed. Click OK to confirm that this is the rule that must be discontinued.

A confirmation message will be displayed.

Adding the new rule (rate).

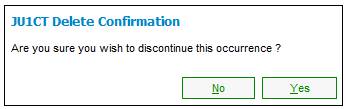

Click NEW to add the new rule (rate).

![]()

The JU1CT Scheme Income Rule Details screen is displayed.

Complete the following fields:

|

Description |

A description of the rule |

|

Frequency |

BI-ANNUAL / MONTHLY / QUARTERLY / ANNUAL / ADHOC |

|

Calculation Type |

% OF SALARY % OF CONTRIBUTION FIXED AMOUNT etc. |

|

Percentage |

The new rate |

Click VALIDATE and then OK to save the rule.

The next step is to indicate WHO is eligible to contribute at this rate.

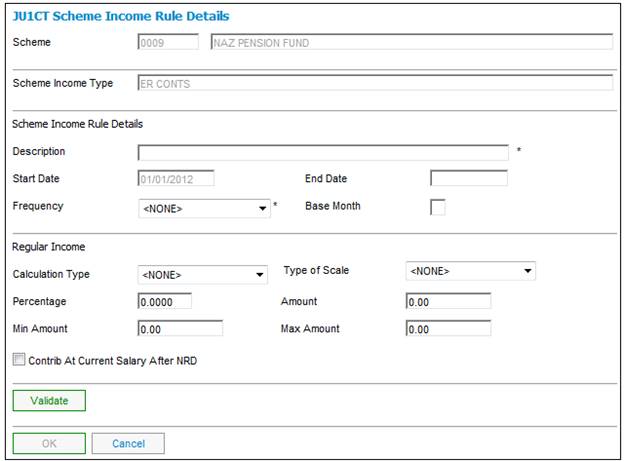

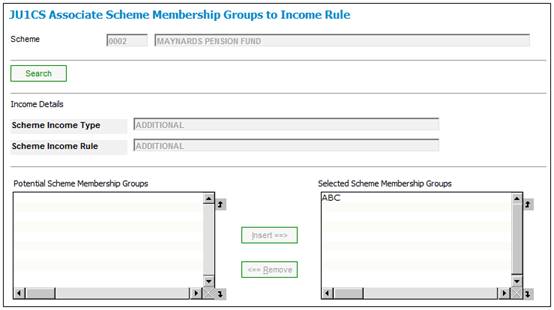

Highlight the new rule and from the menu on the left click on Associate SMG to Rules. (SMG is Scheme Membership Group).

The JU1CS Associate Scheme Membership Groups to Income Rule screen is displayed.

From the Potential Scheme Membership Groups list, link in the CONTRIBUTION categories applicable.

Use the CANCEL/CLOSE options to navigate back to the JU1BX Scheme Income Type List screen.

Authorise the update.

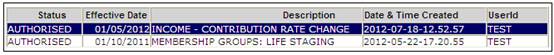

Use the CANCEL/CLOSE options to navigate back to the JU1BH Scheme Update Type List screen.

Highlight the update and click CLOSE UPDATE.

If there are no errors, the status of the update will change to CLOSED.

Highlight the update again and click AUTHORISE UPDATE.

Note:

It might require a 2nd authorizer.

If there are no errors, the status of the Scheme Update will change to AUTHORISED.

On payroll, the rates will automatically be updated (as at the effective date of this update).