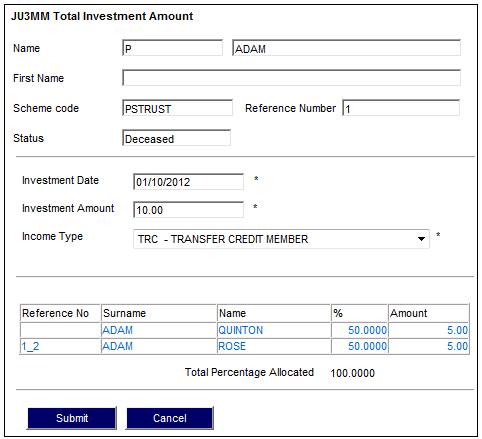

If the total is equal to 100, the system will calculate the investment amount for each Beneficiary as follows:

Total Investment Amount x Percentage Allocation / 100.

Where applicable, Administration Fees and Commission per Beneficiary will be calculated when an Investment Amount is captured for an individual Beneficiary.

Note:

If no Expense Rules are set up for Administration Fees and Commission, these will not be calculated.

The net investment amount will be calculated as follows:

Investment Amount – Administration Fee – Commission.

The system will create the Business Transactions on the Pre-Authorised Business Transaction (BT) table for each of the amounts listed below with the Accounting Activities indicated.

Total Investment Amount

|

BENEFICAIRY INV |

MAINMEMINV |

FUND |

DR |

BANK |

|

|

|

|

CR |

BENINVCONTRL |

Investment Amount per Beneficiary

|

BENEFICIARY INV |

MEM CONTRIB |

MEMBER |

DR |

MEM DEPOSIT |

|

|

|

|

CR |

CONTRIBUTION |

|

|

|

FUND |

DR |

BENINVCONTRL |

|

|

|

|

CR |

CONTRIBFUND |

Commission per Beneficiary

|

BENEFICIARY INV |

MEM COMM |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

COMMISSION |

|

|

|

|

CR |

COMMPAYABLE |

Admin Fee

|

BENEFICIARY INV |

MEMINVADMFEE |

MEMBER |

DR |

CONTRIBUTION |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

FEEEXPENSE |

|

|

|

|

CR |

FEEPAYABLE |

Where applicable, the relevant VAT BT’s will be created.

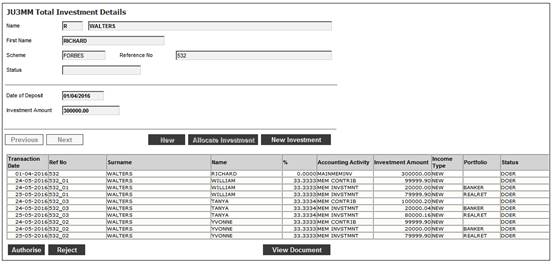

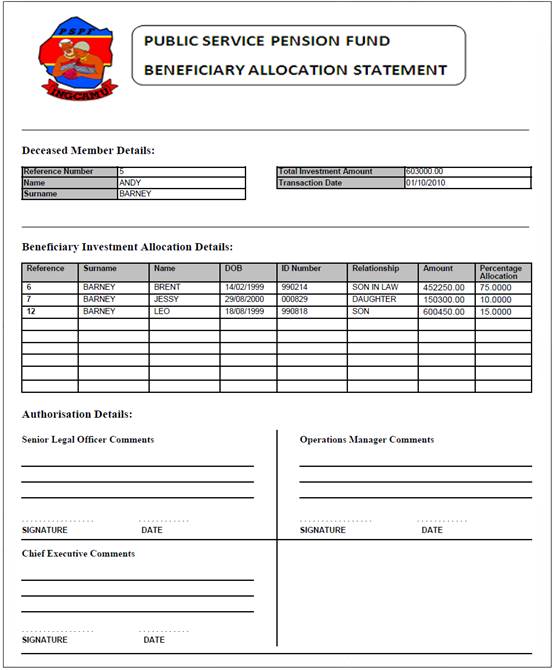

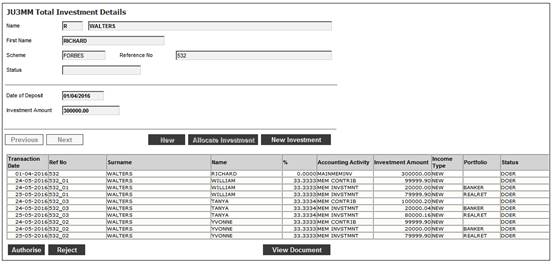

The Pre-Authorised BT’s will be created with the User ID of the person who captured the details on the JU3MM Total Investment Amount screen and Due Date, Transaction Date and Effective Date equal to the Date of Investment captured, and with the Income Type selected.

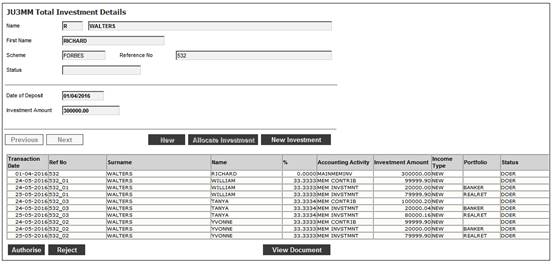

The system will read the values for Initial Payment Percentage and Initial Payment Amount captured on the Member Details screen. If a value is found for one of these fields, the Pre-Authorised BT’s will be displayed for each Beneficiary on the JU3MM Total Investment Details screen.

If no value is found for Initial Payment Percentage or Initial Payment Amount for a Beneficiary, the system create the BT’s to record the Net Investment Amount per Beneficiary i.e. the Beneficiaries portion less Administration Fees and Commission with the following Accounting Activity:

|

BENEFICAIRY INV |

MEM INVSTMNT |

MEMBER |

DR |

INVESTMEMB |

|

|

|

|

CR |

MEM DEPOSIT |

|

|

|

FUND |

DR |

INVESTMENT |

|

|

|

|

CR |

INVESTTRANST |

Where an Initial Payment Percentage or Initial Payment Amount value has been captured, an Initial Payment Request must be processed for all of the Beneficiaries or the individual Beneficiaries. The investment transactions will then be captured after the capture of these initial payments.

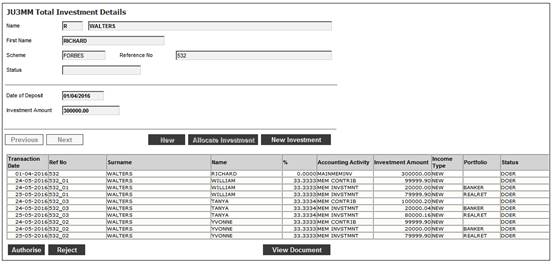

To view the Beneficiary Allocation Statement, click VIEW DOCUMENT.

The system will read the document template with the Process Type of BENEFICIARY and a Template Type of BENEFICIARY INV.

The Beneficiary Allocation Statement will be displayed in PDF format.

This document displays the following data:

- Deceased Member Reference Number

- Deceased Member First Name

- Deceased Member Surname

- Total Investment Amount

- Transaction Date

- For Each Beneficiary:

- Membership Reference Number

- Surname and Name

- Date of Birth

- ID Number

- Relationship

- Amount

- Percentage Allocation

To authorise BT’s, highlight a Beneficiary with a Status of DOER on the JU3MM Total Investment Details screen and click AUTHORISE.

The JU3MM Total Investment Details screen will be redisplayed. The Status for the selected Beneficiary will change to AUTHORISED BT.

Note:

The Authoriser may not be same person as the Doer.

My Work for Linked Beneficiary Funds

- When a Service Request is selected on the My Work screen with a Process of BENEFICIARY INV and an Activity Name of AUTH ALLOCATIONS and the Process Service Request option is selected, the JU3MM Total Investment Amount screen will be displayed.

- When AUTHORISE is selected on the JU3MM Total Investment Details screen and the BT’s are successfully authorised, the Status on the Service Request will be updated to COMPLETED.

To reject BT’s, highlight a Beneficiary with a Status of AUTHORISED BT on the JU3MM Total Investment Details screen and click REJECT.

In the Benefit payments Process, when a lump sum death claim is processed, the Benefit Payable Update Type is processed on the JU4CN Benefit Payment Process screen. If the scheme being processed is linked to a Trust Fund with a Type of Fund of BENEFICIARY FUND, the system displays the details on the JU3MM Total Investment Amount screen.

Note:

In the event of the death of a Beneficiary who is still receiving an annuity, the remaining balance of the deceased beneficiary’s allocation will be re-allocated to the remaining Beneficiaries.

My Work

The user can create a Service Request in My Work with a Process of END BENEFICIARY, Activity Name of INITIATE and with the Scheme Code and Membership Number of the Beneficiary Fund Membership with a Status of BENEFICIARY and a Status of OPEN.

When the Service Request is selected and the Process Service Request menu option is selected, the Member Details screen will be displayed with the details of the Membership captured.

Processing

The system will retrieve the Business Transactions (BT’s) in the Deceased Member’s INVESTMEMB account and if a MAINMEMINV BT is found, the details are displayed on the JU3MM Total Investment Amount screen with the amount in the Total Investment Amount field, the transaction date in the Investment Date field and the Income Type in the Income Type field.

Note:

These fields will not be enabled for update, i.e.

- Total Investment Amount

- Investment Date

- Income Type

If there are more than one MAINMEMINV BT:

- All of the BT’s will be displayed

- The amounts summed and the total amount will be displayed in the Total Investment Amount field

- The earliest Transaction Date will be displayed in the Investment Date field.

If a MEMBERBONUS BT is found, the BT will be displayed and the amount will be included in the sum of the MAINMEMINV BT’s displayed in the Total Investment Amount field.

If no MAINMEMINV BT is found in the Deceased Member’s INVESTMEMB account, the MAINMEMINV BT will be retrieved from the BENINVCONTRL account.

Details not captured via the Benefit Payment Process

Where the Investment Amount has been captured on the JU3MM Total Investment Amount screen i.e. the BT’s were not created via the Benefit Payment Process, the SUBMIT button will be enabled if no beneficiary details have been captured, or if beneficiary details have been captured and the sum of the percentages for all of the Beneficiaries captured is less than 100.

If the beneficiaries have been captured, the MEM INVSTMNT BT’s will be retrieved for the beneficiaries captured. If no BT’s are found and the sum of the beneficiaries’ percentages equals 100, the system will calculate each beneficiary’s portion based on the sum of the MAINMEMINV and MEMBERBONUS BT’s and the beneficiary’s percentage.

The MEM CONTRIB and MEM INVSTMNT Pre-authorised BT’s for the individual beneficiary portions will be created as per the current process. But when the MEM CONTRIB BT is created, the system will read the Investment Allocation for the Member or, if not found the Investment Allocation for the Investment Membership Group to which the Membership is linked, or, if not found, the Investment Allocation for the Scheme for the Income Type TRC and create the BT with the Portfolio found.

The system will create the following additional BT with the Membership Reference Number of the Deceased Member and with an Income Type of TRC and the Portfolio equal to the Portfolio linked to the Scheme Investment Allocation for the Income Type TRC:

BENEFICIARY INV TRUST INVMNT MEMBER DR MEM DEPOSIT

BENEFICIARY INV TRUST INVMNT MEMBER CR INVESTMEMB

Note:

If interest is not to be calculated on the unallocated balance in the Deceased Member’s investment account then the Accounting Rule for the TRUST INVMNT Accounting Activity above must be created as follows:

BENEFICIARY INV TRUST INVMNT MEMBER DR MEM DEPOSIT

BENEFICIARY INV TRUST INVMNT MEMBER CR MEM DEPOSIT

If beneficiaries have been captured and MEM INVSTMNT BT’s are retrieved, the system will check if a BT is retrieved for each of the beneficiaries captured.

If not, the system will check that the sum of the beneficiaries percentages is less than or equal to 100. For the beneficiaries for which no MEM INVSTMNT BT is retrieved, the beneficiaries portion based on the sum of the MAINMEMINV and MEMBERBONUS BT’s and the Beneficiary’s percentage will be calculated.

The system will create the MEM CONTRIB and MEM INVSTMNT Pre-authorised BT’s for the individual beneficiary portions with Due Date, Transaction Date and Effective Date equal to the current date.

The following additional BT will be created with the Membership Reference Number of the Deceased Member:

BENEFICIARY INV TRUST INVMNT MEMBER DR MEM DEPOSIT

BENEFICIARY INV TRUST INVMNT MEMBER CR INVESTMEMB

If the total of the Beneficiary percentages is greater than 100 provide the following message will be displayed:

The sum of the beneficiary allocations is equal to XXX%. Please adjust the beneficiary allocations so that the total does not exceed 100.

For the Beneficiaries for which a MEM INVSTMNT BT is retrieved, the system will check that the amount is equal to the beneficiaries percentage of the sum of the MAINMEMINV and MEMBERBONUS BT’s. The system will multiply the sum of the MAINMEMINV and MEMBERBONUS BT’s by the beneficiaries percentage divided by 100. The result will be compared with the sum of the beneficiary’s MEM INVSTMNT BT’s. If the calculated value is greater than the sum of the BT’s, the following Pre-authorised BT’s will be created for the difference with the Membership Reference Number of the Beneficiary and Due Date, Transaction Date and Effective Date equal to the current date and Portfolio equal to the Portfolio on the BT’s retrieved from the Beneficiary’s INVESTMEMB account:

BENEFICIARY INV MEM CONTRIB

BENEFICIARY INV MEM INVSTMNT

The following Pre-authorised BT will be created with the Membership Reference Number of the Deceased Member:

BENEFICIARY INV TRUST INVMNT

Note:

This must be done to cater for an additional lump sum as a result of a benefit revision.

My Work

When all of the Pre-authorised BT’s have been created, the Activity Name on the My Work Service Request will be updated to AUTH ALLOCATIONS.