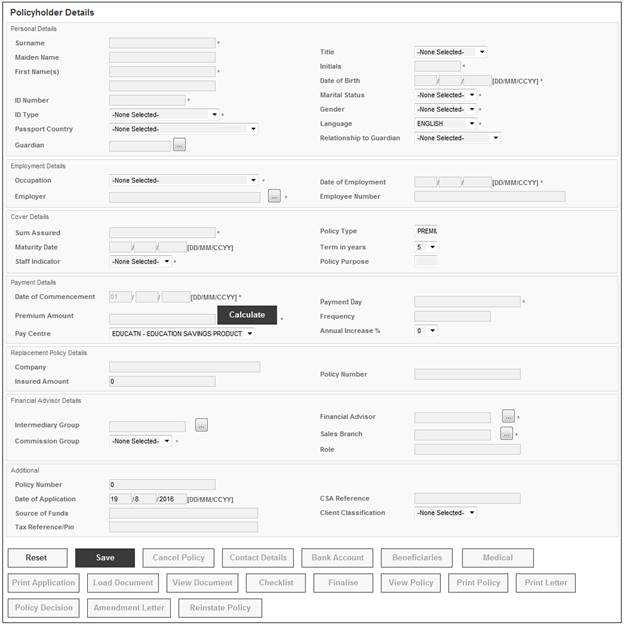

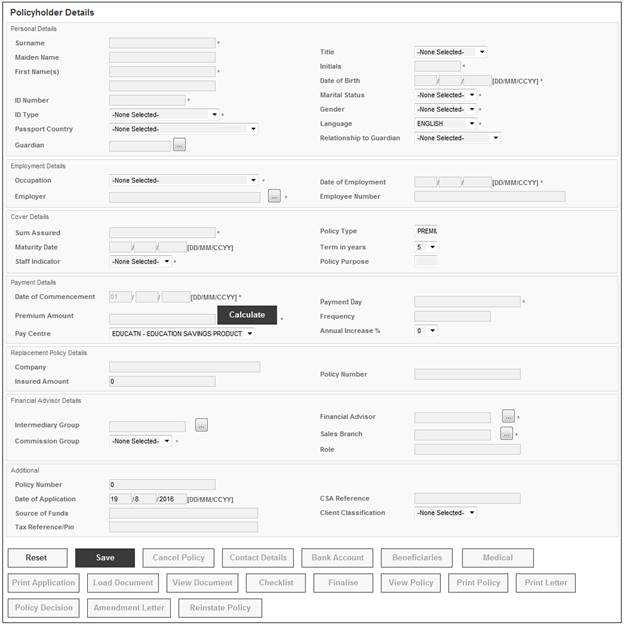

To add a new policyholder, select New Policyholder Details on the sub-menu on the left.

A report can be run for all new policies or amendments to the name, bank account or debit order date for existing policies. For more information refer to

System Reports

Audit

Bank Mandates

Note:

A batch job will extract the data for all new Policyholders for submission to Barclays Compliance for comparison to the Sanctions lists provided by government. For more information refer to

Client Specific

Barclays Africa

Sanctions Screening Data Extract

The Policyholder Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

Personal Details

|

Surname |

The policyholder’s name.

Note: If the Membership is linked to a Corporate Client, the Corporate Client Name will be displayed in this field

Mandatory field |

|

Maiden Name |

In the case of a married female, this is her family name before she was married. |

|

First Name(s) |

The policyholder’s first names.

The capture of at least one name is mandatory. |

|

Title |

Select the required title for the policyholder from the drop-down box.

Optional field |

|

Initials |

The policyholder’s initials.

Mandatory field |

|

Date of Birth |

The policyholder’s date of birth.

The Policyholder must not be older than 60 or younger than 18.

Mandatory field |

|

Marital Status |

Select the policyholder’s marital status from the drop-down box.

Mandatory field |

|

Gender |

Select the policyholder’s gender from the drop-down box.

Mandatory field |

|

Language |

The policyholder’s preferred language.

The system defaults to ENGLISH. If a different language applies, select a value from the drop-down box. |

|

ID Number |

The policyholder’s identity number.

Mandatory field |

|

ID Type |

Select the type of ID from the drop-down box.

Mandatory field |

|

Passport Country |

The Country for which a Passport Number applies. If the value for ID Type is PASSPORT DOCUMENT then select the required Country from the drop-down box.

Optional field |

|

Guardian |

A nominated adult in cases where one or more of the beneficiaries are minors.

Click the LIST button to flow to the Person Search screen and select a Guardian from a list.

Processing The system will create a Natural Person record and a Client Relationship record with a Client Relationship Type of GUARDIAN linking the Person to the Policyholder and a value for Beneficiary Relationship equal to the value selected. If there is an existing Client Relationship record with a Client Relationship Type of GUARDIAN linked to the Policyholder, the system will update the End Date with a date equal to the Start Date of the new record less one day. |

|

Relationship to Guardian |

Select the relationship of the Beneficiary to the Guardian from the drop-down list. |

Employment Details

|

Occupation |

The policyholder's occupation. Select a value from the drop-down list.

Mandatory field |

|

Employer |

The name of the Employer.

Click the LIST button to flow to a list of employers and select one.

Note: When the LIST button for the Employer field in the Employment Details section of the Policyholder Details screen is selected, the following screen is displayed:

Select an Employer and click SELECT.

Mandatory field |

|

Date of Employment |

The date the policyholder commenced employment with the current employer.

Mandatory field |

|

Employee Number |

The Company Reference Number of the Policyholder.

Optional field |

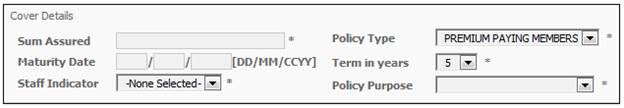

Cover Details

|

Sum Assured |

The guaranteed maturity value that the Policyholder will receive when the policy matures.

The sum assured amount must greater than 9999.00 ZMW and less than 250 000.01 ZMW.

Note: For more information, refer to Save policyholder details below.

Mandatory if Type of Fund is ENDOWMENT. |

||||||||||||

|

Maturity Date |

The date on which the Endowment Policy matures.

Note: Once the policyholder has been saved, the system will display a date calculated as date of birth plus 66. |

||||||||||||

|

Staff Indicator |

Whether the Policyholder is a staff member or not. Select a value from the drop-down list: NON STAFF STAFF

Note: Policyholders who are Staff members receive a 10% staff discount on their premiums payable.

Mandatory field |

||||||||||||

|

Policy Type |

The default benefit membership group to which the Policyholder is linked.

Select a value from the drop-down list. Examples: PREMIUM – PREMIUM PAYING MEMBERS PAID UP – PAID UP MEMBERS DTHPREMWAIVER – DEATH PREMIUM WAIVER BENEFIT

Note: If the Benefit Membership Group is changed, i.e. a different value selected for Policy Type, the system will recalculate the Premium Amount. Refer to the Payment Details section below.

Mandatory field |

||||||||||||

|

Term in years |

The term of a payment expressed in years.

Select a value from the drop-down list.

Mandatory field |

||||||||||||

|

Policy Purpose |

The level of education for which the Policy has been bought.

Select a value from the drop-down list. The list of Policy Purpose options displayed are filtered, based on the country on the scheme.

Mandatory field |

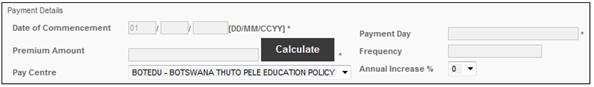

Payment Details

|

Date of Commencement |

The date on which this membership / Policyholder commences.

The date may not be greater than 3 months from today’s date. The following message will be displayed if the date is greater than 3 months.

Date of commencement cannot be greater than 3 months from today.

Click OK to remove the message. Capture a date less than 3 months from today’s date.

The payment date will be used as the commencement date for a policy in the letters.

Mandatory field |

|

Payment Day |

The day on which payments must be made.

The system default is 1.

If the day captured is greater than 31, the following message will be displayed:

Please supply a numeric value for Payment Day less than 31.

Click OK to remove the message. Capture a date of 31 or less.

Mandatory field |

|

Premium Amount

CALCULATE |

The amount of premium that the policyholder will pay.

Click CALCULATE for the system to use the Rate Tables to calculate and display the amount of premium.

This is a protected field and a value cannot be captured other than by selecting CALCULATE.

Processing: When calculating the premium the system will read rate table with a Parameter Type of BENCALC and a Parameter Sub-Type equal to the value for the Calculation Parameter on the Benefit Product with a Description of PREMIUM RATE CALC linked to the Benefit Package with an Event Category of OTHER and a Benefit Event of PREMIUM RATES CALC and linked to the Benefit Membership Group selected. Note: If the Benefit Membership Group is changed, i.e. a different value selected for Policy Type, the system will recalculate the Premium Amount. Refer to the Cover Details section above.

Rounding For Products in countries where decimal places are rounded, any premium amounts collected via debit order and any payment values will have their financial transactions values rounded to the nearest 5 cents. When calculating a premium, the system will read the value for Rounding Method on the Benefit Product linked to the Benefit Package with an Event Category of OTHER and a Benefit Event of PREMIUM RATES CALC and linked to the Benefit Membership Group selected. If it is NEAREST 0.05, the calculated premium amount will be rounded to the nearest 0.05 e.g. if the value calculated is 95.03 it will be rounded to 95.05, if it is 95.02 it will be rounded to 95.00, if it is 95.06 it will be rounded to 95.00, etc.

Mandatory field. |

|

Frequency |

The frequency of payments.

Processing: The system will read the value for Frequency on the rate table with a Parameter Type of BENCALC and a Parameter Sub-Type equal to the value for the Calculation Parameter on the Benefit Scale linked to the Benefit Product with a Description of PREMIUM RATE CALC linked to the Benefit Package with an Event Category of OTHER and a Benefit Event of PREMIUM RATES CALC and linked to the Benefit Membership Group selected and default this to the value found.

Mandatory field |

|

Pay Centre |

The Pay Centre from which the policyholder’s contribution / premium data is collected.

Select a Pay Centre from the drop-down list.

Optional field |

|

Annual Increase % |

The percentage by which an annuity must be increased annually. Select a value from the drop-down list.

Optional field |

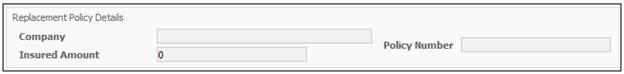

Replacement Policy Details

|

Company |

The name of the Company for the replacement policy.

Optional field |

|

Insured Amount |

The amount insured. |

|

Policy Number |

The Policy Number of the Policy.

Optional |

Financial Advisor Details

|

Intermediary Group |

The name of an Intermediary Group.

Click the LIST button to flow to a list of Intermediary Groups and select one.

Note: If applicable, the system will display the Branch of the Intermediary Group to which the Intermediary is linked.

Optional field. |

|

Commission Group |

The name of a Commission Group.

Click the LIST button to flow to a list of Commission Groups and select one.

Mandatory field. |

|

Financial Advisor |

The name of the financial advisor.

Click the LIST button to flow to a list of employers and select one.

Note: The list for selection will not be displayed until an Intermediary Group has been selected.

Mandatory field |

|

Sales Branch |

The sales branch for this policy.

Click the LIST button to flow to a list of Sales Branches and select one.

If a Financial Advisor is selected then this field is mandatory. |

|

Role |

The role which the Financial Advisor plays. |

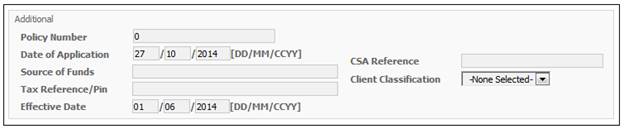

Additional

|

Policy Number |

The number of the Policyholder. If this field is left blank, a number will be generated by the system. |

||||||||||

|

CSA Reference |

The number identifying a Corporate Client or Person for external system purposes.

Note: If no CSA number is received, the bank account number can be used.

Optional field |

||||||||||

|

Date of Application |

The date on which the Policy was applied for.

The system will pre-populate this field with the current date.

This field may be amended to a date that is less than or equal to the current date. |

||||||||||

|

Source of Funds |

The actual source of funds for the policy. |

||||||||||

|

Tax Reference/Pin |

The tax Reference Number or PIN for the Policyholder. |

||||||||||

|

Client Classification |

Values are displayed for selection based on the country of the scheme, as per the table below:

|

||||||||||

|

Effective Date |

The date effective for the Endowment Policy.

This date will only be displayed once a new Policyholder has been created. |