Note:

A new payment record cannot be captured if the current payment is suspended. The following error message will be displayed:

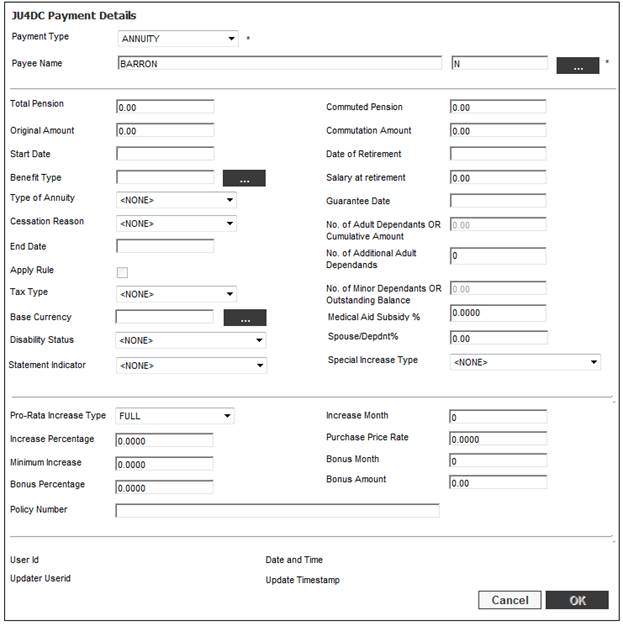

To create new payment details, click NEW on the JU4DC Membership Payment Maintain screen. The JU4DC Payment Details screen will be displayed.

Note:

These fields will automatically be populated if the DB CALC update type of the benefit payment process has been used to create the annuitant. Even though the benefit payment process may not have been completed, it will still be possible to commence the annuity payments, provided that the DB CALC update type of the benefit payment process has been authorised. This is to allow for the fact that there could be a delay in the payment of the commutation amount (e.g. a delay in obtaining the tax directive), and such delays should not hold up the commencement of the payment of the annuity.

Descriptions of the input fields appear below:

|

Payment Type |

The type of payment. Select the appropriate type from the drop-down box. Note: The payment type selected will determine which fields appear on this screen.

For more detailed information refer to Supplements Annuity Payment Type Definitions and Uses |

|

Payee Name |

The name of the payee.

Click LIST to display the JU1DV Search Criteria screen.

Tick the appropriate box to select Link to an Organisation or Link to a Person. Click OK. The system will flow to the JU1DV Client Relationship Select screen, to select a client as a payee.

Refer to Maintain payment details below. |

|

Total Pension |

The total amount of pension. |

|

Commuted Pension |

The amount of pension that has been converted to a cash value. |

|

Original Amount |

The original cost of the pension. |

|

Commutation Amount |

The commutation amount. |

|

Start Date |

The date the annuity first becomes payable.

Mandatory

For details of scenarios where the Start Date field (payment start date), has an influence in determining the tax period, therefore affecting the way in which tax is calculated, refer to Supplements Use of Payment Start Date for Annuity Tax Calculation |

|

Date of Retirement |

The date the member retired. |

|

Benefit Type |

Click LIST to flow to the JU1AE Global Type List screen and select a value. |

|

Salary at retirement |

The amount of the member's salary at retirement |

|

Type of Annuity |

The reason for the annuity payment or the event resulting in the payment of the annuity. Examples of values are: - Abolition Office - Balofguarantee - Child Post Retiral - Child Pre Retiral - Disability - Early Retiral - Ill-health - Late Retiral - Normal Retiral - Paid Up - Sick Pre Retiral - Spouse post retiral - Spouse pre retiral - Term - etc. |

|

Cessation Reason |

The reason that the annuity payment has ceased. Select the appropriate reason from the drop-down box. Examples are: - DEATH - DISABILITY END - EDUCATION ENDED - TERM ENDED

Note: Once the Home Affairs file is uploaded via the system, the batch job will put a cessation reason of death in the CESSATION REASON field. Note: This is mandatory if END DATE has been captured. |

|

Guarantee Date |

The date until which the annuity payment is guaranteed. |

|

End Date |

The date the annuity ceases to be payable.

This field is populated by the value in the END_DATE field on the AB77 Annuity Payment take-on layout

Note: Once the Home Affairs file is uploaded via the system, the batch job will put the date of death in the END DATE field.

Also refer to End Dating of Annuity Record under Processes Regular Payments Annuity Payments Calculation of Overpayments on Death of Annuitant |

|

Apply Rule |

If this is ticked the medical aid expense rules will be applied to the annuitants to calculate their medical aid contributions. |

|

Tax Type. |

The purpose for which tax will be deducted. Select a value from the drop-down list. Examples are: - CHILD - DEATH - DEFERRED - MEMBER - PENSIONER - WIDOW |

|

Base Currency |

The primary currency in which the scheme operates. Click LIST to flow to the JU0AC Permitted Value List screen and select a value. |

|

Disability Status |

Select one of the following values from the drop-down list. - MEMBER DISABLED - DEPENDANT DISABLED |

|

Statement indicator |

Indicates whether or not a pensioner statement must be generated for the annuitant.

Select YES or NO from the drop-down list.

If the indicator is set to YES then a pensioner statement will be prepared by the system.

If the indicator is set to NO then a pensioner statement will NOT be prepared by the system.

If no selection is made i.e. <NONE>, a warning message will be displayed when OK is selected. (See Statement Indicator field below). |

|

No. Of Adult Dependants OR Cumulative Amount |

The number of adults dependant on the member where the payment type selected is MEDICAL AID, or the cumulative total of the loan amount where the payment type selected is ANN LOAN. |

|

No. of Additional Adult Dependants |

The number of additional dependants on the member where the payment type selected is MEDICAL AID or the balance of the loan amount still outstanding where the payment type selected is ANN LOAN. |

|

No. Of Minor Dependants OR Outstanding Balance |

The number of minors dependant on the member where the payment type selected is MEDICAL AID or the balance of the loan amount still outstanding where the payment type selected is ANN LOAN. |

|

Medical Aid Subsidy % |

The employer’s contribution percentage to the pensioner’s medical aid premiums. |

|

Spouse/Depdnt% |

The percentage of the annuity that is payable to the spouse or dependent. This is used to determine what the member’s annuity would be at any point, taking into account increases, when applying the minimum pension amount.

The system allows for a value greater than 100% to be captured.

Note: This field only appears if the payment type selected is ANNUITY. |

|

Special Increase Type |

If a value of AGE BASED is selected, then age related increases will be applied for a member, spouse or disabled dependant reaching a predefined age.

For more information refer to Supplements Processes Setting up Age Band Increases for Annuitants |

|

Pro-Rata Increase Type |

The member can elect a full or pro-rata first increase when purchasing an annuity and this is taken into account in the cost. Select PRO-RATA or FULL from the drop-down list. Examples are: - FULL - FULLINCPARTMNTH - FULLMONTHSONLY - PRO-RATA

If no selection is made, the system will default to PRO-RATA. |

|

Increase Month |

The month that Instalment Growth pension increases are applied, if applicable, e.g. Product 10)

Note: This is only relevant for purchased annuities where the annuitant has the option to select their own increase month. |

|

Increase Percentage |

The Guaranteed Escalation percentage.

Note: If an Annuitant has a Product that is based upon CPI plus a percentage growth or CPI multiplied by a percentage growth, the percentage growth must be captured in the Increase Percentage field. |

|

Purchase Price Rate |

The interest rate, if applicable, at which the annuity was purchased, i.e. ignoring future returns in excess of this rate. |

|

Minimum Increase |

The minimum amount of applicable. |

|

Bonus Percentage |

The percentage bonus that an annuitant will receive where the bonus is different for an annuitant than the bonus for the Scheme.

Note: If a value is captured for Bonus Amount then the Bonus Percentage field will not be enabled to capture a value.

Note: If a value has been captured on the JU4DC Payment Details screen for Bonus Percentage, the system will default the value for Bonus Participation to INDIVIDUAL on the JU4DD Membership Payment Details screen. |

|

Bonus Month |

The month for which the bonus is effective.

Note: This is only relevant for purchased annuities where the annuitant has the option to select their own bonus month. |

|

Bonus Amount |

The amount of bonus that an annuitant will receive where the bonus is different for an annuitant than the bonus for the Scheme.

Note: If a value is captured for Bonus Percentage then the Bonus Amount field will not be enabled to capture a value.

Note: If a value has been captured on the JU4DC Payment Details screen for Bonus Amount, the system will default the value for Bonus Participation to INDIVIDUAL on the JU4DD Membership Payment Details screen. |

|

Policy Number |

The number identifying the Policy for the member. |

|

User Id |

The User Id of the user who created the payment. |

|

Date and Time |

The date and time on which the payment was created. |

|

Updater Userid |

The User Id of the last user to update the payment details.

If no subsequent updates have been made, this field will be blank. |

|

Update Timestamp |

The timestamp of the last update made to the payment details.

If no subsequent updates have been made, this field will be blank. |

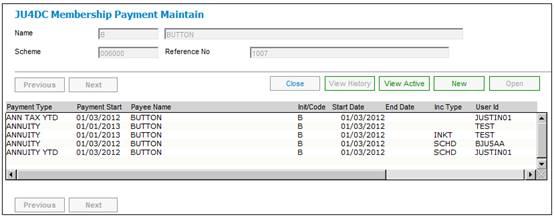

Click OK. The JU4DC Membership Payment Maintain screen will be displayed.

Statement Indicator field

When OK is selected, the following warning message will be displayed if a value has not been selected for the Statement Indicator field:

A statement indicator value has not been selected. A pensioner statement will be created. Do you wish to continue?

Click YES to continue. I.e. a pensioner statement will be created, or click NO and select NO from the Statement Indicator field drop-down list.

To add an annuity record, click NEW. The JU4DC Payment Details screen will be displayed.

Note:

This screen is also used to add deductions if you are working with a main Annuitant.

To view payment details, highlight a payment on the JU4DC Membership Payment Maintain screen and select Payment Details from the sub-menu on the left.

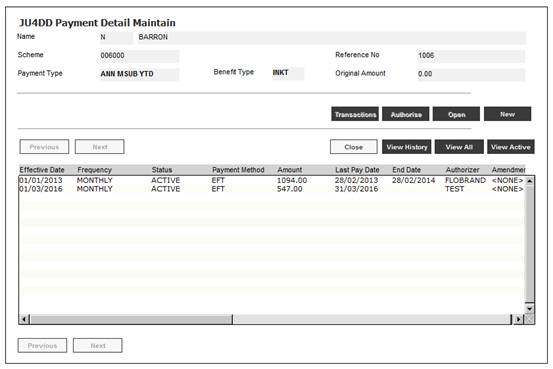

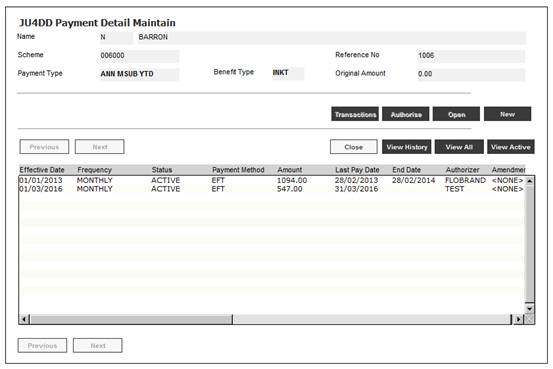

The JU4DD Payment Detail Maintain screen will be displayed.

To authorize the payment, highlight the payment, then select Authorise Payment Detail from the sub-menu on the left.

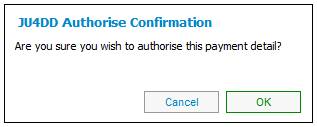

The following confirmation will be displayed:

The JU4DD Payment Detail Maintain screen will be re-displayed.

Click OK to authorize the payment detail. The authorization detail will be displayed on the JU4DD Payment Detail Maintain screen.

The payment and relationship details can be updated, if required.

For information on the processing of Medical Aid, refer to Processing medical aid when a new membership payment is created under

Processes

Regular Payments

Annuity Payments

Processing Medical Aid